يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Does Delta’s Entry Into Riyadh With Nonstop Flights Shift the Long-Term Story for DAL?

Delta Air Lines, Inc. DAL | 67.10 | -0.21% |

- Delta Air Lines recently announced the launch of its first nonstop service between Atlanta and Riyadh, Saudi Arabia, with flights commencing in October 2026 in partnership with Riyadh Air.

- This marks Delta’s entry into the Saudi market and expands its network in the Middle East, aligning with Saudi Arabia’s plans to boost tourism, business, and global connectivity.

- We’ll explore how Delta’s move into the Saudi market through its Riyadh Air partnership could influence its investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Delta Air Lines Investment Narrative Recap

If you are considering investing in Delta Air Lines, the long-term thesis centers on the company’s ability to protect margins and free cash flow by aligning supply with demand, while leaning into premium, loyalty, and international travel to drive revenue. The recent announcement of new nonstop service to Riyadh expands Delta’s international presence, but is not expected to materially impact the main short-term catalyst: the resilience of demand in premium and international segments. The greatest near-term risk remains potential softening in core domestic travel and main cabin demand, which could pressure Delta’s margins if economic uncertainty persists.

Among Delta’s recent announcements, the expansion of the maintenance, repair, and overhaul (MRO) partnership with UPS stands out as most relevant to the airline’s effort to diversify revenue streams and manage costs, supporting the margin protection that underpins its investment thesis. While international route additions like Atlanta to Riyadh capture headlines, long-term agreements like the UPS deal strengthen Delta’s position beyond passenger travel, especially if passenger demand slows.

By contrast, investors should also be mindful of the risk posed by...

Delta Air Lines' narrative projects $68.4 billion revenue and $4.6 billion earnings by 2028. This requires 3.4% yearly revenue growth and a $0.1 billion earnings increase from $4.5 billion.

Uncover how Delta Air Lines' forecasts yield a $71.75 fair value, a 22% upside to its current price.

Exploring Other Perspectives

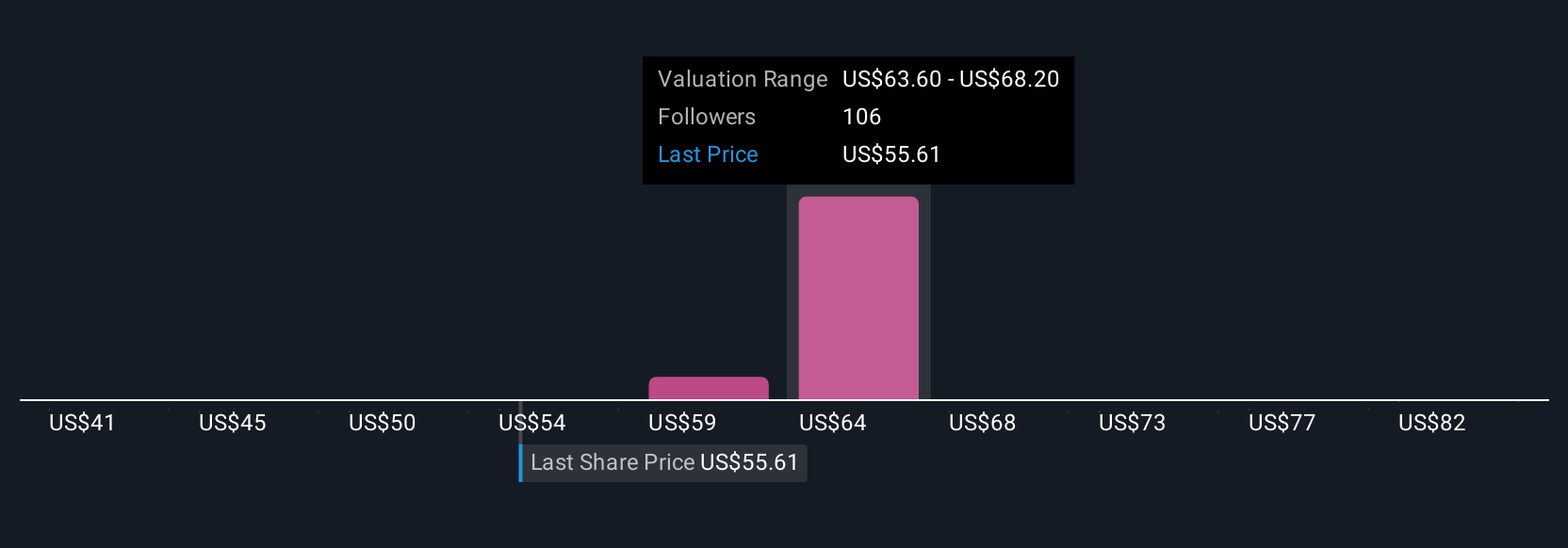

Eight individual fair value estimates from the Simply Wall St Community range from US$41 to US$100 per share. While some see substantial upside, the underlying risk of softer main cabin demand could shape future results in ways that are top of mind for many market participants.

Explore 8 other fair value estimates on Delta Air Lines - why the stock might be worth 31% less than the current price!

Build Your Own Delta Air Lines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Delta Air Lines research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Delta Air Lines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Delta Air Lines' overall financial health at a glance.

No Opportunity In Delta Air Lines?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.