يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Investors May Respond To First Hawaiian (FHB) Persistent Weakness in Net Interest Income and Profitability

First Hawaiian, Inc. FHB | 25.25 | -0.32% |

- Recent news indicates that First Hawaiian Bank has continued to experience weak net interest income growth and margins compared to industry peers, which has resulted in a flat tangible book value per share over the past five years.

- This sustained underperformance in key profitability metrics has become a material concern for stakeholders assessing the bank's fundamental health and competitive position.

- We will now examine how ongoing challenges in net interest income growth and profitability metrics affect First Hawaiian's broader investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

First Hawaiian Investment Narrative Recap

To be a shareholder in First Hawaiian, you need to believe in the company's ability to leverage its strong local brand and deposit base despite ongoing net interest margin pressure. The recent news of persistently weak net interest income growth underlines a material short-term risk: that future earnings may continue to lag if these profitability metrics do not recover. However, this development does not dramatically shift the current investment catalysts, which center around potential loan growth and digital adoption.

The most relevant recent announcement is the Q2 2025 results, where the bank posted year-over-year growth in both net interest income and earnings per share. This shows some progress, yet with tangible book value per share remaining flat, ongoing operational improvements must still translate into long-term value for shareholders and support the bank's short-term performance stories. Still, investors should keep in mind that...

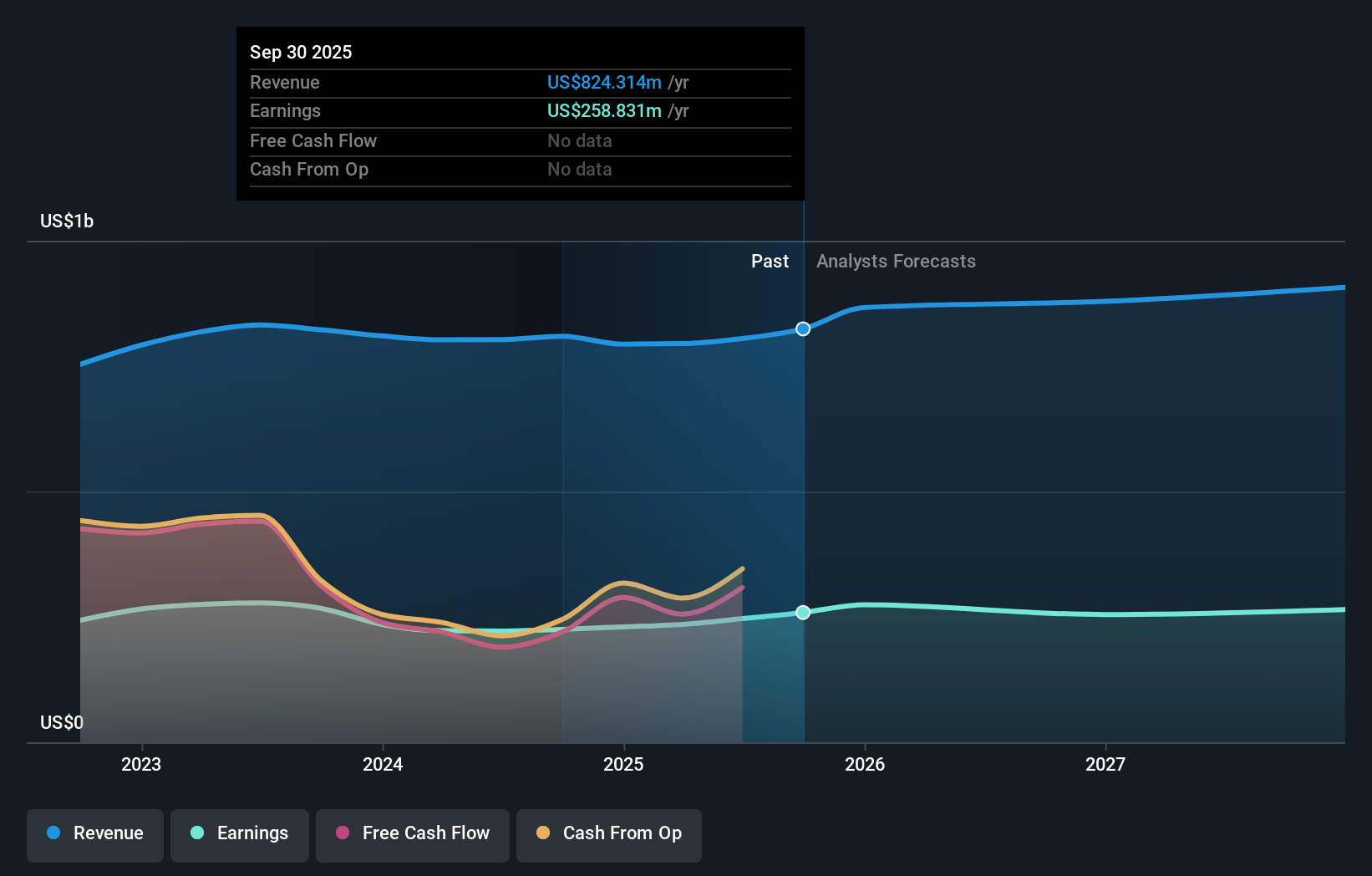

First Hawaiian's outlook projects $952.3 million in revenue and $263.9 million in earnings by 2028. This assumes a 5.8% annual revenue growth rate and an earnings increase of $17.4 million from current earnings of $246.5 million.

Uncover how First Hawaiian's forecasts yield a $26.12 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Private investors in the Simply Wall St Community set fair value estimates from US$26.13 to US$62.99, offering a broad span of outlooks. With net interest margin growth still challenged, consider how your view on future earnings resilience fits among these differing expectations.

Explore 2 other fair value estimates on First Hawaiian - why the stock might be worth just $26.12!

Build Your Own First Hawaiian Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Hawaiian research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free First Hawaiian research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Hawaiian's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 39 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.