Please use a PC Browser to access Register-Tadawul

A Look at Vericel’s (VCEL) Valuation Following Strong Earnings and Growing Institutional Interest

Vericel Corporation VCEL | 36.23 | -1.52% |

Vericel (VCEL) recently delivered quarterly earnings that surpassed Wall Street estimates, with revenue climbing 20% over the same period last year. This performance has caught the attention of institutional investors, who are increasing their stakes in the company.

Vericel’s upbeat quarterly report sparked renewed momentum in the stock, with a 1-day share price return of 3.4% and a 1-week gain of 4.6%. Despite these recent rallies, its year-to-date share price remains down 37%, reflecting a tough year for investors. However, the longer-term story is brighter. Vericel’s three- and five-year total shareholder returns of 39% and 67% show that patient shareholders have still come out well ahead.

If you’re interested in finding more innovators with potential to deliver strong long-term performance, now’s the perfect moment to discover See the full list for free.

But with analysts updating their price targets and institutional investors increasing their stakes, is Vericel still trading below its true value? Alternatively, has the market already factored in the company’s future growth prospects?

Most Popular Narrative: 35.7% Undervalued

Vericel’s most widely followed investment thesis suggests strong upside from the current share price, with its fair value seen far above the recent closing price. A clear revenue growth trajectory and conviction in future earnings are central to this optimistic outlook.

Ongoing operational initiatives such as automation, new manufacturing facility ramp (with expected commercial manufacturing for MACI in 2026), and salesforce expansion are increasing plant utilization and operational leverage. This supports steady gross margin expansion and bottom-line (EBITDA) growth as scale increases.

Curious what ambitious financial targets lie behind this bullish price target? The narrative hints at key changes in earnings power, faster growth, and a profit profile few would expect from this sector. Don’t miss which projections support this dramatic re-rating.

Result: Fair Value of $53.88 (UNDERVALUED)

However, Vericel’s dependence on a limited product range and unpredictable Epicel revenues could challenge the optimistic forecasts if setbacks emerge.

Another View: Value Signals from Sales Multiples

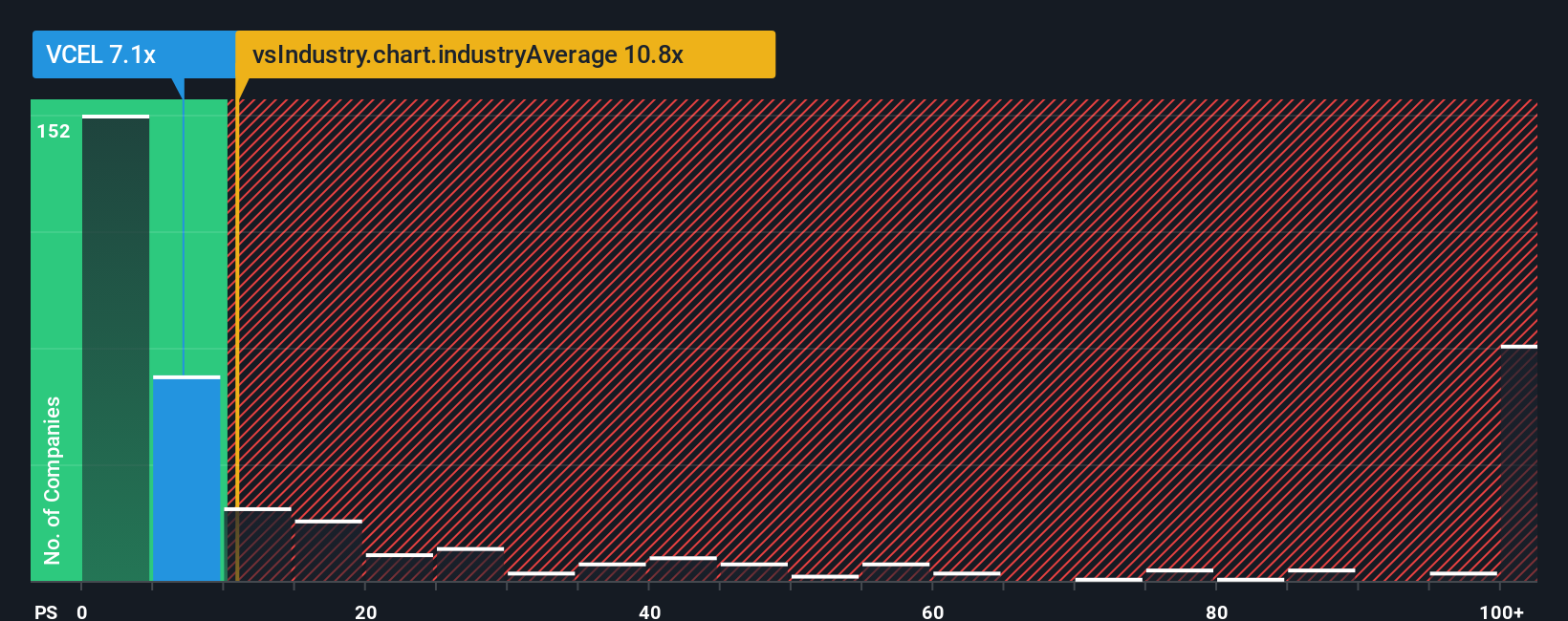

Looking at Vericel’s price-to-sales ratio of 7x paints a different picture from the fair value model. While it looks pricey against peers, whose average is 4.4x, it is still less expensive than the US Biotechs industry at 10.3x. The market’s fair ratio sits at 5.9x, so Vericel’s current valuation leaves less room for error. Could this premium be justified, or does it leave investors exposed if expectations slip?

Build Your Own Vericel Narrative

If you prefer a different perspective or want to dig deeper into Vericel’s financials and forecasts, you can quickly craft your own take in just a few minutes, Do it your way

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Vericel.

Looking for More Investment Ideas?

Ready to uncover your next market winner? Gain an edge with screens selected for their long-term potential, strong returns, and unique growth angles.

- Power up your portfolio with income by tapping into these 18 dividend stocks with yields > 3% offering yields above 3% and reliable dividend histories.

- Stay ahead of technology trends and spot breakout opportunities among these 24 AI penny stocks disrupting industries with artificial intelligence and automation.

- Capture value with these 872 undervalued stocks based on cash flows that our analysis shows are trading below their intrinsic worth based on robust cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.