يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

A Fresh Look at Albertsons (ACI) Valuation Following $4 Billion Credit Facility Expansion

Albertsons Companies, Inc. ACI | 17.22 | -2.49% |

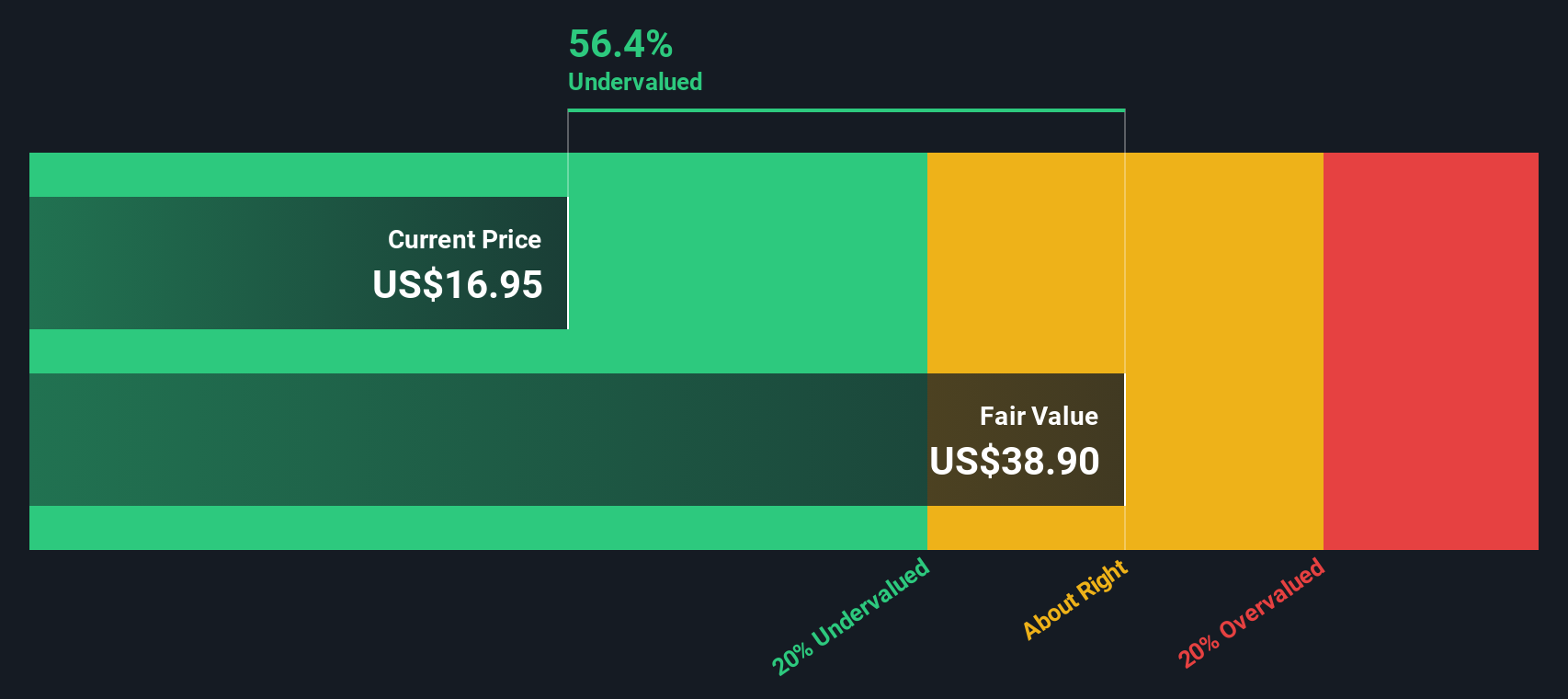

Most Popular Narrative: 22.6% Undervalued

According to the most widely followed narrative, Albertsons Companies is considered meaningfully undervalued, with the current market price at a steep discount to projected fair value.

Modernization through technology investments, such as automation, AI-driven inventory and pricing, and centralized buying, are streamlining operations, reducing labor and supply chain costs, and positioning the company for long-term margin expansion and improved net earnings.

Want to know what’s fueling this big price gap? Analysts are betting on game-changing growth levers, a profit surge, and a future valuation multiple that challenges the industry norm. Curious how ambitious these assumptions get, or which trends they think will move the needle most? Discover the bold projections at the heart of this fair value estimate.

Result: Fair Value of $24.19 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slower e-commerce scaling and rising labor costs could undermine margin gains. This may potentially slow down Albertsons Companies’ momentum despite its digital and pharmacy growth.

Find out about the key risks to this Albertsons Companies narrative.Another View: Discounted Cash Flow Model

Taking a step back from analyst targets, our DCF model looks at Albertsons Companies from a different perspective and also signals the stock is undervalued. However, does this approach paint the full picture?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Albertsons Companies Narrative

If you see the story differently, or want to dig deeper into the numbers yourself, you can craft your own perspective in just a few minutes. Do it your way

A great starting point for your Albertsons Companies research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Timely Investment Ideas?

If you want to uncover fresh opportunities and stay a step ahead, don’t miss out on new trends and standout stocks using the Simply Wall St screener tools.

- Boost your portfolio with companies showing strong cash flow potential by tapping into undervalued stocks based on cash flows, which highlights undervalued opportunities flying under Wall Street’s radar.

- Tap into the fast-evolving world of medical breakthroughs and find future leaders in care with healthcare AI stocks to spot pioneering healthcare technology innovators.

- Enhance your passive income and target reliable yields with dividend stocks with yields > 3% for stocks offering attractive dividends backed by strong financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.