يرجى استخدام متصفح الكمبيوتر الشخصي للوصول إلى التسجيل - تداول السعودية

Woodward (WWD): Assessing Valuation After U.S.-China Thaw and Strong Aerospace Results

Woodward, Inc WWD | 303.45 | +0.60% |

Woodward (WWD) shares climbed after President Trump adopted a friendlier stance on U.S.-China relations, which helped lift market spirits. Investors also took note of Woodward’s strong aerospace results and encouraging full-year guidance.

Woodward has delivered a remarkable run over the last year, boasting a 46.75% year-to-date share price return and a stellar 52.67% total shareholder return, with multi-year returns that show real staying power. The latest uptick reflects both improved sentiment around U.S.-China relations and the company’s reinforcing strength in aerospace. This momentum suggests more investors are buying into its long-term growth story.

If you’re interested in discovering other market movers in the aerospace and defense space, now’s a great time to explore See the full list for free.

But with Woodward’s shares already soaring this year and expectations riding high after strong earnings, the key question is whether investors can still find value here, or if the market has already priced in future growth.

Most Popular Narrative: 15% Undervalued

With the narrative's fair value of $295.71 significantly ahead of Woodward's last close at $251.50, the current momentum has sparked debate about whether the market is still underestimating its prospects.

The global push for decarbonization and rising energy efficiency standards is accelerating demand for high-tech propulsion, actuation, and energy management systems in both aviation and industrial markets. This trend is supporting Woodward's revenue growth and expanding its addressable market over the coming years.

Is there a decisive edge hidden in the company's future projections? The growth assumptions and profitability targets behind this fair value could surprise even seasoned investors. Want to know which expectations are fueling bullish sentiment? Dive in to uncover the real numbers behind this ambitious valuation.

Result: Fair Value of $295.71 (UNDERVALUED)

However, ongoing supply chain disruptions and heavy capital investments could quickly pressure Woodward’s margins if execution falters or if conditions worsen.

Another View: Market Multiples Tell a Different Story

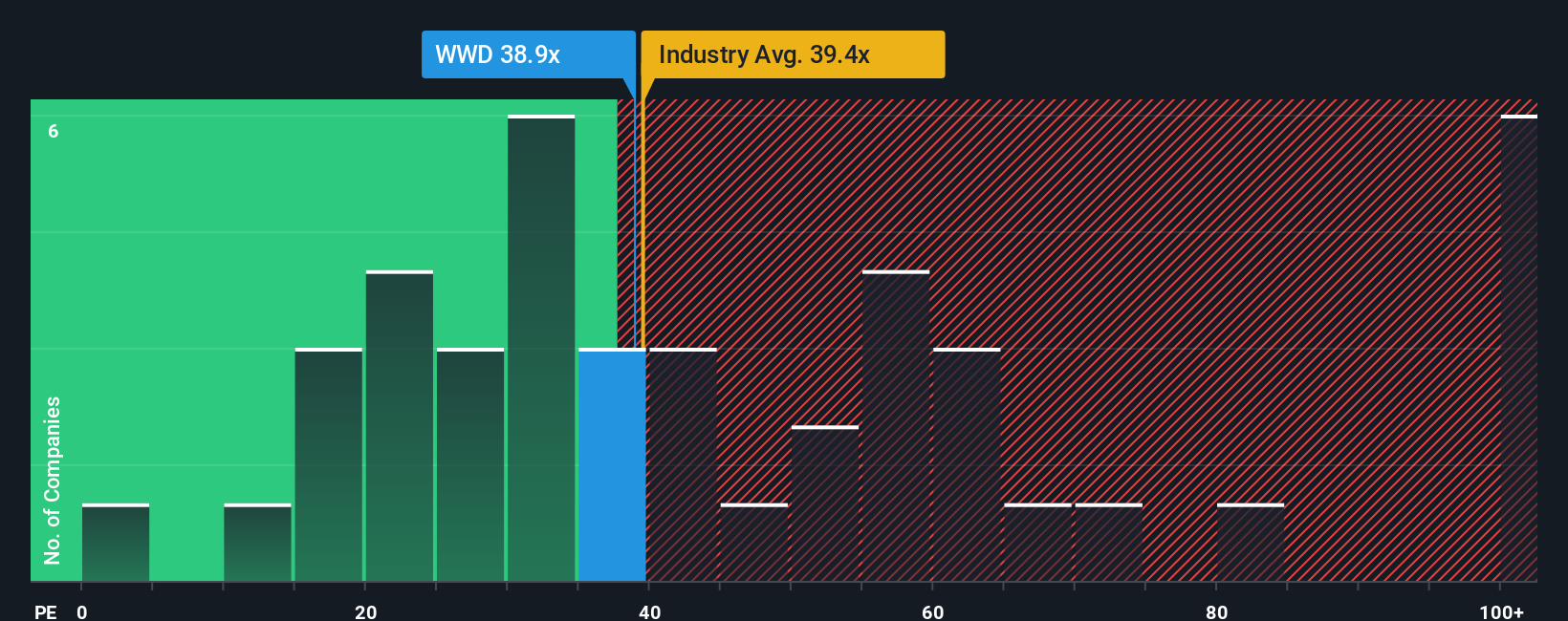

While analyst forecasts point to Woodward being undervalued, current market multiples offer a more mixed picture. The company's price-to-earnings ratio stands at 38.9x, just under the industry average of 40x and the peer average of 39.1x, but significantly above its fair ratio of 26.6x. This suggests the stock could be priced well above what historical trends would recommend. Are investors overestimating Woodward's future strength?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Woodward for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Woodward Narrative

If you see things differently or want to weigh the facts for yourself, you can build your own perspective on Woodward in just a few minutes using the same data, and make your own call. Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Woodward.

Looking for more investment ideas?

Smart investors always keep an eye on fresh opportunities. Tap into trends shaking up the market and make confident picks. Don't let these top ideas pass you by.

- Capitalize on the rise of digital assets and tap into future-forward companies paving the way with these 79 cryptocurrency and blockchain stocks.

- Target reliable income streams and stay ahead of inflation by checking out these 18 dividend stocks with yields > 3% offering strong yields above 3%.

- Position yourself for explosive growth by evaluating these 24 AI penny stocks driving innovation in artificial intelligence worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.