يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Unity Group (UNIT) Surges 22% Over The Past Week

Uniti Group Inc UNIT | 6.39 | -2.74% |

Unity Group (UNIT) experienced a significant share price increase of 22% over the past week. While specific latest events impacting the company were not detailed, this surge occurred amidst a broad market trend where the S&P 500 and Nasdaq reached all-time highs, supported by positive economic indicators such as a lower Producer Price Index. The company's price gain outpaced the broader market's 1% rise, suggesting additional factors may have influenced Unity Group specifically. Despite this impressive performance, the exact reasons behind the notable price movement remain undetermined without specified events or news tied directly to the company.

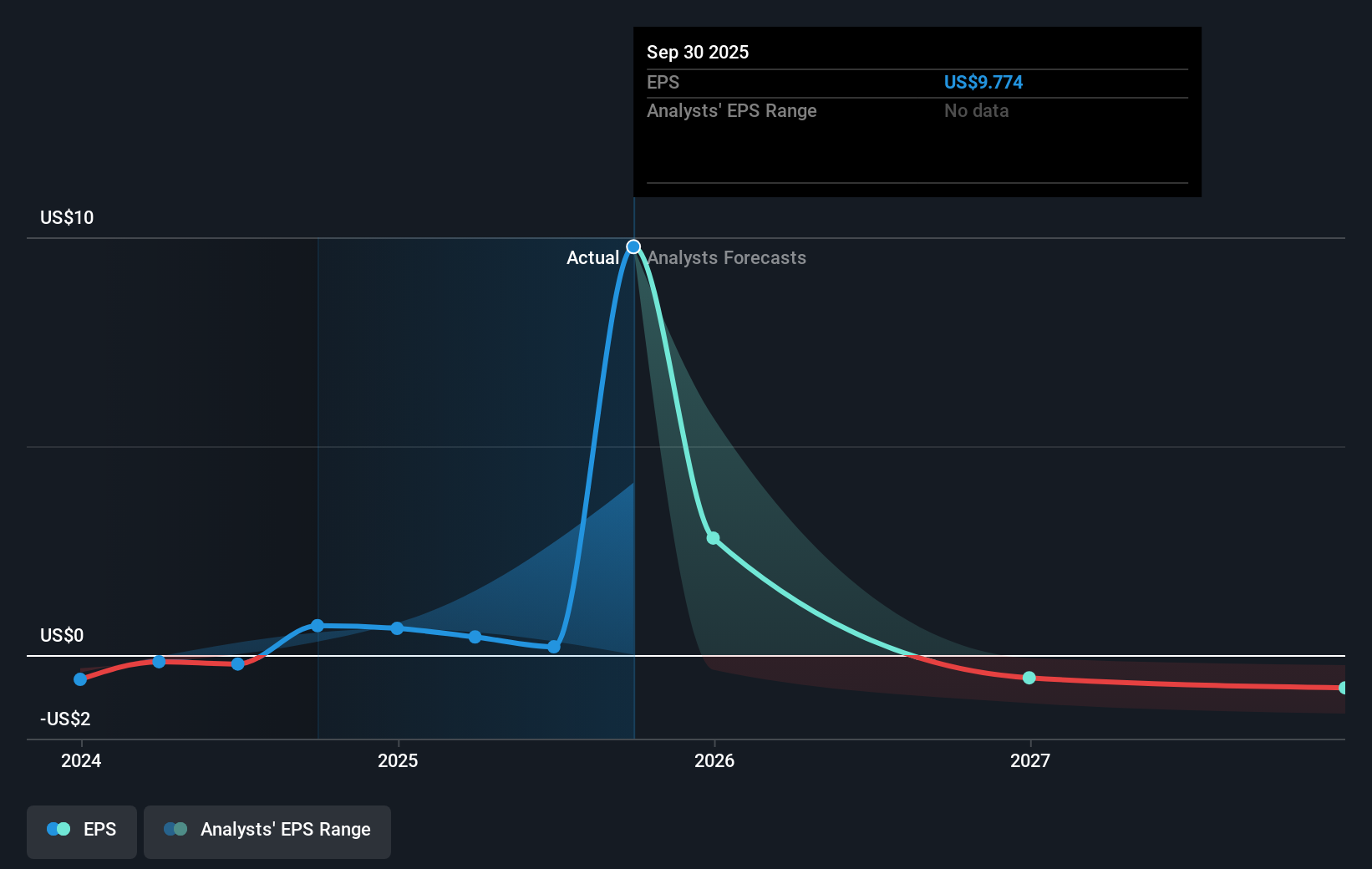

The recent surge in Unity Group's share price, while not directly linked to any specific event, could have repercussions on the broader narrative. This increase aligns with a market uptrend where indices like the S&P 500 and Nasdaq hit record levels. However, the jump outpacing the market indicates potential underlying factors specific to Unity that may affect future revenue and earnings forecasts. Given the company's focus on expanding fiber infrastructure and its financial projections, this upward movement might reflect investor optimism about Unity's long-term growth potential, despite existing risks.

Looking at the longer-term performance, Unity Group experienced a total return of 17.38% decline over the past year, highlighting a challenging period. Despite the recent boost, the company underperformed both the US Telecom industry, which saw a 16.4% gain, and the overall US Market, which recorded a 20.5% gain during the same timeframe. This underperformance suggests that while short-term gains are promising, sustained improvements are needed to bring long-term returns in line with broader market performance.

The recent price movement brings the current share price to $7.14, moving closer to the analyst consensus price target of $8.25. With the shares trading at a 15.55% discount to this target, it suggests there is still a belief among analysts of potential upside. The forecasted revenue growth and revised earnings projections, which assume continued emphasis on fiber, are crucial for achieving the targeted share price. As Unity Group continues to navigate high leverage and capital expenditure needed for expansion, future price movements will likely reflect the execution of these growth initiatives and their impact on financial performance.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.