يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Investors Met With Slowing Returns on Capital At OPAL Fuels (NASDAQ:OPAL)

Opal Technologies Inc Com OPAL | 2.63 | +1.54% |

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. Having said that, from a first glance at OPAL Fuels (NASDAQ:OPAL) we aren't jumping out of our chairs at how returns are trending, but let's have a deeper look.

What Is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. To calculate this metric for OPAL Fuels, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.0059 = US$4.7m ÷ (US$906m - US$98m) (Based on the trailing twelve months to June 2025).

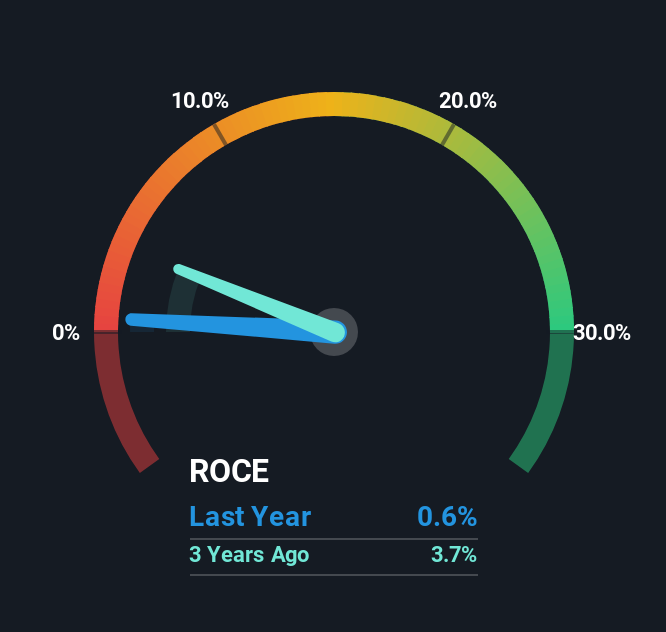

Therefore, OPAL Fuels has an ROCE of 0.6%. Ultimately, that's a low return and it under-performs the Oil and Gas industry average of 9.1%.

Above you can see how the current ROCE for OPAL Fuels compares to its prior returns on capital, but there's only so much you can tell from the past. If you're interested, you can view the analysts predictions in our free analyst report for OPAL Fuels .

The Trend Of ROCE

The returns on capital haven't changed much for OPAL Fuels in recent years. The company has consistently earned 0.6% for the last five years, and the capital employed within the business has risen 573% in that time. This poor ROCE doesn't inspire confidence right now, and with the increase in capital employed, it's evident that the business isn't deploying the funds into high return investments.

On a side note, OPAL Fuels has done well to reduce current liabilities to 11% of total assets over the last five years. Effectively suppliers now fund less of the business, which can lower some elements of risk.

Our Take On OPAL Fuels' ROCE

In summary, OPAL Fuels has simply been reinvesting capital and generating the same low rate of return as before. And investors may be expecting the fundamentals to get a lot worse because the stock has crashed 74% over the last three years. On the whole, we aren't too inspired by the underlying trends and we think there may be better chances of finding a multi-bagger elsewhere.

OPAL Fuels does have some risks, we noticed 3 warning signs (and 1 which can't be ignored) we think you should know about.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.