يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

US Foods Holding (USFD) Reaffirms 2025 Earnings Guidance with 4% to 6% Sales Growth

US Foods Holding Corp. USFD | 74.86 74.87 | -0.45% +0.01% Post |

US Foods Holding (USFD) reaffirmed its earnings guidance for fiscal 2025, projecting net sales growth between 4% and 6%, which likely influenced its share price increase of 2.72% over the last quarter. During this period, the company reported strong Q2 earnings with significant improvements in sales and net income. Additionally, it confirmed a continued share repurchase program, which aligns with its commitment to shareholder value. These positive developments may have added weight to the overall positive market trend, as the S&P 500 and Nasdaq reached all-time highs and broader markets experienced gains.

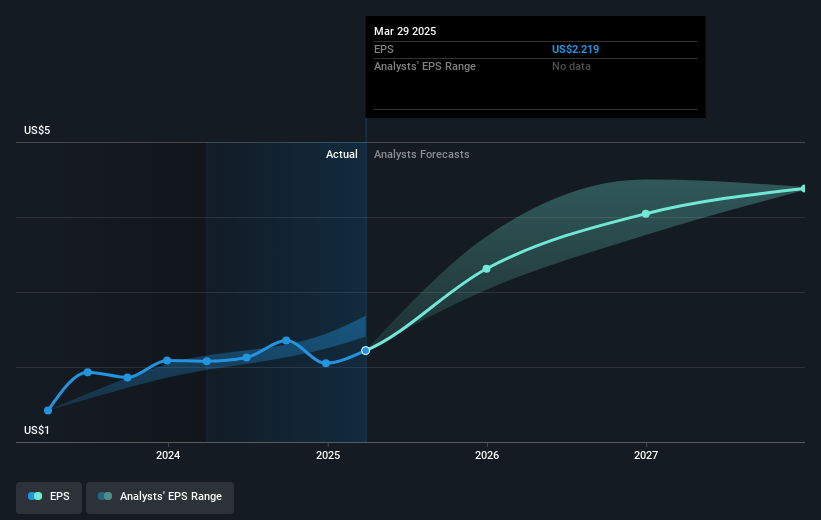

The reaffirmation of US Foods Holding's earnings guidance for fiscal 2025 is significant as it suggests confidence in its growth trajectory, potentially enhancing investor sentiment. This development is expected to bolster its revenue forecasts, projected to grow by approximately 5.3% annually. The company's strategic focus on digital automation and sustainable sourcing is projected to positively influence long-term profitability, aligning with analysts' expectations for earnings to reach US$1.1 billion by 2028. The recent share price increase of 2.72% over the last quarter comes amid broader market gains, with the S&P 500 and Nasdaq reaching all-time highs, reinforcing the optimism in US Foods' market standing.

Over the past five years, US Foods has delivered a total shareholder return, including share price appreciation and dividends, of 212.49%. This strong performance provides a wider context for the company's recent quarterly gains. While US Foods' earnings growth over the past year lagged behind the consumer retailing industry's 9.1% growth rate, it still managed to outperform both the industry and the broader US market returns of 20.1% and 20.5%, respectively. Such relative outperformance highlights the company's effective execution of its business strategies.

Concerning valuation, the current share price of $78.06 reflects a 17% discount to the consensus analyst price target of $91.33, suggesting there might be further upside if the company meets its projected financial targets. However, with a Price-To-Earnings ratio of 31.8x, US Foods is considered more expensive compared to its industry peers. Investors may need to weigh this valuation against growth prospects, leveraging the company's ongoing operational improvements and market opportunities for informed decision-making.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.