يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Rexford Industrial Realty (REXR): A Fresh Look at Valuation After Recent Unexplained Share Price Moves

Rexford Industrial Realty, Inc. REXR | 40.73 | -1.12% |

Rexford Industrial Realty (REXR) has quietly slipped into the spotlight as recent price swings catch investors’ eyes, even without a single headline-grabbing event to explain the move. For those weighing their next move, the lack of a specific trigger this week is precisely what makes this moment interesting. When a stock moves in the absence of big news, it often raises questions about whether market sentiment or a deeper valuation reset is at play.

Over the past month, shares have gained 16%, continuing a steady advance that has taken the stock up 11% this year. This comes even as Rexford’s one-year return is still down by 12%, reminding investors that longer-term momentum has cooled compared to the sharp climb of earlier years. This dynamic, with a rebound from lackluster recent results, puts greater focus on whether new growth or changes in risk perception are making a difference for valuation-minded buyers.

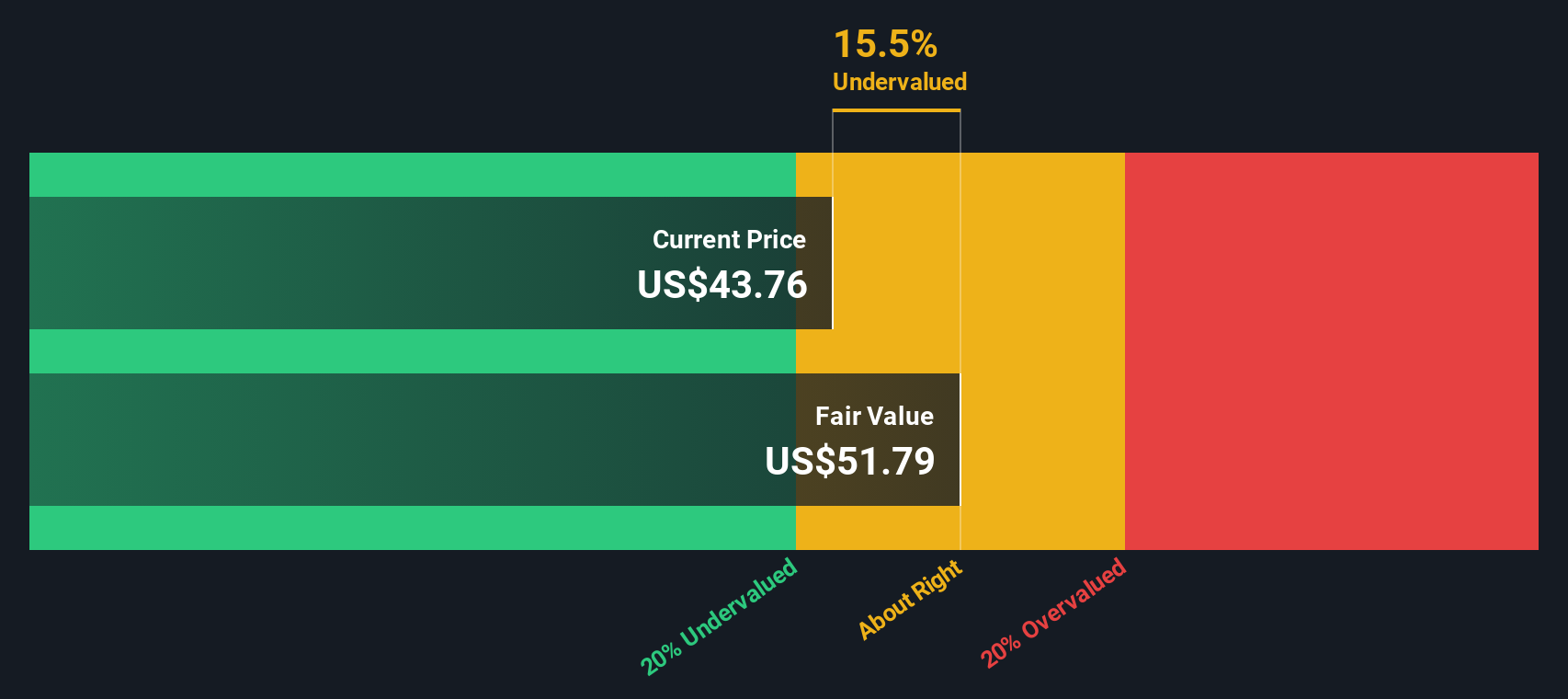

After the bounce this month, is Rexford Industrial Realty actually trading at a bargain, or has the market fully priced in the company’s future growth?

Most Popular Narrative: 7% Overvalued

The most widely followed narrative suggests Rexford Industrial Realty is trading above its fair value, reflecting a cautious outlook from market watchers even as the company continues to see active redevelopment and solid demand in Southern California.

Persistent land constraints and growing resistance to new industrial development in major Southern California urban centers are expected to drive long-term scarcity value for Rexford's existing, well-located properties. This supports rent growth and asset appreciation, which should positively impact revenue and NAV over time.

Is Rexford’s current valuation the result of market overexcitement or careful analysis of its future earnings trajectory? A combination of high-stakes redevelopment, shifting margins, and bold growth forecasts shapes this fair value call. Interested in the projections and assumptions driving analysts to their conclusion? Discover the decisive details behind this premium verdict.

Result: Fair Value of $39.88 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, declining market rents and delayed lease-ups could undermine revenue growth. This raises questions about whether today's optimism will truly last.

Find out about the key risks to this Rexford Industrial Realty narrative.Another View: Discounted Cash Flow Says Undervalued

While analysts call Rexford Industrial Realty slightly overvalued based on their price targets, our DCF model suggests the opposite. REXR currently trades well below what its long-term cash flows might justify. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Rexford Industrial Realty Narrative

If you see things differently or want to dig into the numbers yourself, you can shape your own story in just a few minutes. Do it your way.

A great starting point for your Rexford Industrial Realty research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t leave opportunity on the table by sticking with familiar stocks. Jump into market themes that could energize your portfolio with these targeted ideas:

- Capitalize on tech disruption by targeting businesses shaping the future with AI penny stocks powering artificial intelligence.

- Secure stronger income streams by tapping companies offering dividend stocks with yields > 3% and potentially reliable yields above 3%.

- Ride the next wave of financial innovation by scouting firms at the forefront of cryptocurrency and blockchain stocks and blockchain breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.