Please use a PC Browser to access Register-Tadawul

A Fresh Look at Boston Scientific’s (BSX) Valuation as Key Division President Announces Retirement

Boston Scientific Corporation BSX | 97.52 | -0.20% |

Boston Scientific (BSX) is navigating a pivotal moment as the company prepares for the retirement of Jeffrey B. Mirviss, its Executive Vice President and President of Peripheral Interventions. Scheduled to step down in December, Mirviss’s departure introduces a meaningful shift in leadership for a division that is central to Boston Scientific’s business and long-term strategy. With Mirviss set to remain as a senior advisor for several months, investors are weighing what this transition could mean for momentum within the Peripheral Interventions group and Boston Scientific as a whole.

This leadership change comes as Boston Scientific’s stock continues to attract notice. Over the past year, shares have climbed 30%, and they show a gain of nearly 9% in the past 3 months alone. While recent conferences and executive announcements have kept the company in the spotlight, the steady performance signals that investor confidence, at least for now, is holding up, even as Boston Scientific faces the challenge of integrating new leadership in a key area.

With the stock’s strong run this year and such a crucial transition underway, some are questioning whether the market is underestimating Boston Scientific’s growth prospects or if future success is already reflected in the current share price.

Most Popular Narrative: 13% Undervalued

The prevailing narrative sees Boston Scientific as undervalued based on future earnings and growth catalysts, projecting significant upside from current levels.

Investment in proprietary, high-margin technologies (for example, next-generation mapping, advanced diagnostic tools, and differentiated urology/neuromodulation pipelines) combined with successful integration of recent acquisitions including Axonics, SoniVie, Intera, and Silk Road expands Boston Scientific's addressable market and is likely to drive margin expansion as product mix improves.

Curious about what’s fueling this bullish outlook? The narrative is built on ambitious forecasts for top-line growth and profit expansion, hinging on a future price-to-earnings multiple well above the industry norm. Want to know how Boston Scientific could justify such a premium? Discover the full details behind these bold assumptions in the complete story.

Result: Fair Value of $124.27 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cost pressures and intensifying competition in key markets could challenge Boston Scientific’s ability to sustain both revenue growth and expanding margins.

Find out about the key risks to this Boston Scientific narrative.Another View: What Do Market Ratios Suggest?

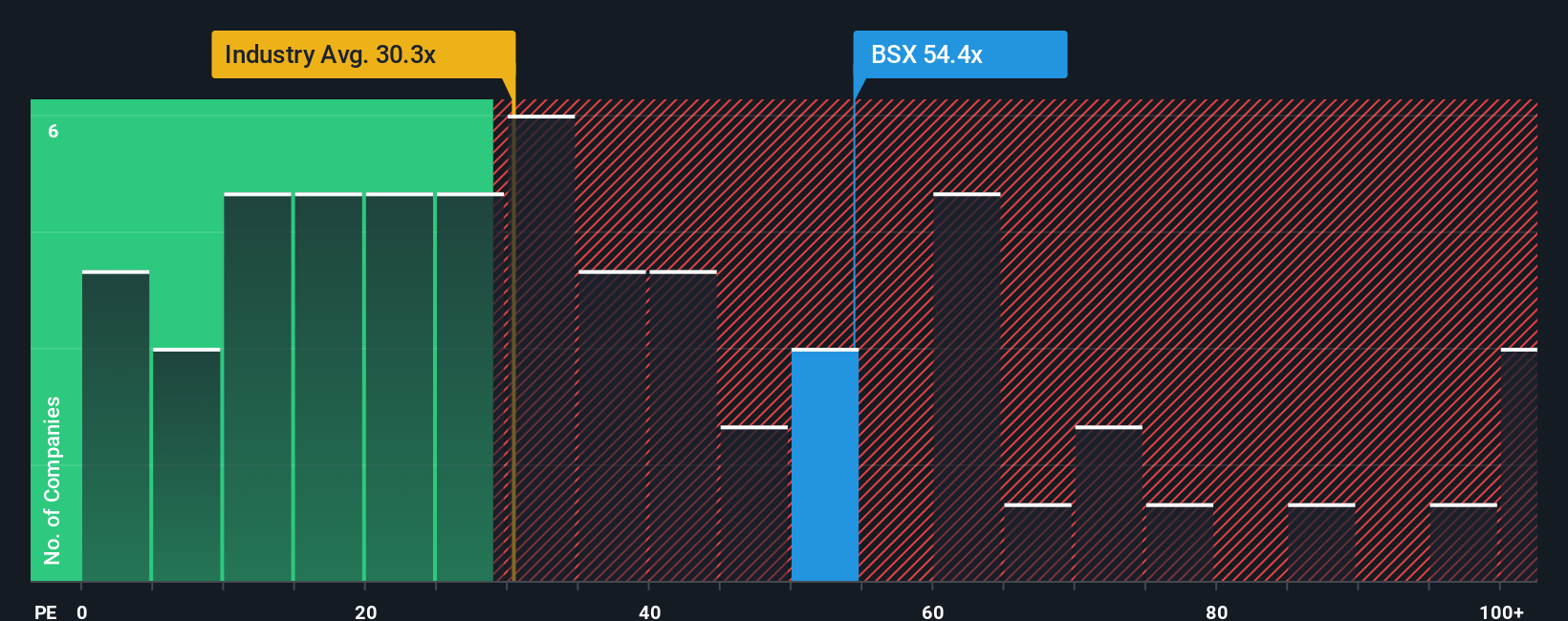

On the other hand, when you look at how the market values Boston Scientific using its price-to-earnings ratio compared to the broader industry, the stock appears expensive, not undervalued. Could the market be signaling caution?

Build Your Own Boston Scientific Narrative

If you see things differently or want to run your own analysis, you can put together your own version in just a few minutes. Do it your way.

A great starting point for your Boston Scientific research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Investment Ideas?

Don’t let the next breakout stock pass you by. Expand your watchlist with hand-picked opportunities designed to grow your wealth and keep you ahead of the market.

- Spot tomorrow’s disruptors trading at a fraction of their potential by scanning through penny stocks with strong financials, shaping the next wave of market leaders.

- Uncover steady income streams and reliable performers with dividend stocks with yields > 3%, offering above-average yields for confident, long-term investing.

- Stay ahead of innovation curves with AI penny stocks, built on advanced automation and next-generation technology breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.