Please use a PC Browser to access Register-Tadawul

Can Monetary Policy Optimism Shape First Commonwealth Financial’s (FCF) Competitive Position Among Regional Banks?

First Commonwealth Financial Corporation FCF | 16.49 | -0.66% |

- First Commonwealth Financial Corporation previously announced it would host a conference call on October 29, 2025, to discuss its third quarter results, with a press release to be issued after markets closed on October 28, 2025.

- Broader positive sentiment toward regional banks, following stronger-than-expected results from larger peers and signaling of potential monetary policy easing by the Federal Reserve, appeared to influence investor interest in First Commonwealth Financial during this period.

- We'll examine how growing optimism around possible monetary policy shifts could impact First Commonwealth Financial's investment narrative and outlook.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

First Commonwealth Financial Investment Narrative Recap

To be a shareholder in First Commonwealth Financial, you need to believe in the company’s ability to grow its core lending businesses and embrace digital transformation amid competition from larger banks and fintechs. The recent upswing in regional bank sentiment, sparked by positive big bank earnings and hints at monetary easing from the Federal Reserve, could support near-term optimism, but does not materially alter the central risk: escalating regional competition and margin pressure remain key challenges.

The upcoming third-quarter results announcement, scheduled for October 28, 2025, is the most relevant recent update. With heightened investor focus on the impact of interest rate changes and loan growth trends, this report should provide insights into how First Commonwealth Financial is balancing core profitability, deposit retention, and competitive pressures in an uncertain rate environment.

However, against this backdrop, investors should be especially mindful of how intensifying competition from national banks and fintechs may compress net interest margins and ...

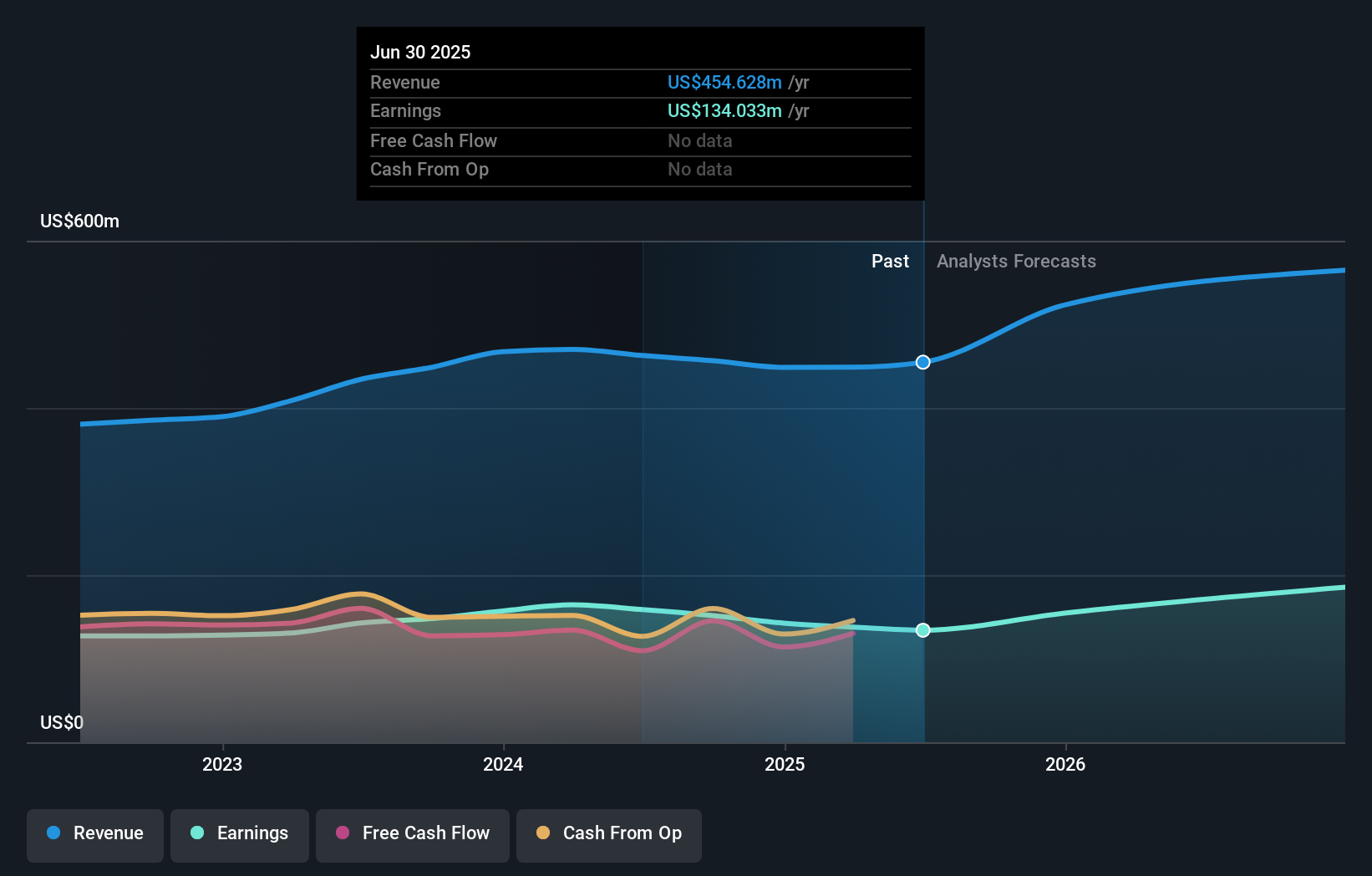

First Commonwealth Financial's narrative projects $698.8 million revenue and $250.5 million earnings by 2028. This requires 15.4% yearly revenue growth and an $116.5 million earnings increase from $134.0 million today.

Uncover how First Commonwealth Financial's forecasts yield a $19.20 fair value, a 17% upside to its current price.

Exploring Other Perspectives

Four separate fair value estimates from the Simply Wall St Community range from US$16.01 up to US$12,644.96. As you weigh the unusually wide range of opinions, consider that competitive risks in the sector could impact the company’s longer term returns and prompt you to explore more perspectives on growth and value.

Explore 4 other fair value estimates on First Commonwealth Financial - why the stock might be worth just $16.01!

Build Your Own First Commonwealth Financial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your First Commonwealth Financial research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free First Commonwealth Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate First Commonwealth Financial's overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.