Please use a PC Browser to access Register-Tadawul

Avidity Biosciences (RNA): Evaluating Valuation as New Duchenne Data Gains Scientific and Investor Attention

Avidity Biosciences RNA | 71.63 | +0.13% |

Avidity Biosciences (RNA) said it will share new late-breaking clinical data next month at the World Muscle Society Congress, highlighting progress for its experimental therapy in Duchenne muscular dystrophy. The presentations add momentum to ongoing trial results.

With anticipation building around next month’s clinical data, Avidity Biosciences has seen a modest but positive trend: the 1-year total shareholder return stands at 5.1%, and the 3-year result is even stronger, reflecting ongoing confidence in the company’s research progress. Momentum appears steady, hinting at long-term growth potential as trial results continue to deliver encouraging signals.

If you’re looking for other biotech innovators making headlines, you might want to see what’s emerging from our healthcare-focused screener: See the full list for free.

With shares trading nearly 47 percent below the average analyst target and clinical data on the horizon, the key question is whether the market is overlooking Avidity’s long-term upside or has already priced in future growth.

Price-to-Book of 5.6x: Is it justified?

Avidity Biosciences trades at a price-to-book ratio of 5.6x compared to its peer average of 7.1x, while its most recent closing price sits at $46.18. This suggests that, at least on this metric, the stock screens better value relative to similar companies.

The price-to-book ratio compares a company's share price to its net assets. For biotech firms, this can serve as a baseline to gauge how much growth or success is already priced into the shares, particularly since many lack steady profitability.

While Avidity Biosciences appears less expensive than direct competitors based on this multiple, it is important to note that it still trades significantly above the broader US Biotechs industry average of 2.5x. In other words, the market is pricing in a higher level of optimism for Avidity’s future prospects compared to most other biotech names, though less so than its closest peers.

Result: Price-to-Book of 5.6x (UNDERVALUED)

However, ongoing losses and uncertainty around clinical trial outcomes remain significant risks that could disrupt the company’s current momentum as well as its long-term outlook.

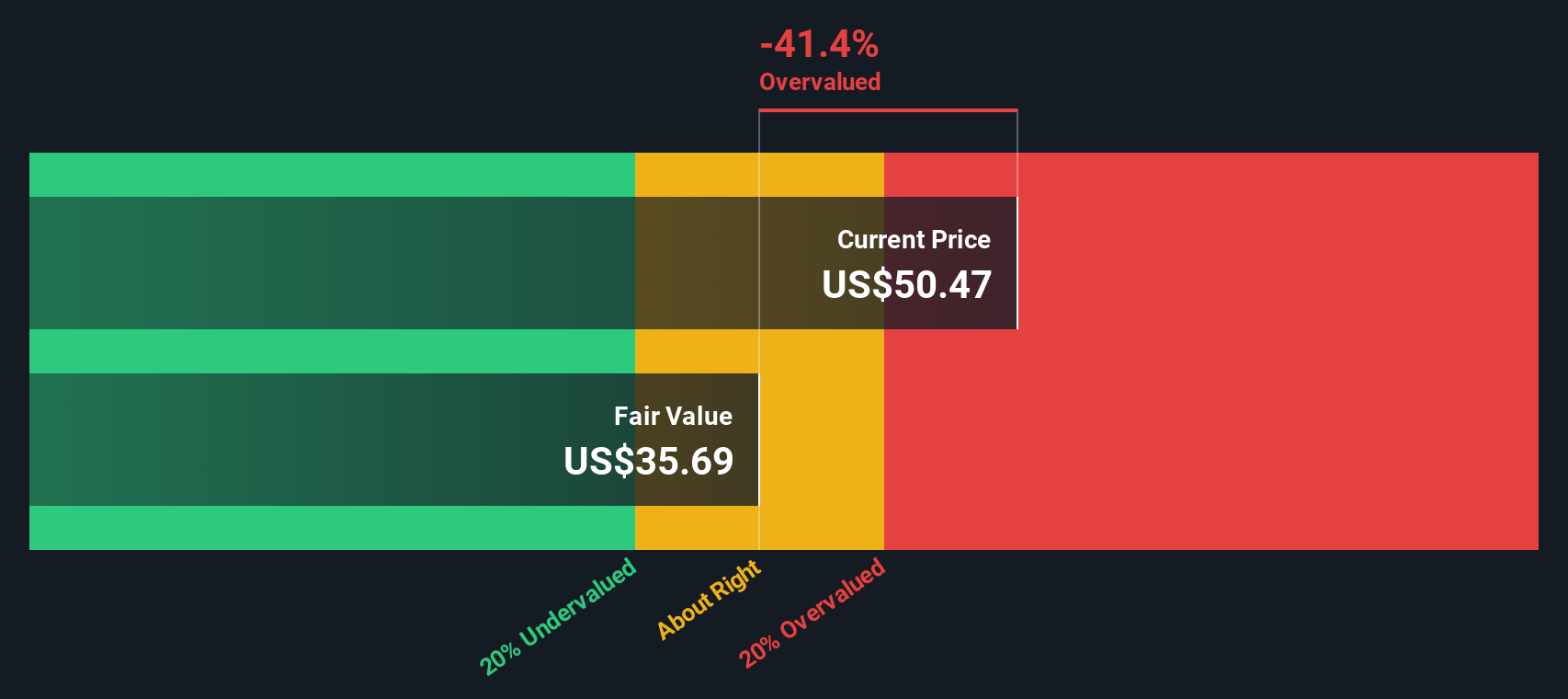

Another View: What Does the DCF Model Say?

Looking through a different lens, our DCF model estimates Avidity Biosciences’ fair value at $35.84, which is nearly 22 percent below the current share price of $46.18. This points to a potential risk that the stock may be overvalued by this method, even as multiples suggest a bargain. Which view makes more sense for future returns?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avidity Biosciences for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avidity Biosciences Narrative

If you'd like to see the numbers from a different perspective or value digging into the data yourself, you can craft your own view in just a few minutes. Do it your way

A great starting point for your Avidity Biosciences research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stick to just one opportunity. Unlock your next win by taking advantage of handpicked stock ideas many overlook, now available on Simply Wall Street.

- Tap into the future of healthcare by screening these 32 healthcare AI stocks, where AI-driven breakthroughs are transforming medical treatment and diagnostics.

- Position yourself ahead of the curve by checking these 894 undervalued stocks based on cash flows, with strong upside potential based on cash flow fundamentals.

- Accelerate your growth strategy by targeting these 25 AI penny stocks, harnessing the power of artificial intelligence for market-beating returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.