يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

How Warrior Met Coal’s Expanded Credit Facility Could Shape Growth Prospects for HCC Investors

Warrior Met Coal, Inc. HCC | 81.61 | -1.21% |

- Warrior Met Coal recently amended and extended its asset-based revolving credit facility, increasing total borrowing commitments by US$27.0 million to US$143.0 million and extending the maturity date to as late as August 2030.

- This move expands Warrior’s financial flexibility just as it approaches first production from the scale-enhancing Blue Creek growth project.

- Let’s explore how Warrior’s expanded credit facility could support operational growth as Blue Creek ramps up to full capacity.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

Warrior Met Coal Investment Narrative Recap

To own Warrior Met Coal, you need to believe in a meaningful rebound in steelmaking coal demand, especially as Blue Creek’s ramp-up drives higher sales volumes and improved cost efficiency. The expanded credit facility offers extra liquidity, which could help fund operations as Blue Creek moves toward first tonnage, but persistent coal price pressures remain the biggest risk in the near term, this facility alone does not materially offset commodity-driven risks.

Of Warrior's recent updates, the August 2025 production guidance stands out: expectations for 8.3 million to 9.1 million short tons of output underscore management’s confidence despite weak revenue and earnings this year. The rising borrowing base supports this ambition, but it will only matter if higher volumes translate into stronger sales as Blue Creek comes online.

By contrast, investors should keep in mind that new credit lines are helpful, but they do not erase the risk of mounting capital intensity and uncertain placement of Blue Creek volumes if...

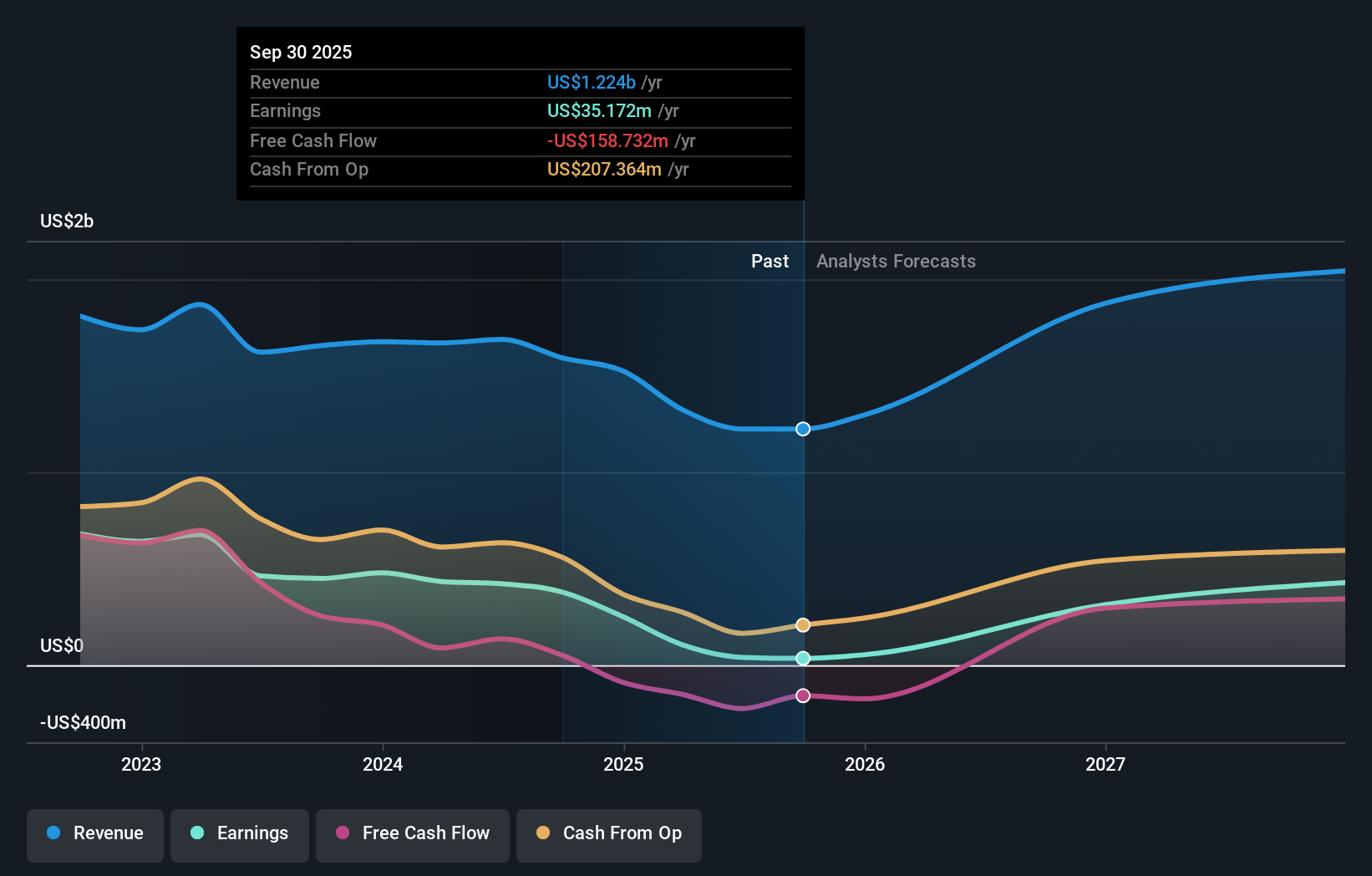

Warrior Met Coal's outlook anticipates $2.0 billion in revenue and $636.5 million in earnings by 2028. This projection is based on an expected 18.8% annual revenue growth rate and a $596 million increase in earnings from the current $40.3 million.

Uncover how Warrior Met Coal's forecasts yield a $65.67 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Five members of the Simply Wall St Community value Warrior Met Coal between US$65.67 and US$209.47 a share. While many expect profit growth to accelerate as Blue Creek delivers, the wide range of estimates shows just how much your outlook on demand and execution can shape expectations for this stock.

Explore 5 other fair value estimates on Warrior Met Coal - why the stock might be worth just $65.67!

Build Your Own Warrior Met Coal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Warrior Met Coal research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Warrior Met Coal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Warrior Met Coal's overall financial health at a glance.

Seeking Other Investments?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.