يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

TowneBank (TOWN): Assessing the Valuation Behind Its Consistent Performance and Investor Attention

TowneBank TOWN | 34.03 | -0.64% |

TowneBank (TOWN) has caught the eye of investors, though there has not been a single headline-grabbing announcement pushing the stock into the spotlight this week. Sometimes, a stock’s steady performance and underlying fundamentals can be just as intriguing as a splashy news event. This prompts investors to ask whether the market is fully appreciating the company’s potential or overlooking key signals.

Over the past year, TowneBank has seen its stock climb 11%, a respectable showing that builds on consistent gains over the past three years. The past month alone brought a move higher, suggesting that momentum has not completely cooled off in 2024. Underneath the surface, the bank’s strong revenue and net income growth have kept TowneBank on watchlists, even as headline news has been relatively sparse compared to larger peers.

Given the steady hand in recent months, the big question now is whether investors are being offered a bargain, or if TowneBank’s recent growth has already made its way into the current share price.

Price-to-Earnings of 15.4x: Is it justified?

TowneBank is currently valued at a price-to-earnings (P/E) ratio of 15.4x, making it more expensive than both the US Banks industry average of 11.9x and its peer group average of 10.6x.

The price-to-earnings ratio is a commonly used valuation measure that compares the company's current share price to its per-share earnings. For banks, it helps investors gauge whether the current stock price reflects the company's profitability relative to other institutions in the same sector.

While TowneBank's P/E ratio appears elevated compared to its peers, the company shows signs of robust earnings growth and improving profit margins. However, investors may want to consider whether this premium is warranted given its recent performance relative to the wider market and industry.

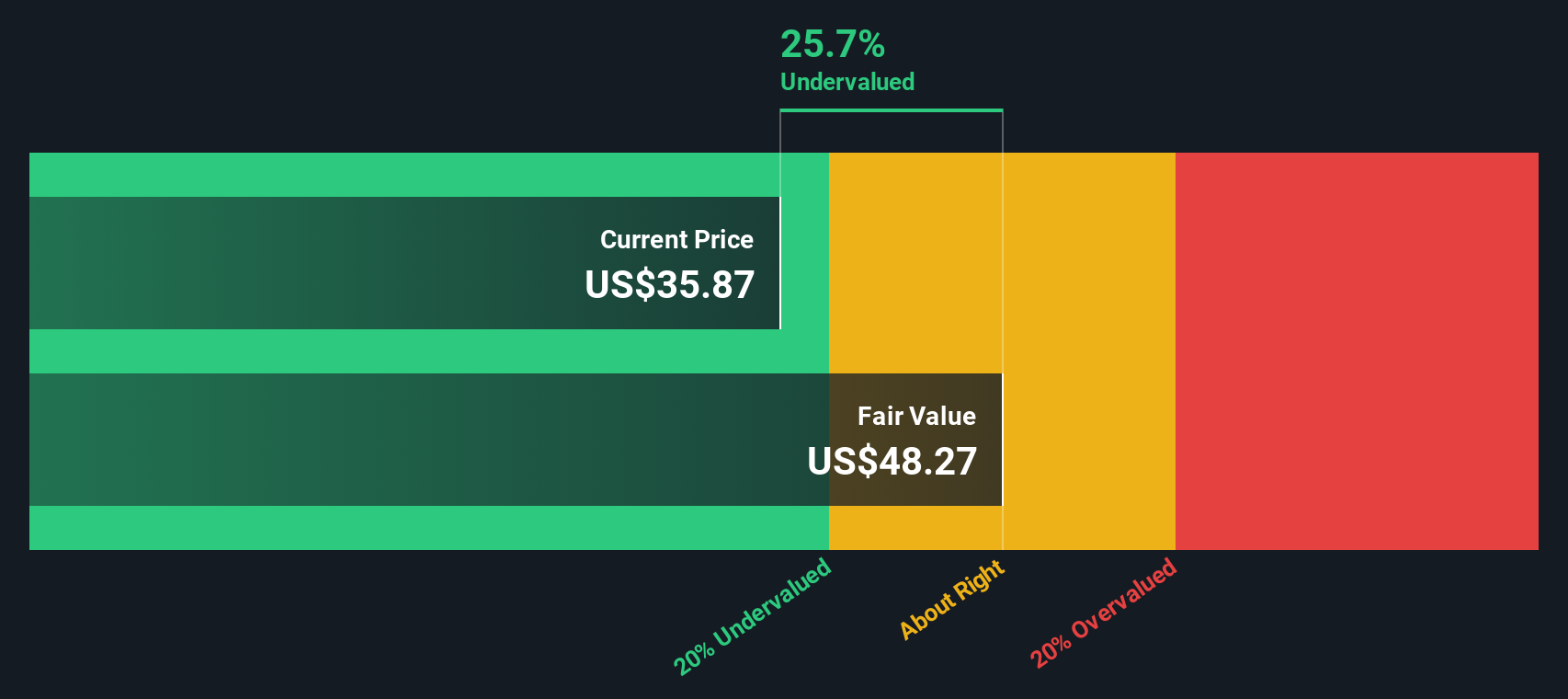

Result: Fair Value of $48.27 (UNDERVALUED)

See our latest analysis for TowneBank.However, slowing revenue growth or a sudden shift in the broader banking sector could quickly change TowneBank's current trajectory.

Find out about the key risks to this TowneBank narrative.Another View: What Does the SWS DCF Model Say?

While the earlier valuation relies on market comparisons, our SWS DCF model offers a different perspective. It suggests TowneBank is undervalued and highlights the power of future cash flow projections. Could this method reveal value that the market overlooks?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own TowneBank Narrative

If you see things differently or want to dig into the data on your own terms, creating a personalized assessment takes just a few minutes. Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding TowneBank.

Looking for More Smart Opportunities?

Why limit yourself to just one pick? Turn your curiosity into confidence by uncovering other standout stocks tailored to your goals using these top strategies:

- Uncover high-yield potential and reliable cash flow with companies offering dividend stocks with yields > 3%.

- Capitalize on growth at a bargain by targeting stocks that are currently undervalued stocks based on cash flows.

- Catch the next wave in innovation by finding disruptive businesses with dynamic advancements in artificial intelligence, featured in our AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.