Please use a PC Browser to access Register-Tadawul

Did New Enterprise AI Partnerships Just Shift Palantir Technologies' (PLTR) Investment Narrative?

Palantir PLTR | 181.76 | +2.16% |

- Palantir Technologies recently announced expanded multi-year partnerships with Lear Corporation and new collaborations with Lumen Technologies, deepening the adoption of its Artificial Intelligence Platform (AIP) across major commercial clients.

- These developments underscore Palantir's emerging role as a key provider of AI-driven digital transformation, with clients reporting measurable cost savings and improved operational efficiency.

- We'll explore how Palantir's growing commercial platform adoption enhances its investment narrative amid robust demand for AI-powered enterprise solutions.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Palantir Technologies' Investment Narrative?

For anyone considering Palantir Technologies as an investment, the story has always been about believing in the company’s ability to lead enterprise and government adoption of AI at scale, and now, with these high-profile partnerships, that story is gaining fresh momentum. The recent news: expanded, multi-year deals with Lear, collaboration with Lumen, and a pioneering initiative in nuclear construction, all reinforce Palantir’s positioning as an essential AI infrastructure provider. These new alliances could accelerate near-term revenue growth and keep AI-driven efficiency gains front and center as a key catalyst. Yet, with Palantir’s valuation already at elevated levels, the greatest risk remains the potential for sharp stock price swings if growth or customer adoption slows. While the latest updates strengthen the commercial case, the high expectations built into the current price mean that any disappointment could be felt more acutely than before.

However, investors should not overlook how quickly sentiment can shift when expectations are this high.

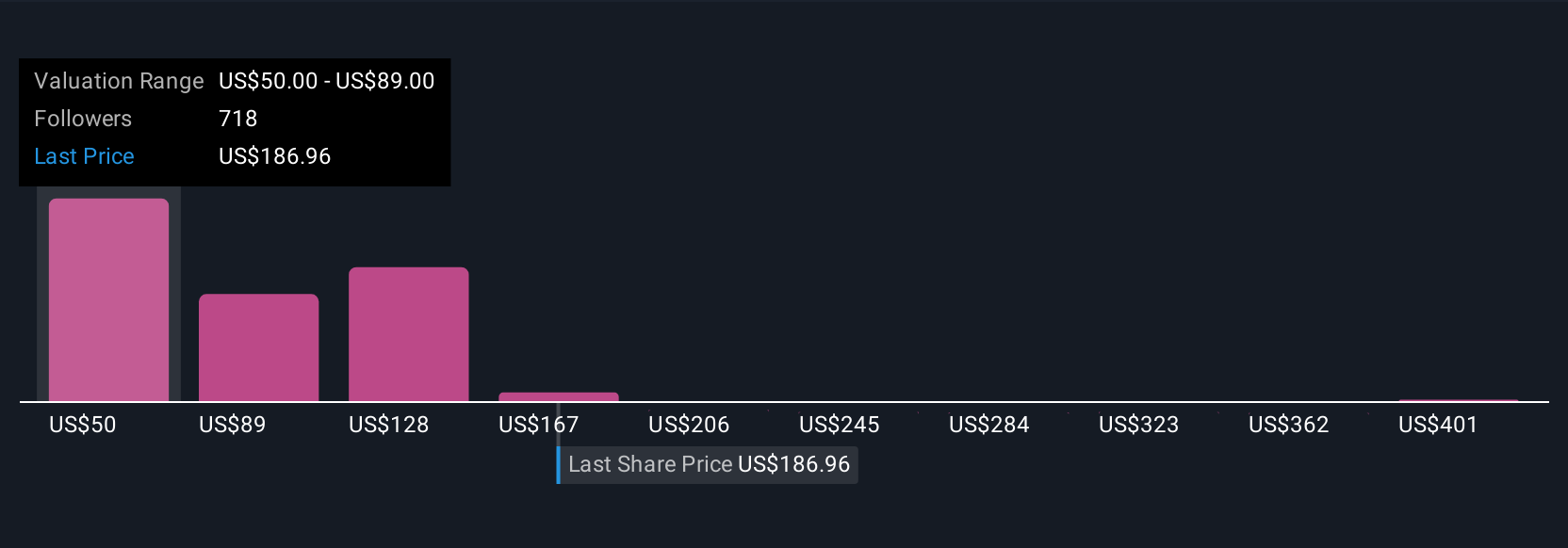

Palantir Technologies' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 156 other fair value estimates on Palantir Technologies - why the stock might be worth less than half the current price!

Build Your Own Palantir Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Palantir Technologies research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Palantir Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Palantir Technologies' overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.