يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Moody's (MCO): Fresh Analyst Optimism Sparks a Closer Look at Valuation

Moody's Corporation MCO | 496.50 | +1.43% |

Moody's (MCO) has been in the spotlight after several brokerages reaffirmed or upgraded their ratings, with a consensus of "Outperform" across 26 firms. This signals growing confidence in the company’s outlook and financial trajectory.

Moody's latest run of positive analyst attention has come alongside a dip in its share price, which slipped by 5.95% over the past month, even as the stock remains up for the year. For long-term shareholders, the story shines brighter: a remarkable three-year total shareholder return of 102.94% and an 80% return over five years show that momentum has been strong, despite recent pullbacks.

If analyst optimism around Moody's has you thinking bigger, now is the perfect time to broaden your search and discover fast growing stocks with high insider ownership

After a surge of analyst upgrades and strong multi-year returns, the big question remains: does Moody's current dip represent a rare value opportunity, or has the market already priced in the company’s future growth prospects?

Most Popular Narrative: 12.3% Undervalued

Moody's is trading at $478.51, noticeably below the narrative fair value estimate of $545.50. This gap reflects considerable optimism from analysts, with upward pricing influenced by new growth catalysts and strong operating leverage projections.

Moody’s investment in advanced analytics, AI, and machine learning, including 40% of Moody’s Analytics products now featuring GenAI enablement and GenAI-related spending growing at twice the rate of MA overall, positions Moody’s to capture a larger share of the data-driven risk management market. This is resulting in higher recurring revenues and improved net margins through automation and operational efficiency.

Want the details behind this valuation leap? The narrative is built on transformative technology bets and massive operating gains, all tied to ambitious future numbers. Which forecasts power this bold target? Find out what’s fueling the bullish outlook and if it could hold up.

Result: Fair Value of $545.50 (UNDERVALUED)

However, increased regulatory scrutiny of private credit and persistent customer churn could challenge Moody’s growth trajectory sooner than some analysts expect.

Another View: High Earnings Multiple Poses a Risk

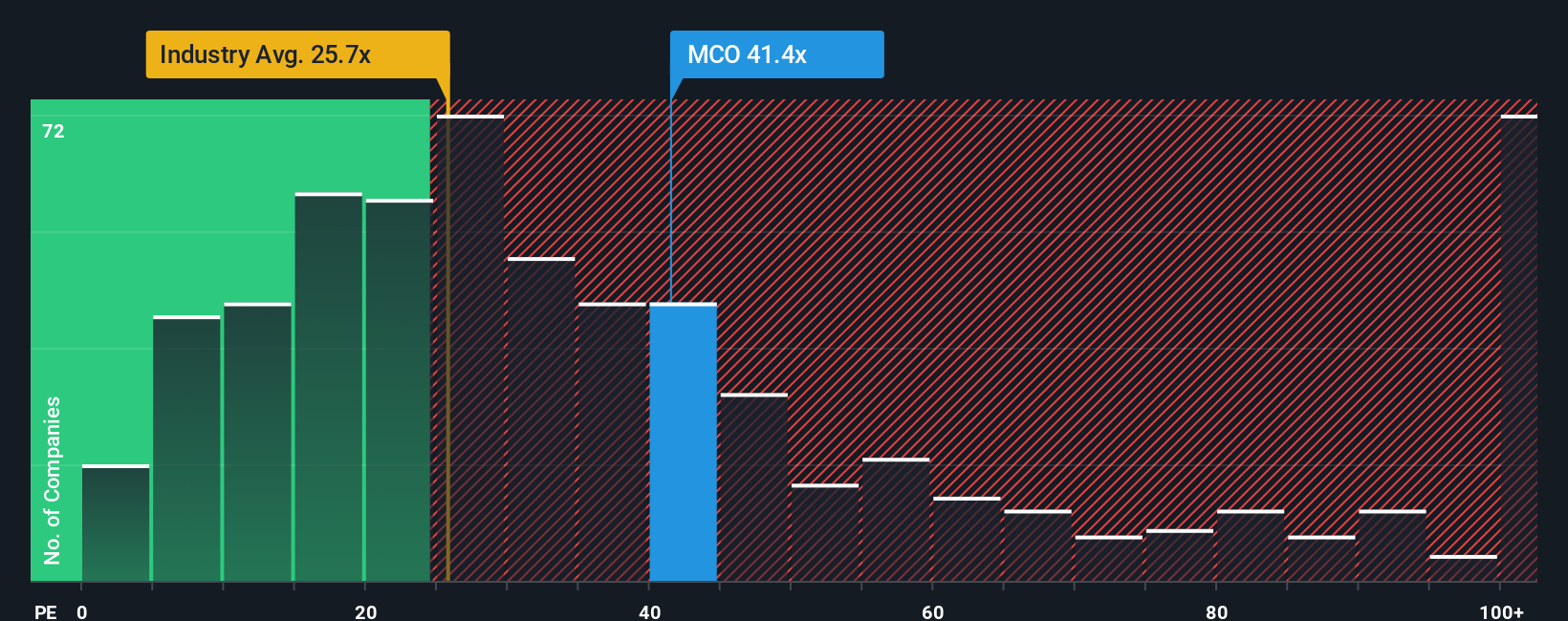

While the fair value narrative suggests Moody's is undervalued, a look at the earnings multiple paints a more cautious picture. Moody's trades at 40.3 times its earnings, which is well above both the US Capital Markets industry average of 25.8x, the peer average of 30.1x, and the fair ratio of 19.5x. This unusually high multiple signals that investors are paying a significant premium for future growth. This raises the question: is the optimism justified, or could expectations be outpacing reality?

Build Your Own Moody's Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft your own narrative in just a few minutes, so Do it your way

A great starting point for your Moody's research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means seizing the right opportunity before everyone else. Boost your portfolio with proven strategies from these top picks that crowd favorites often overlook.

- Capitalize on overlooked stocks showing reliable potential by checking out these 3565 penny stocks with strong financials and spot hidden gems before they go mainstream.

- Pursue passive income by finding companies with consistent cash flows and yields over 3% through these 18 dividend stocks with yields > 3%, and position yourself for financial stability.

- Shape your future in tech by evaluating these 24 AI penny stocks and gain exposure to transformative companies innovating in artificial intelligence today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.