Please use a PC Browser to access Register-Tadawul

A Fresh Look at Varonis Systems (VRNS) Valuation After New AI Security Offering Unveiled at Dreamforce 2025

Varonis Systems, Inc. VRNS | 30.20 | -2.93% |

Varonis Systems (VRNS) revealed its new AI identity protection offering for Salesforce Agentforce at Dreamforce 2025. The new solution gives IT and security teams improved oversight of sensitive business data accessed by AI agents. This expansion targets growing enterprise demand for secure AI integration.

After gaining attention with its latest AI security offerings, Varonis Systems has seen notable momentum, with a year-to-date share price return of almost 37%. The three-year total shareholder return stands out even more at 132%, highlighting that recent innovation is building on a strong foundation.

If you’re looking to spot other dynamic tech names making moves in the AI and software security space, don’t miss the chance to explore the market’s most promising opportunities with our curated list, See the full list for free.

With shares up sharply this year and innovation accelerating, does Varonis still have room to surprise investors to the upside, or is the current stock price already reflecting all of its future growth?

Most Popular Narrative: 4.6% Undervalued

With Varonis Systems’ most-followed narrative estimating a fair value above its recent closing price, the market is not fully pricing in its growth potential yet. This evaluation relies on updated analyst expectations and recent business momentum, setting the stage for a deeper look at what drives the narrative.

Expanding global data privacy regulations and mounting cyber threats are compelling enterprises to invest in advanced unstructured data security and governance. Varonis' differentiated platform (with new FedRAMP authorization, SaaS model, and deep cloud coverage) stands to benefit from long-term, recurring revenue tailwinds as security budgets become more data-centric.

What is fueling this compelling narrative? The heart of the case is a set of aggressive assumptions about future revenue streams and margin traction, paired with the expectation that Varonis will capture outsized demand as enterprise data needs increase. Want to see which key drivers are making analysts lean bullish? Find out what numbers could justify this ambitious valuation upgrade.

Result: Fair Value of $63.48 (UNDERVALUED)

However, the ambitious outlook relies on smooth SaaS adoption and expanding margins. Both of these factors could be challenged if competition or cloud costs unexpectedly intensify.

Another View: Valuation Multiples Signal a Premium

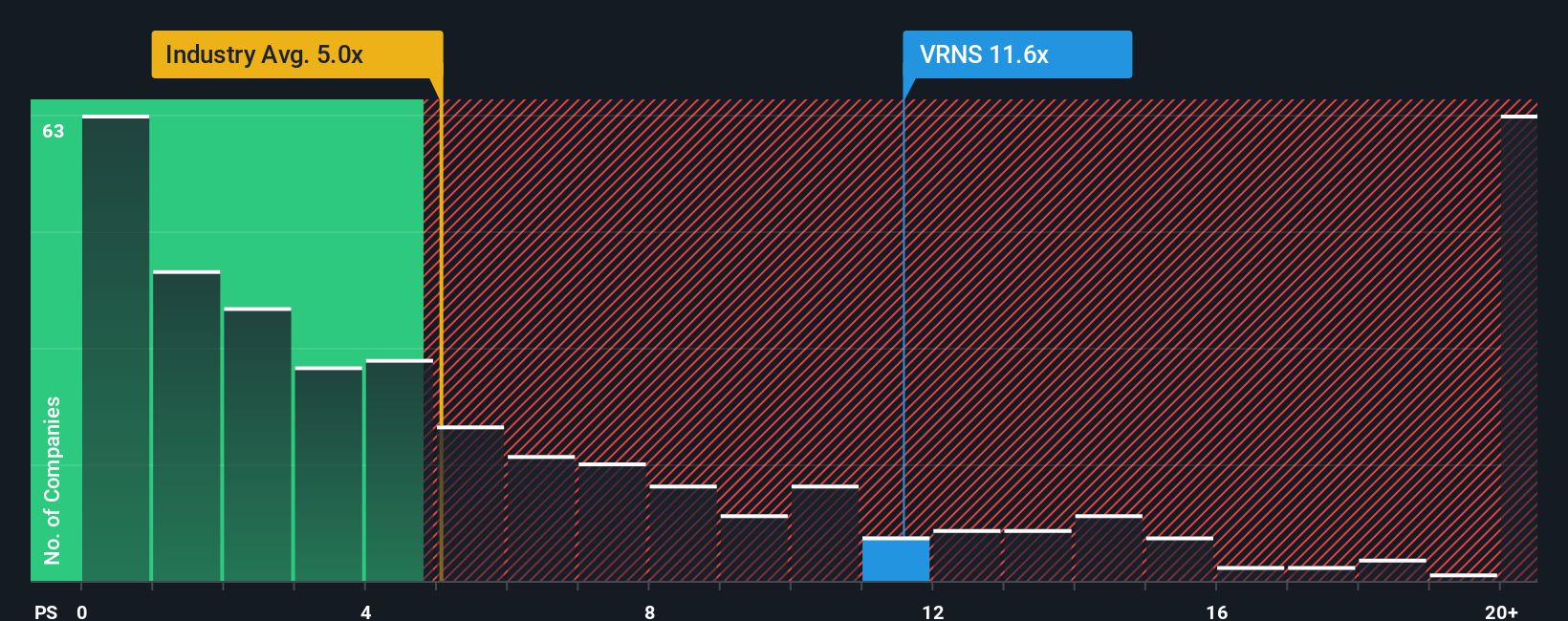

While the narrative leans on growth and analyst targets, our valuation using price-to-sales tells a different story. Varonis trades at 11.4x sales, far above the US Software industry’s 5.2x average and a fair ratio of just 7.3x. This premium suggests investors are betting heavily on future success and raises the stakes should growth falter. Is the market pricing in too much optimism, or is there more upside ahead?

Build Your Own Varonis Systems Narrative

If you see the story differently or want to dig deeper into the numbers yourself, it's easy to build your own perspective in just a few minutes. Do it your way

A great starting point for your Varonis Systems research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Why limit your search to just one opportunity? Enhance your portfolio by taking action on these forward-thinking stock ideas that serious investors are tracking right now.

- Lock in growing yields by checking out these 18 dividend stocks with yields > 3% offering reliable payouts and stability, even when markets swing.

- Unleash the potential of cutting-edge medicine with these 33 healthcare AI stocks, which is advancing innovation in healthcare through artificial intelligence.

- Seize early-stage momentum with these 3571 penny stocks with strong financials. These combine strong fundamentals and room for future growth before the crowd catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.