Please use a PC Browser to access Register-Tadawul

A Glimpse Into The Expert Outlook On NiSource Through 4 Analysts

NiSource Inc. NI | 42.00 | +0.26% |

NiSource (NYSE:NI) underwent analysis by 4 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 0 | 2 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 1 | 0 | 0 |

| 3M Ago | 0 | 1 | 0 | 0 | 0 |

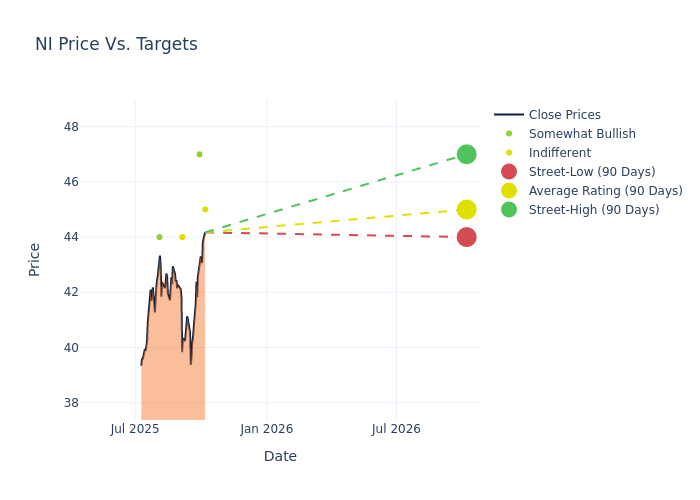

In the assessment of 12-month price targets, analysts unveil insights for NiSource, presenting an average target of $45.0, a high estimate of $47.00, and a low estimate of $44.00. This current average represents a 0.73% decrease from the previous average price target of $45.33.

Deciphering Analyst Ratings: An In-Depth Analysis

An in-depth analysis of recent analyst actions unveils how financial experts perceive NiSource. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nicholas Amicucci | Evercore ISI Group | Announces | In-Line | $45.00 | - |

| James Thalacker | BMO Capital | Raises | Outperform | $47.00 | $46.00 |

| Julien Dumoulin-Smith | Jefferies | Lowers | Hold | $44.00 | $48.00 |

| Nicholas Campanella | Barclays | Raises | Overweight | $44.00 | $42.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to NiSource. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Gaining insights, analysts provide qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of NiSource compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for NiSource's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of NiSource's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on NiSource analyst ratings.

About NiSource

NiSource is one of the nation's largest natural gas distribution companies with 3.2 million customers in Indiana, Kentucky, Maryland, Ohio, Pennsylvania, and Virginia. NiSource's electric utility transmits and distributes electricity in northern Indiana to about 500,000 customers. The regulated electric utility also owns more than 3,000 megawatts of generation capacity, including coal, natural gas, and renewable energy.

NiSource: A Financial Overview

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: NiSource displayed positive results in 3M. As of 30 June, 2025, the company achieved a solid revenue growth rate of approximately 18.28%. This indicates a notable increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Utilities sector.

Net Margin: NiSource's net margin falls below industry averages, indicating challenges in achieving strong profitability. With a net margin of 7.97%, the company may face hurdles in effective cost management.

Return on Equity (ROE): NiSource's ROE falls below industry averages, indicating challenges in efficiently using equity capital. With an ROE of 1.15%, the company may face hurdles in generating optimal returns for shareholders.

Return on Assets (ROA): NiSource's ROA is below industry averages, indicating potential challenges in efficiently utilizing assets. With an ROA of 0.3%, the company may face hurdles in achieving optimal financial returns.

Debt Management: NiSource's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 1.77.

The Basics of Analyst Ratings

Analysts work in banking and financial systems and typically specialize in reporting for stocks or defined sectors. Analysts may attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish "analyst ratings" for stocks. Analysts typically rate each stock once per quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.