يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Coherent (COHR) Reports 22% Quarterly Sales Rise Despite Losses

Coherent, Inc. COHR | 181.79 | +2.50% |

Coherent (COHR) recently launched its EDGE FL30 fiber laser, a move aligned with the company's dedication to innovation in high-power cutting technology. Their collaboration with the Lawrence Livermore National Laboratory in fusion energy development reflects the company's focus on advancing sustainable energy solutions. These initiatives come amidst a 22% rise in quarterly sales, even though the company still reported losses. Coherent's share price, climbing 22% last quarter, aligns with broader market gains, as the Nasdaq and S&P 500 hit all-time highs, underscoring its recovery trend despite sector challenges.

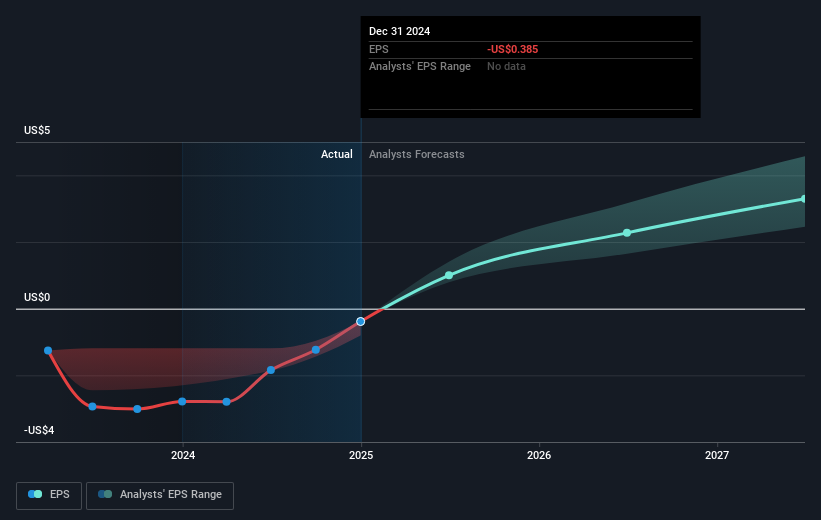

Coherent's recent initiatives, including its collaborative efforts in fusion energy and the launch of the EDGE FL30 fiber laser, are positioned to significantly influence its future revenue and earnings landscape. By focusing on high-power cutting technology and sustainable energy solutions, Coherent is poised to enhance its core offerings, which may positively affect its operational metrics. The company's revenue is anticipated to grow, supported by robust demand in high-performance datacenters and strategic contracts with major partners like Apple. This, in turn, reinforces the analysts' revenue and earnings forecasts, contributing to improved market confidence.

Over the past five years, Coherent's total shareholder return, including share price appreciation and dividends, stood at 151.51%. This period marks a significant growth trajectory, reflecting the company's ability to adapt and expand within its industry. However, when compared to the recent performance within the broader US market over the past year, Coherent's returns have lagged, as it underperformed the US Electronic industry, which saw an impressive 43.5% increase. This contrast highlights both the potential and challenges faced by Coherent in maintaining consistent long-term growth amidst industry competition.

The current share price of US$99.22 suggests a discount compared to the consensus price target of US$113.37, which indicates market anticipation of further growth potential. As Coherent continues to execute its strategic initiatives, the alignment with industry trends such as AI and high-performance computing infrastructure expansion could act as key drivers for future revenue and margin enhancements. Investors might find the price target realistic, provided the company effectively manages competition and economic uncertainties.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.