Please use a PC Browser to access Register-Tadawul

AGNC Investment (AGNC): Assessing Valuation as Shares Gain Momentum in the Mortgage REIT Sector

American Capital Agency Corp. AGNC | 10.62 | +1.24% |

AGNC Investment (AGNC) has recently seen its stock price edge higher over the past month, catching the attention of investors curious about shifts in the mortgage real estate investment sector. Returns continue to show strength, even as broader market sentiment fluctuates.

Over the last year, AGNC Investment has generated a strong 21.75% total shareholder return. Momentum has picked up recently with a 6.68% share price gain over the past 90 days. This steady climb comes as investor confidence in the wider mortgage REIT space appears to be returning, hinting at shifting risk perceptions and a renewed appetite for yield-focused plays.

If AGNC’s recent recovery has you rethinking your next move, you might want to broaden your perspective and discover fast growing stocks with high insider ownership

With shares climbing and recent results exceeding expectations, the question now is whether AGNC Investment remains undervalued or if the current price already reflects all future growth. Is there still a genuine buying opportunity here?

Price-to-Earnings of 15.7x: Is it justified?

AGNC Investment's shares are currently trading at a price-to-earnings (P/E) ratio of 15.7x, which positions its valuation above many of its industry peers. With a last close price of $10.06, this figure suggests the market is willing to pay a premium for each dollar of AGNC’s earnings.

The price-to-earnings ratio is a common way for investors to compare how much they are paying for a company’s profits relative to others in the same sector. For a Mortgage REIT like AGNC, the P/E ratio also reflects expectations for future earnings, the reliability of those earnings, and confidence in management’s ability to generate returns.

However, AGNC’s multiple is notably higher than the US Mortgage REITs industry average, which sits at 12.3x. This suggests the stock is trading at a relatively expensive level. The comparison to AGNC’s estimated Fair P/E ratio of 22.5x, however, indicates there may still be room for the market to re-rate the shares higher if earnings growth meets expectations.

Result: Price-to-Earnings of 15.7x (OVERVALUED)

However, slowing revenue growth or broader market volatility could quickly dampen optimism and pose a challenge to the upbeat outlook seen in recent months.

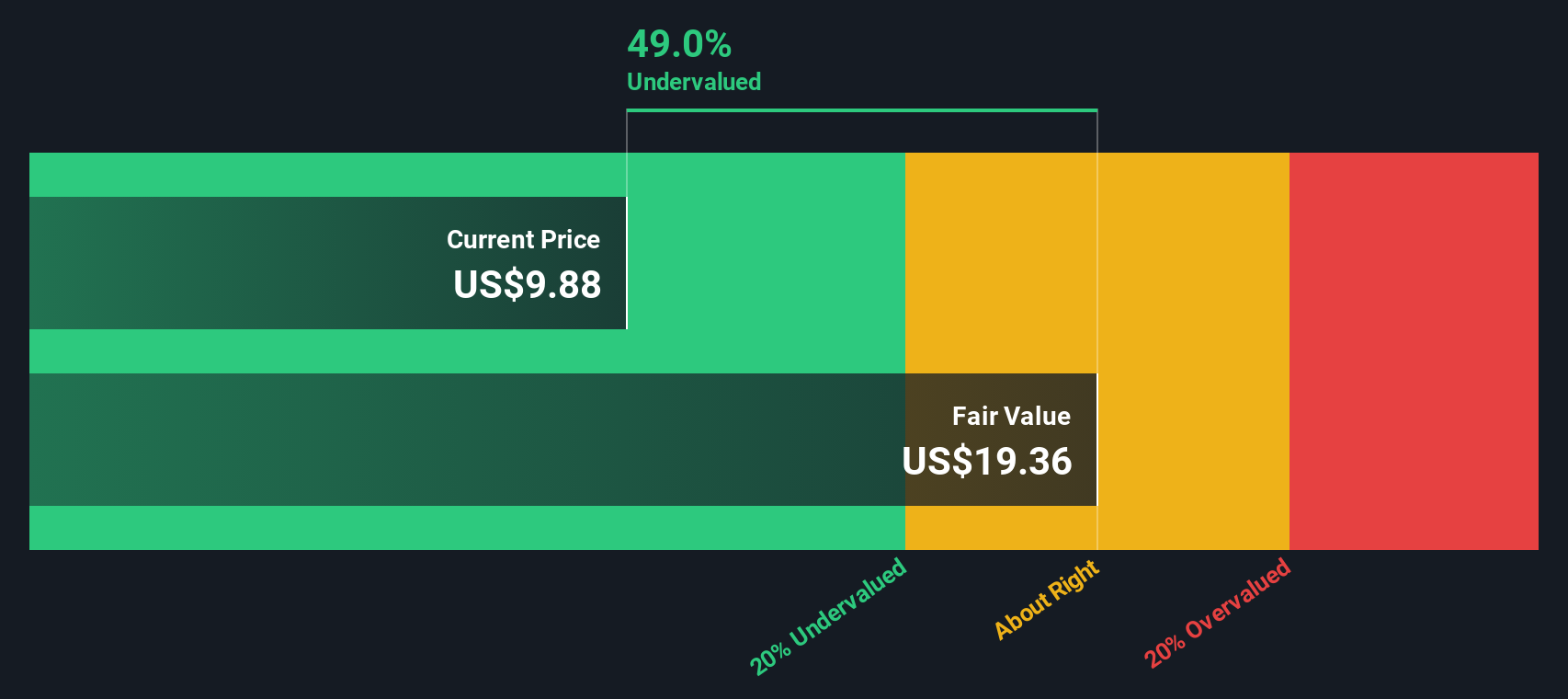

Another View: DCF Suggests Undervaluation

While AGNC Investment looks expensive compared to peers using the P/E ratio, the SWS DCF model paints a different picture. With shares trading at $10.06 and an estimated fair value of $19.23, this approach suggests AGNC could be substantially undervalued. Could the market be overlooking long-term potential?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out AGNC Investment for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 848 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own AGNC Investment Narrative

If you'd rather dig into the numbers and form your own view, you can quickly assemble your own perspective in just a few minutes, Do it your way

A great starting point for your AGNC Investment research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors constantly seek new angles to grow their portfolios. Don’t let fresh opportunities slip by. Let the Simply Wall Street Screener guide you toward your next winning move.

- Tap into untapped growth by checking out these 848 undervalued stocks based on cash flows where forward-looking companies might be trading at bargain prices and ready to outperform.

- Unlock the possibilities of tomorrow's medicine through these 34 healthcare AI stocks targeting companies reshaping healthcare with artificial intelligence and cutting-edge breakthroughs.

- Seize big yield plays by reviewing these 21 dividend stocks with yields > 3% featuring stocks designed for steady income and robust financials in today’s dynamic market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.