يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Dropbox (DBX) Valuation: What Recent Share Price Swings Could Mean for Investors

Dropbox DBX | 29.34 | -1.48% |

Dropbox’s share price has recently stepped back, slipping about 7% over the last month but still holding onto a more than 8% total shareholder return over the past year. This mix of short-term volatility and longer-term gains suggests that investors are reassessing growth potential and weighing changes in risk sentiment as the stock recalibrates near $28 per share.

If you’re tracking market movers in the tech world, now is the time to widen your search and discover See the full list for free.

This raises a critical question: does Dropbox’s current valuation offer hidden upside for investors, or has the market already accounted for its future growth prospects, leaving little room for surprise moves?

Most Popular Narrative: Fairly Valued

With Dropbox closing at $28.40 and the most followed narrative calling fair value near $28.13, bullish and bearish views strike a balance. What exactly is underpinning this consensus? Let’s go to the source.

The planned expansion and deeper integration of AI-driven productivity tools (Dash), including upcoming self-serve offerings and seamless bundling with Dropbox's existing file sync and share product, position the company to capture higher ARPU and accelerate recurring revenue growth as digital transformation and hybrid work drive demand for intelligent, collaborative cloud platforms.

Want to know the assumptions fueling this fair value call? The narrative hinges on a fresh approach, sticky recurring revenue, and upgraded profit margins—something few investors might expect. Just what is changing in Dropbox’s future earnings power? Dive in and see what’s really shaping these projections.

Result: Fair Value of $28.13 (ABOUT RIGHT)

However, ongoing declines in total revenue and rising competition from larger cloud providers could put pressure on Dropbox’s growth story and challenge this fair value outlook.

Another View: What Do the Numbers Say?

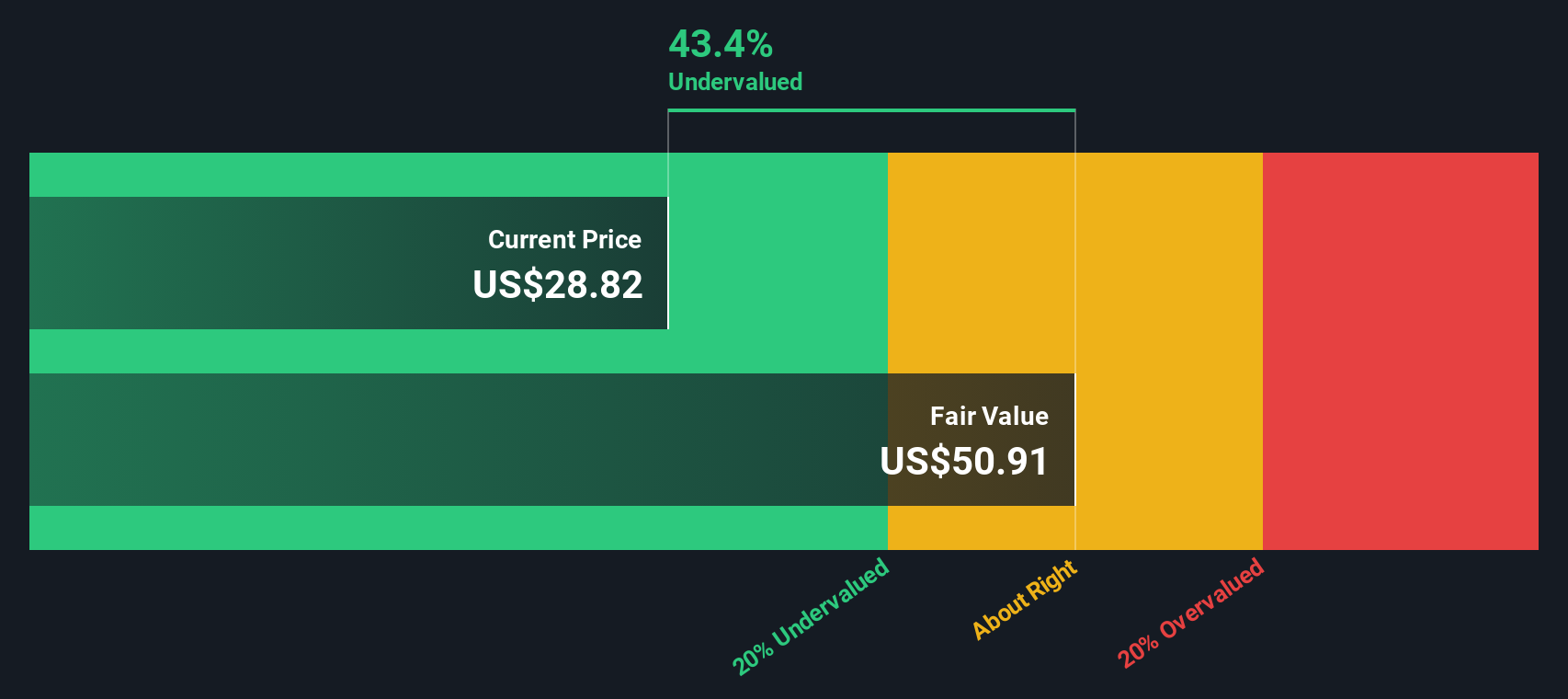

While analyst estimates suggest Dropbox’s current price is about fair, our DCF model paints a different picture. By projecting future cash flows, this approach estimates fair value at $51.33, which is 44.7% above the latest price. Could this mean the market is missing potential upside, or are risks being overlooked?

Build Your Own Dropbox Narrative

If you see things differently or want to dig into the numbers yourself, you can craft your own conclusion in just a few minutes. Do it your way.

A great starting point for your Dropbox research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t settle for a single perspective. Level up your investing journey by tapping into powerful opportunities that others might overlook. Get ahead before the crowd catches on.

- Supercharge your watchlist and unlock growth potential with these 849 undervalued stocks based on cash flows, featuring stocks that may be trading below their true worth right now.

- Spot tomorrow’s digital leaders, as these 26 AI penny stocks offers access to companies on the edge of AI innovation and smart technology breakthroughs.

- Collect reliable income by scanning these 21 dividend stocks with yields > 3%, where you can filter for stocks consistently paying attractive yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.