Please use a PC Browser to access Register-Tadawul

Cimpress (CMPR): Reviewing Valuation Following Return to Profitability and Strong Sales Growth

Cimpress N.V. CMPR | 70.47 | -2.27% |

Cimpress (CMPR) just posted first quarter results showing a clear turnaround. The company swung from a net loss last year to a net profit this time around, with sales up strongly year-over-year. Investors are watching closely as these numbers mark a shift for the company.

After spending much of the past year under pressure, Cimpress shares have seen real momentum return, with a 21% share price gain over the last 90 days as investors respond to the company’s profit turnaround. While the 1-year total shareholder return is still down 12%, the stock’s three-year total return sits at an impressive 187%. This illustrates how quickly sentiment can shift when financials improve.

If Cimpress’s rebound has you watching for other market-moving stories, it might be time to discover fast growing stocks with high insider ownership

With Cimpress’s financial rebound and recent rally, the question now is whether the stock still offers value at current prices, or if the market has already factored in the company’s future growth prospects. Is this a real buying opportunity?

Most Popular Narrative: 13.9% Undervalued

Compared to Cimpress’s last closing price of $66.75, the most popular narrative puts fair value at $77.50 per share. This suggests market optimism around future performance, laying the groundwork for a deeper dive into what is driving this outlook.

Strategic investments in proprietary production technology, customer experience, and manufacturing, well above maintenance levels, are expected to deliver $70 to $80 million in incremental annualized adjusted EBITDA improvements by FY '27, setting the stage for significant margin expansion and higher operating income in future years.

Want to know why analysts see major upside here? One key financial forecast underpins this price—hint: it all comes down to ambitious margin expansion and future profit multiples well above sector norms. Which bold numbers and market shifts justify this strong target? Dig into the full narrative and uncover what’s fueling the fair value optimism.

Result: Fair Value of $77.50 (UNDERVALUED)

However, risks remain if Cimpress’s elevated segments fail to offset declines in legacy products or if capital spending does not lead to the expected margin gains.

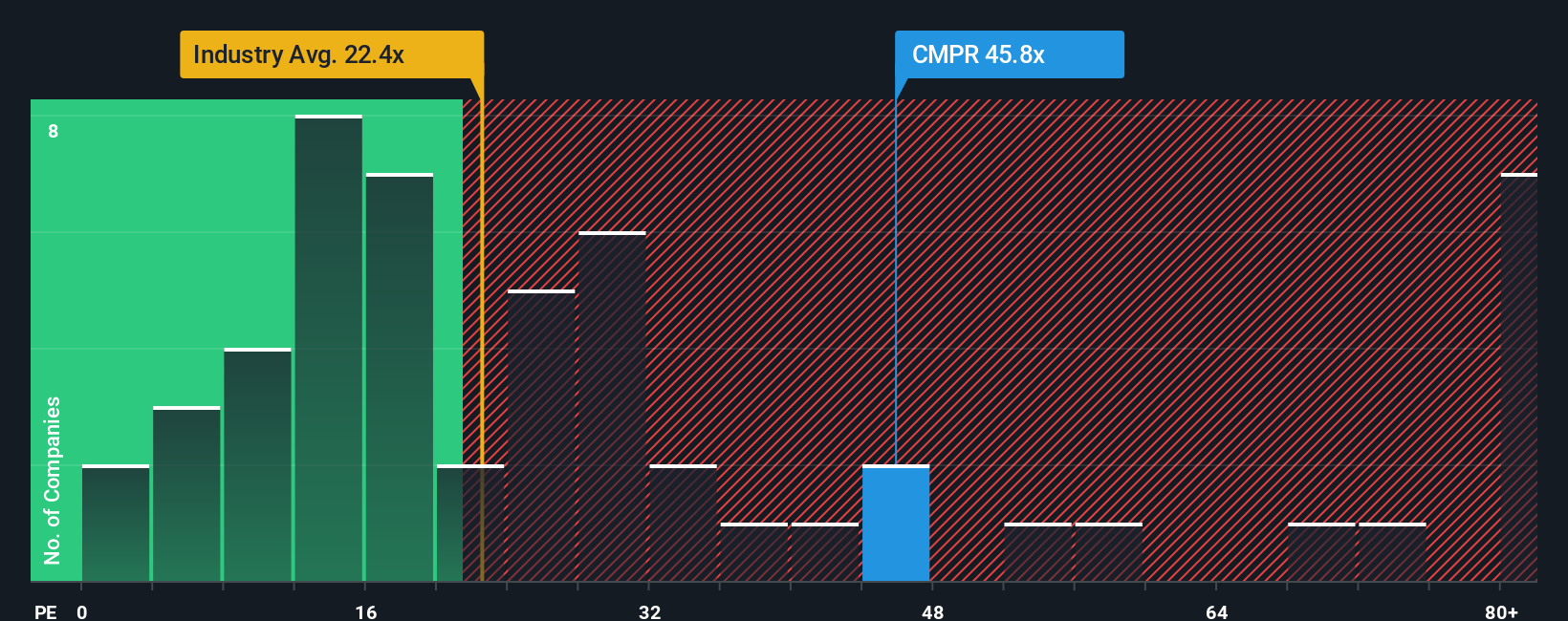

Another View: High PE Ratios Signal Caution

While narrative and discounted cash flow signals point to Cimpress being undervalued, comparing its price-to-earnings ratio presents a different story. The company’s current PE ratio of 109.3x is far higher than the industry average of 26.2x, its peer average of just 14.9x, and also well above the fair ratio of 25.4x. This wide gap means investors could be paying a premium, which adds valuation risk if growth targets are not met. Does the market’s optimism reflect the real opportunity, or a costly leap of faith?

Build Your Own Cimpress Narrative

If you think the current analysis misses something, or want to dig into the numbers yourself, you can put together your own take in just a few minutes with Do it your way.

A great starting point for your Cimpress research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors never stand still. Don’t let opportunity pass you by. Use powerful tools to spot the next winners before the crowd. Here’s where to get started:

- Capture consistent income streams by tapping into these 21 dividend stocks with yields > 3% with high yields and solid fundamentals that could strengthen your portfolio’s stability.

- Unlock early-stage growth opportunities and target impressive gains by checking out these 3583 penny stocks with strong financials with robust financials others may overlook.

- Position yourself at the heart of innovation and progress by tracking advancements through these 26 AI penny stocks that are redefining what’s possible in artificial intelligence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.