يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

New Oriental Education (NYSE:EDU): Assessing Value After Major Share Buyback Completion

New Oriental Education & Technology Group, Inc. Sponsored ADR EDU | 52.63 | +2.65% |

New Oriental Education & Technology Group (NYSE:EDU) has wrapped up a sizable share buyback, retiring over 9% of its outstanding shares since July 2022. This move signals management’s ongoing commitment to shareholder value and capital return strategies.

While New Oriental Education & Technology Group’s share buyback highlights management’s confidence, the share price has seen muted action this year. It is currently trading at $52.75, with momentum wavering and a 1-year total shareholder return of -0.34%. Despite strategic efforts to boost value, investors are watching for signs of renewed growth or sentiment shifts as the company moves beyond this capital return phase.

If you’re weighing what else might offer fresh momentum, it could be the right moment to broaden your search and discover fast growing stocks with high insider ownership

With sizable buybacks now complete and the stock trading at a discount to analyst targets, the question remains: does New Oriental Education & Technology Group represent an undervalued opportunity, or is the market already factoring in its future growth potential?

Most Popular Narrative: 8.3% Undervalued

With the most popular narrative placing fair value at $57.53, New Oriental Education & Technology Group’s last close at $52.75 suggests noticeable upside if consensus projections hold steady. Market participants are closely watching whether the catalysts behind this target can be sustained.

Continued investment and rollout of omnichannel online-merge-offline (OMO) and AI-driven systems are enabling operating leverage, cost reductions, and higher efficiency in delivery. This is already resulting in improved operating margins, with a 410 basis point year-over-year increase in the core business, supporting future earnings growth through both topline expansion and margin expansion.

This valuation hinges on the company’s next chapter. Behind that fair value are bold forecasts for margin growth, sustained profitability, and the business model’s ongoing reinvention. Curious how far these improvements could propel the share price? The full story may upend your assumptions about sector leaders.

Result: Fair Value of $57.53 (UNDERVALUED)

However, rising competition and possible regulatory changes mean that even strong growth ambitions could be tempered unexpectedly, which could quickly shift the outlook for New Oriental Education & Technology Group.

Another View: Comparing Market Ratios

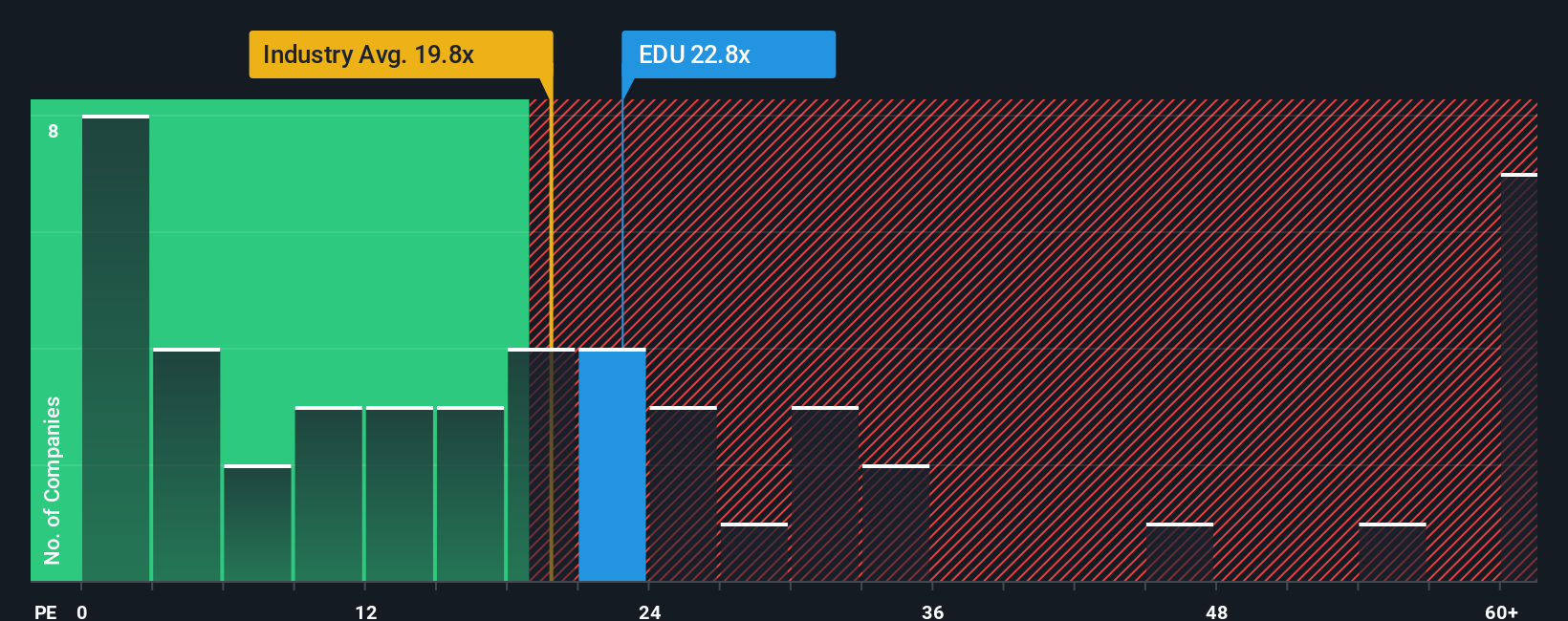

While the analyst consensus points to New Oriental Education & Technology Group being undervalued, market multiples suggest a more complicated picture. The company’s price-to-earnings ratio sits at 22.6 times, higher than the industry average of 18.3 but below the peer average of 36.2, and still under the fair ratio of 25.1. This gap could mean either resilience or over-optimism. Could the market be slow to adjust, or is caution wise here?

Build Your Own New Oriental Education & Technology Group Narrative

If you feel differently, or want to dive deeper into the data yourself, you can shape your own perspective in just a few minutes. So why not Do it your way?

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding New Oriental Education & Technology Group.

Looking for more investment ideas?

Seize the opportunity to supercharge your portfolio by uncovering stocks that fit your style. The most innovative trends and powerful strategies are just a click away. Don’t let great ideas pass you by.

- Uncover growth potential by zeroing in on these 25 AI penny stocks positioned at the forefront of artificial intelligence innovation and automation breakthroughs.

- Boost your passive income by targeting these 19 dividend stocks with yields > 3% offering robust yields and consistent payout histories for long-term wealth building.

- Participate in cutting-edge technology advancements by evaluating these 26 quantum computing stocks accelerating the industry with new computing power and transformative capabilities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.