Please use a PC Browser to access Register-Tadawul

Could Expanding Ria’s Reach With Heritage Grocers Hint at Euronet (EEFT) Growth Potential?

Euronet Worldwide, Inc. EEFT | 74.75 | +1.00% |

- Heritage Grocers Group recently announced an expanded partnership with Ria Money Transfer, a business segment of Euronet Worldwide, rolling out enhanced money transfer services across all Heritage Grocers portfolio companies.

- This collaboration aims to make cross-border remittances more accessible for diverse communities, increasing the reach and convenience of digital financial services in underserved markets.

- Let's examine how expanding Ria's reach across Heritage Grocers may support Euronet Worldwide's growth in its Money Transfer segment.

Find companies with promising cash flow potential yet trading below their fair value.

Euronet Worldwide Investment Narrative Recap

To be a shareholder in Euronet Worldwide, you need to believe in the company's ability to expand and adapt within an evolving global payments industry while leveraging its Money Transfer segment for growth. The partnership news with Heritage Grocers Group enhances Ria Money Transfer’s U.S. presence, which may support short-term transaction volumes, but the most important near-term catalyst, growth in digital payment processing, remains primarily driven by Euronet’s technology efforts. The biggest risk, regulatory volatility in key remittance corridors, continues to hang over the segment, and the impact from this news event is not material enough to shift that dynamic.

Among recent announcements, Euronet’s May 2025 collaboration with Visa to boost digital payout capabilities in the Ria Money Transfer segment stands out as particularly relevant. This partnership complements the Heritage Grocers rollout by underpinning management’s larger push toward providing accessible, digital-first remittance services and broadening their footprint in both physical retail and online channels. While these efforts reinforce the catalysts for payment volume growth and digital adoption, the potential for margin pressure from increased competition and regulation remains a concern.

However, investors should also be aware that regulatory risks could...

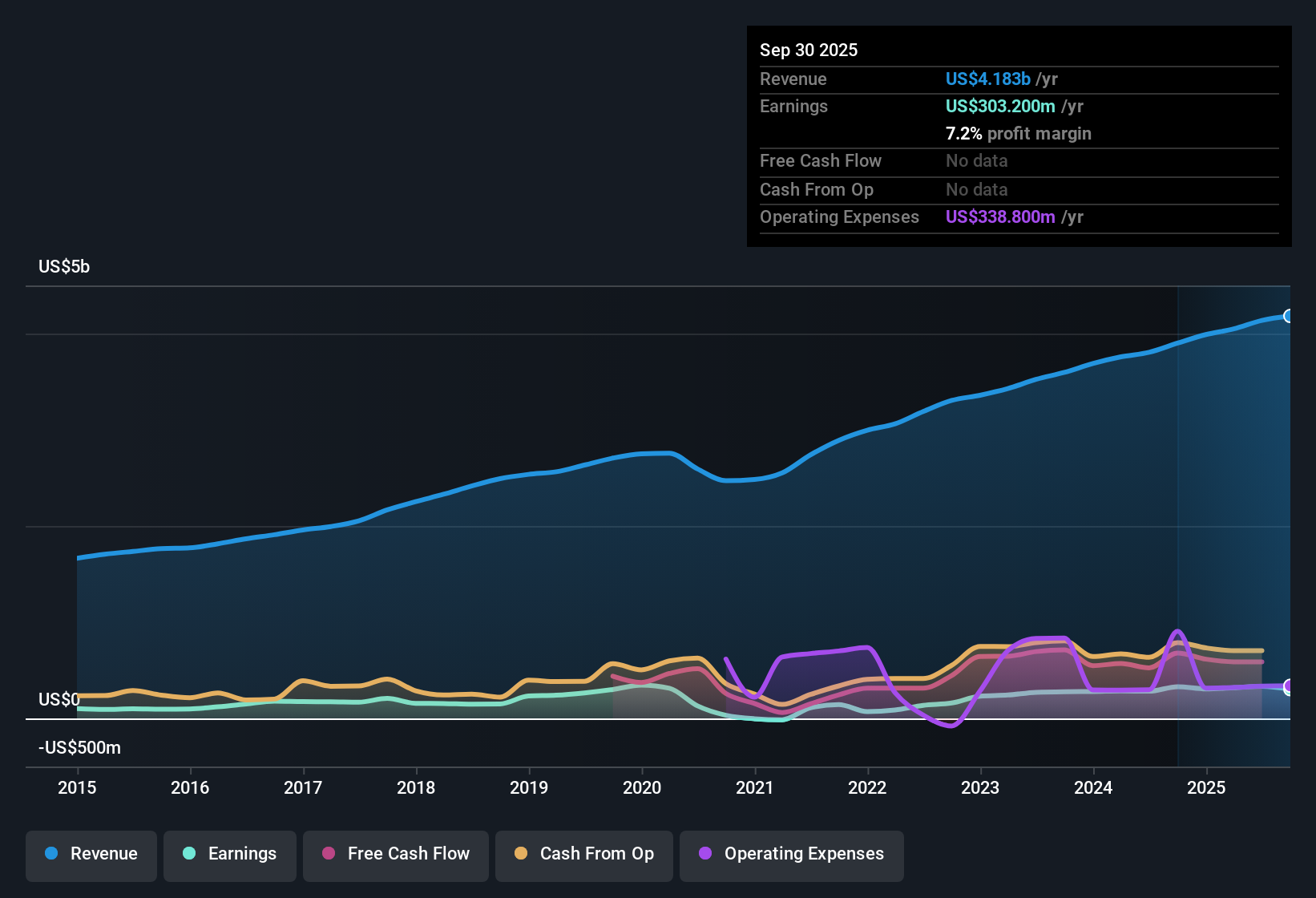

Euronet Worldwide’s outlook anticipates $5.2 billion in revenue and $476.3 million in earnings by 2028. This is based on an expected annual revenue growth rate of 8.2% and a $143.6 million increase in earnings from the current $332.7 million.

Uncover how Euronet Worldwide's forecasts yield a $124.00 fair value, a 60% upside to its current price.

Exploring Other Perspectives

Three members of the Simply Wall St Community estimate Euronet Worldwide’s fair value between US$88.99 and US$124 per share. While market participants see opportunity in cross-border money transfer growth, opinions about regulatory headwinds vary widely, explore these alternative viewpoints to better inform your decisions.

Explore 3 other fair value estimates on Euronet Worldwide - why the stock might be worth as much as 60% more than the current price!

Build Your Own Euronet Worldwide Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Euronet Worldwide research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Euronet Worldwide research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Euronet Worldwide's overall financial health at a glance.

Ready For A Different Approach?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.