Please use a PC Browser to access Register-Tadawul

AES (AES): Is the Utility’s Recent Rebound Enough to Shift Its Valuation?

AES Corporation AES | 13.92 | -0.07% |

AES has managed a solid rebound recently, with a 1-month share price return of 13.2% and shares closing at $14.75. However, its total shareholder return over the past year remains negative at -12.7%. Momentum seems to be building again for AES after a tough stretch, but long-term investors are still looking for clearer signs that the recovery is sustainable.

If you want to see what else is gaining steam beyond the utilities sector, now’s a good moment to broaden your search and discover fast growing stocks with high insider ownership

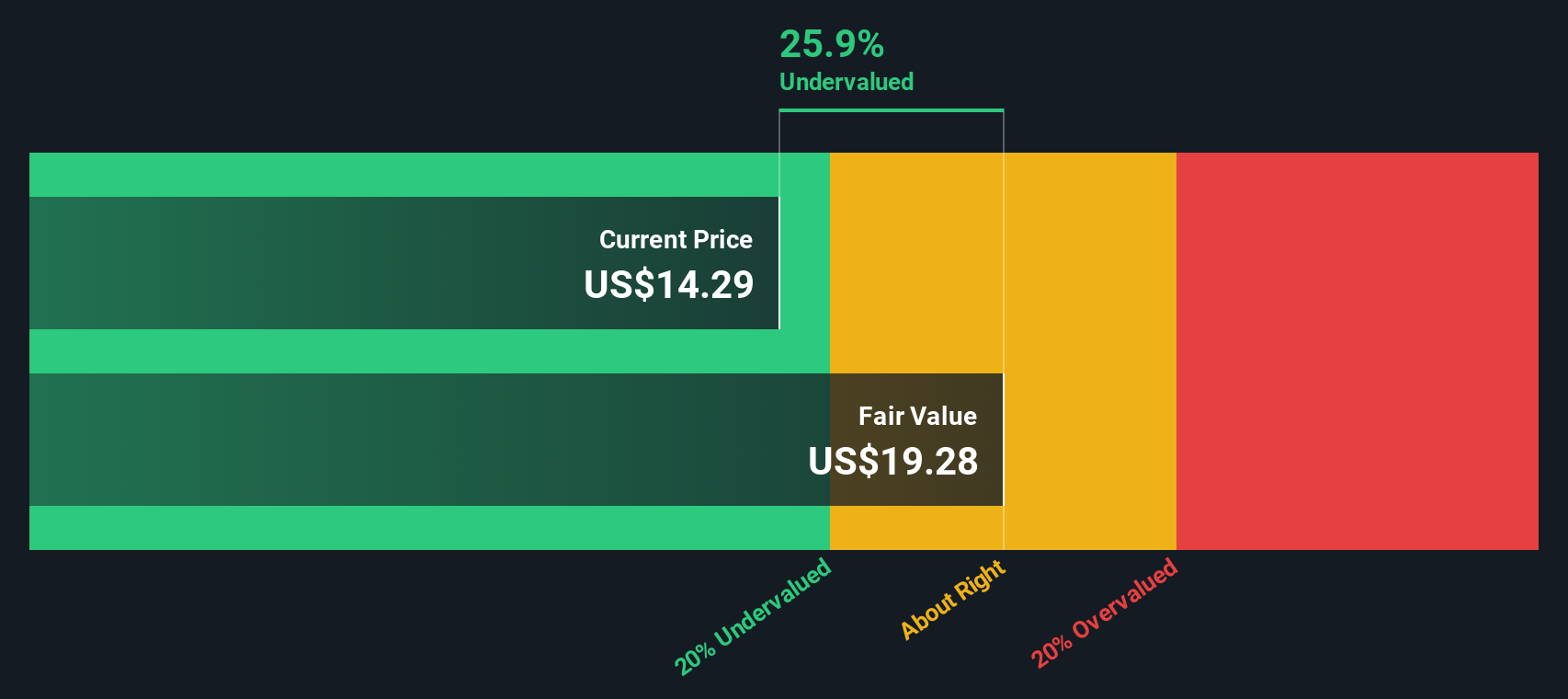

With shares trading at a sizable discount to their intrinsic value, but the recovery still in its early stages, is AES offering a compelling entry point right now, or has the market already priced in the path ahead?

Most Popular Narrative: 4% Overvalued

With the current share price closing at $14.75, compared to a fair value estimate of $14.13 from the most-followed narrative, AES is trading just above its suggested intrinsic value. This sets up a debate on whether this modest premium is warranted as forecasts shift.

"AES's leading, long-term pipeline of renewables and energy storage projects, backed by robust, multi-year Power Purchase Agreements (PPAs) with data center and corporate customers, positions the company to capitalize on rapidly rising electricity demand from AI/data centers, accelerating revenue growth and increasing visibility on future cash flows."

Curious about the logic for this latest fair value? The big missions: rising margins and a future profit multiple not usually seen in utilities. Want to see the numbers and assumptions that power this bold narrative? Dive in to uncover what’s fueling this price target.

Result: Fair Value of $14.13 (OVERVALUED)

However, persistent policy uncertainty around renewables incentives and the heavy capital demands of project expansion could still undermine AES’s earnings outlook in the future.

Another View: SWS DCF Model Says Undervalued

Looking at things differently, the SWS DCF model estimates AES’s fair value at $19.28, well above the recent $14.75 close. This model suggests shares are trading at a substantial discount, indicating potential upside for investors. Is the market missing something here?

Build Your Own AES Narrative

If you want to take a hands-on approach or have your own perspective, you can easily build your own AES story in just a few minutes. Do it your way.

A great starting point for your AES research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Want Even More Investment Ideas?

Seize the moment and elevate your portfolio. Savvy investors are always tracking the hottest opportunities before the rest of the market catches on. Don’t let these trends pass you by.

- Pounce on strong yields by targeting these 18 dividend stocks with yields > 3% with competitive payouts that can boost your income stream.

- Ride the wave of medical innovation when you research these 33 healthcare AI stocks transforming patient care and diagnostics.

- Get ahead of tomorrow’s tech by reviewing these 24 AI penny stocks powering advancements in artificial intelligence across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.