يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Utz Brands (UTZ): Evaluating Valuation Following Robust Q2 Results and Dividend Reaffirmation

UTZ BRANDS INC UTZ | 9.58 | +0.42% |

Most Popular Narrative: 23.3% Undervalued

The most widely followed narrative sees Utz Brands as trading well below its calculated fair value, signaling a significant upside if expectations hold true.

Accelerated geographic expansion, particularly into the Midwest and Western U.S. through expanded distribution points and investment in route infrastructure, is unlocking incremental household penetration and driving top line growth. This is positioning Utz to outperform category peers in revenue growth as the U.S. snacking market and urban populations grow.

Want to discover what’s fueling this bullish outlook? The model hinges on a dramatic earnings rebound, ambitious revenue ambitions, and a profit margin boost that could change the game for Utz. Curious how this transformation adds up to a double-digit discount to fair value? The assumptions behind this narrative might surprise you.

Result: Fair Value of $17.10 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, ongoing high capital demands and a heavy reliance on traditional salty snacks could limit Utz’s ability to maintain long-term margin growth.

Find out about the key risks to this Utz Brands narrative.Another View: What Do Valuation Ratios Say?

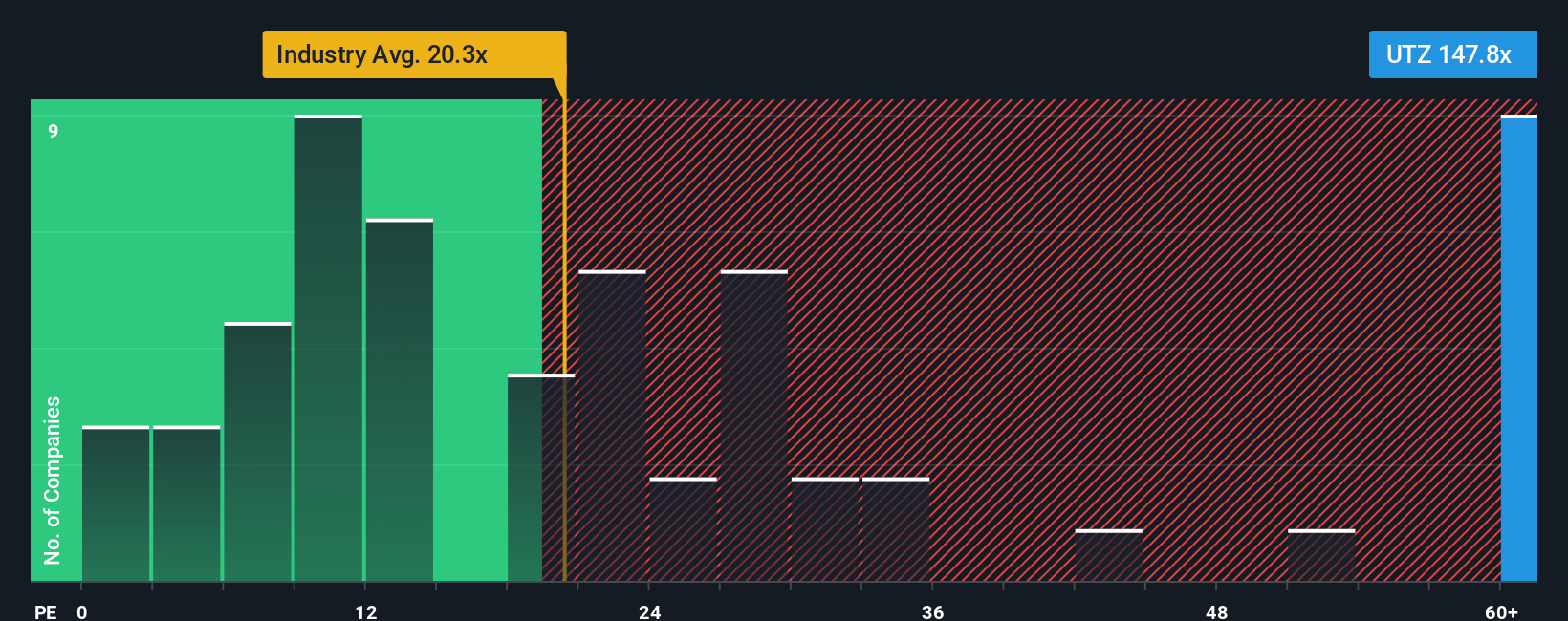

While the most popular approach sees upside for Utz Brands, a closer look at valuation ratios shows the company is actually trading at a much higher multiple than others in its industry. Does this signal possible caution ahead, or do current strengths justify the premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Utz Brands Narrative

If you're curious to dig deeper or think you see another angle, you can easily build your own narrative in just a few minutes. Do it your way.

A great starting point for your Utz Brands research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investment horizons and put yourself ahead of the curve with stock ideas tailored to growth, innovation, and long-term financial health. Don’t miss an opportunity to act on tomorrow’s trends today.

- Spot companies poised for a value comeback and capture untapped potential with our powerful undervalued stocks based on cash flows.

- Unlock steady income streams by checking out businesses that offer robust yields. Let our dividend stocks with yields > 3% show you the top performers.

- Ride the next tech boom by finding companies shaping the future with cutting-edge AI with our smart AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.