Please use a PC Browser to access Register-Tadawul

AC Immune (NasdaqGM:ACIU): Exploring Valuation Following Promising Phase 1b/2a Alzheimer’s Data Publication

AC Immune SA ACIU | 2.80 | -2.78% |

AC Immune (NasdaqGM:ACIU) just shared peer-reviewed data from its Phase 1b/2a trial of ACI-35.030, an active immunotherapy targeting Tau in early Alzheimer's, developed with Janssen. The findings highlight a rapid and sustained antibody response as well as a clean safety profile.

With this encouraging clinical update, AC Immune is starting to turn heads, especially as the company’s latest innovation underscores its growing potential in Alzheimer’s research. Despite seeing only modest movement in its share price this year, with a 1-year total shareholder return just above breakeven and a three-year return comfortably in positive territory, investor optimism appears to be holding steady as scientific milestones continue to build momentum.

If biotech breakthroughs are on your radar, this could be a good opportunity to explore other innovators via our See the full list for free..

With shares still trading at a steep discount to analyst targets, are investors overlooking AC Immune’s growth potential? Alternatively, has the recent clinical momentum already been fully factored into today’s price?

Price-to-Sales Ratio of 9.6x: Is it justified?

Based on its last close at $3.54, AC Immune is trading with a price-to-sales ratio of 9.6x, which puts it below the peer group average. This suggests that, at current levels, the market is valuing the company’s sales at a lower multiple than many of its competitors.

The price-to-sales ratio compares a company’s stock price to its revenues and highlights how much investors are willing to pay for each dollar of sales. For biotechs, where profits may still be elusive, this multiple is a useful way to benchmark growth-stage companies with sizable research pipelines and partnerships.

Right now, AC Immune appears attractively valued relative to both peer and industry averages. Its price-to-sales ratio is lower than the industry benchmark of 10.5x and significantly below the peer average of 13.8x. However, it is higher than the estimated fair ratio of 0.9x, suggesting room for the market’s expectations to adjust if the company’s commercial prospects do not materialize as anticipated.

Result: Price-to-Sales of 9.6x (UNDERVALUED)

However, slower-than-expected revenue growth or unexpected setbacks in clinical trials could quickly change market sentiment regarding AC Immune’s future prospects.

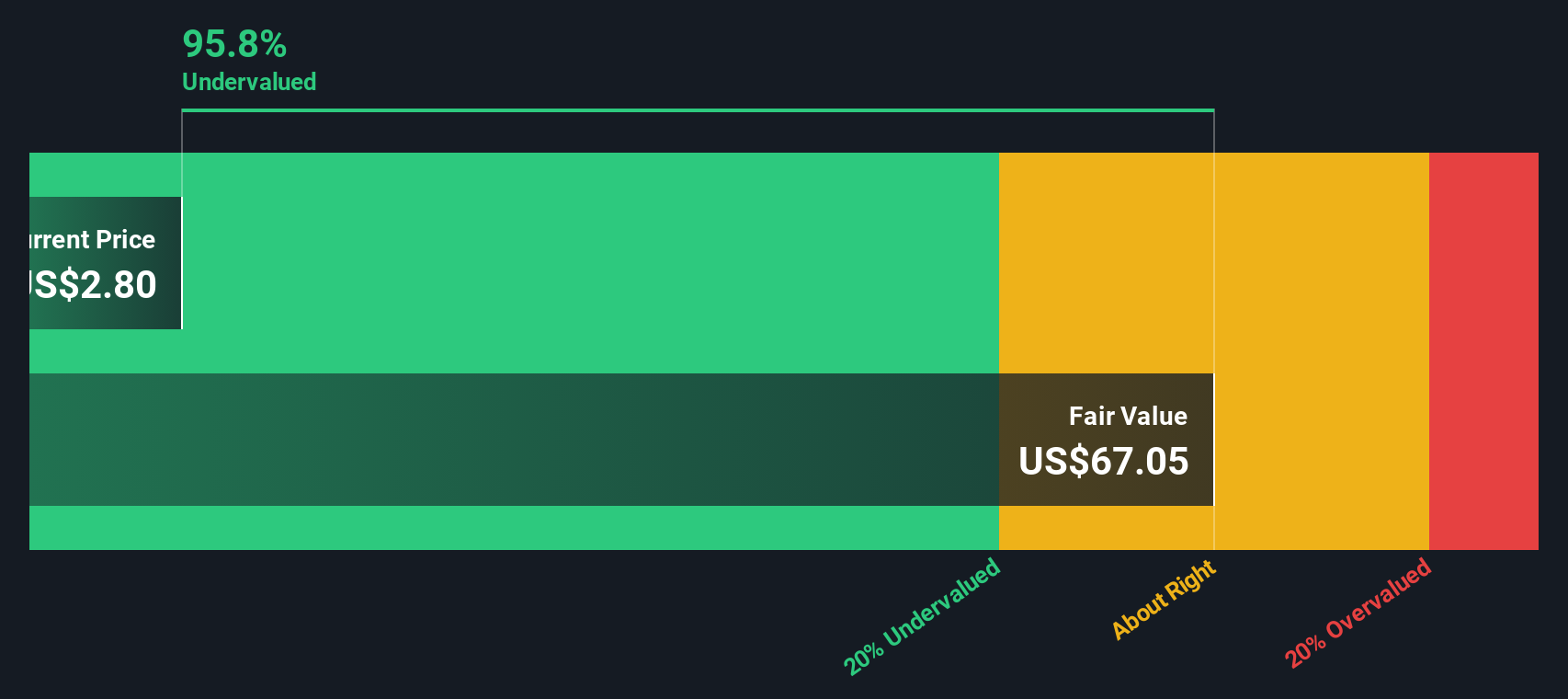

Another View: SWS DCF Model Signals Deep Undervaluation

While the price-to-sales ratio paints AC Immune as undervalued versus peers, the SWS DCF model takes a different angle. This approach suggests the stock is trading at a huge discount, almost 95% below its calculated fair value. Could the market be missing something, or is there a reason for caution?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AC Immune for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AC Immune Narrative

If these analyses spark different thoughts or you believe there’s more to the story, you can easily build your own perspective on AC Immune in just a few minutes. Do it your way.

A great starting point for your AC Immune research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors are always on the lookout for fresh opportunities that others might miss. Don’t wait. Expand your watchlist with these timely investment ideas:

- Capitalize on the momentum of artificial intelligence by checking out these 25 AI penny stocks, shaping tomorrow’s markets with breakthrough machine learning and automation.

- Boost your long-term returns by targeting income-generators through these 19 dividend stocks with yields > 3%, where you’ll find businesses offering yields above 3%.

- Get ahead of the crowd in the quantum race. See these 26 quantum computing stocks pioneering game-changing tech advancements before they become household names.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.