Please use a PC Browser to access Register-Tadawul

Could Federal Signal’s (FSS) Dividend and Analyst Optimism Signal a Shift in Growth Strategy?

Federal Signal Corporation FSS | 110.84 | -0.08% |

- Federal Signal Corporation's Board of Directors recently declared a quarterly cash dividend of US$0.14 per share, payable on December 2, 2025, to shareholders of record as of November 14, 2025.

- Analysts are increasingly optimistic ahead of Federal Signal's Q3 earnings report, citing raised revenue growth expectations and strong prior-quarter performance.

- With analyst forecasts pointing to double-digit revenue growth this quarter, we assess how rising expectations are shaping Federal Signal's investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Federal Signal Investment Narrative Recap

At its core, the case for Federal Signal as an investment hinges on the company’s ability to capitalize on ongoing infrastructure upgrades and industrial demand, supported by record backlog and robust order intake. The recent dividend announcement, though consistent with prior payouts, does not materially alter the near-term focus on upcoming earnings results, which remain the key short-term catalyst, as well as any heightened risk from public sector spending slowdowns that could impact municipal orders.

Among recent developments, Federal Signal’s scheduled Q3 2025 earnings release is most relevant, as analysts anticipate strong double-digit revenue growth driven by favorable momentum in core markets and successful integration of acquisitions. This earnings report could reinforce or challenge analyst optimism, setting the tone for how expectations are realigned with underlying business performance ahead of year-end targets.

However, with Federal Signal’s deep reliance on publicly funded customers, unexpected shifts in municipal or government budgets remain a risk investors should be mindful of, especially if...

Federal Signal's outlook expects $2.6 billion in revenue and $336.9 million in earnings by 2028. This projection implies a 9.2% annual revenue growth rate and a $115.3 million increase in earnings from the current $221.6 million level.

Uncover how Federal Signal's forecasts yield a $132.00 fair value, in line with its current price.

Exploring Other Perspectives

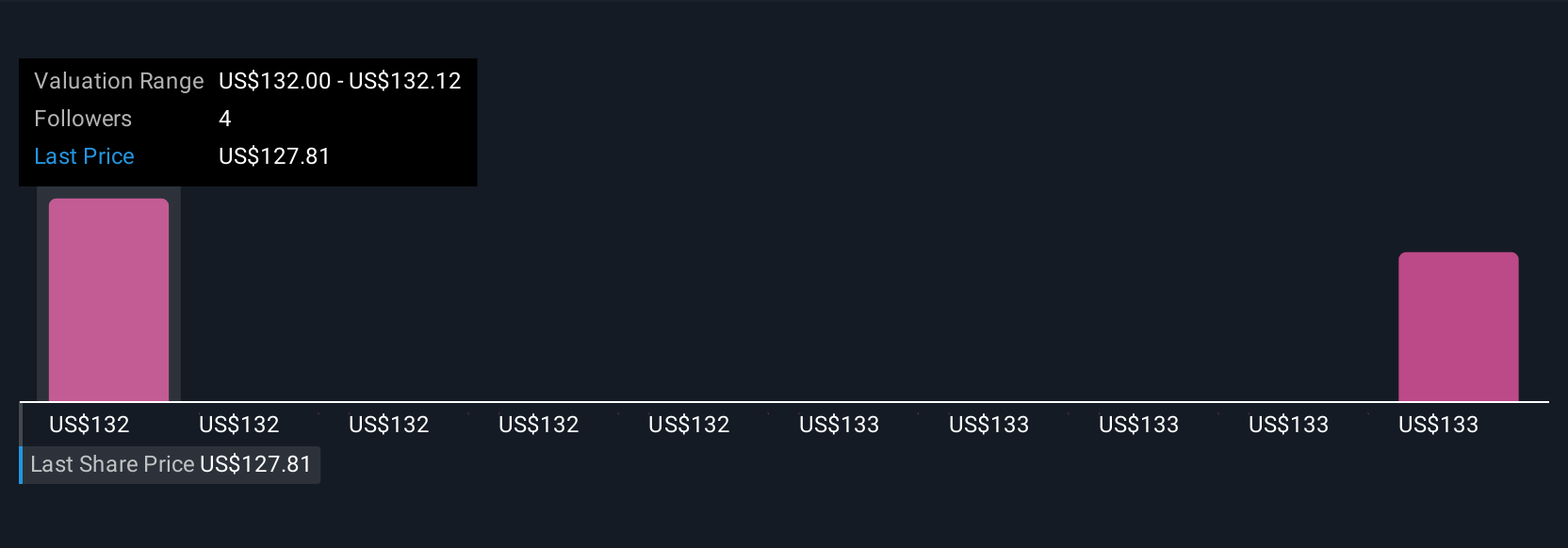

Simply Wall St Community members provided two independent fair value estimates for Federal Signal ranging tightly between US$132 and US$133.37 per share. While consensus points to growth catalysts such as record order intake, you should consider how budget constraints could influence both expectations and long-term outlook, see how other perspectives compare.

Explore 2 other fair value estimates on Federal Signal - why the stock might be worth as much as $133.37!

Build Your Own Federal Signal Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Federal Signal research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Federal Signal research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Federal Signal's overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 21 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.