Please use a PC Browser to access Register-Tadawul

Discovering US Market's Undiscovered Gems in October 2025

SandRidge Energy, Inc. SD | 15.22 | +0.86% |

As the U.S. market navigates a mixed landscape marked by trade discussions between President Trump and China's Xi Jinping, alongside cautious optimism from Federal Reserve Chair Jerome Powell, small-cap stocks within the S&P 600 remain an intriguing focus for investors. Amidst this backdrop of economic indicators and broader market sentiment impacting small caps, identifying undiscovered gems requires a keen eye for companies with strong fundamentals and growth potential that may be overlooked in the current climate.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| First Bancorp | 55.71% | 1.47% | -2.43% | ★★★★★★ |

| Franklin Financial Services | 139.77% | 5.48% | -4.56% | ★★★★★★ |

| Senstar Technologies | NA | -18.50% | 29.50% | ★★★★★★ |

| Sound Financial Bancorp | 34.24% | 1.40% | -12.55% | ★★★★★★ |

| Affinity Bancshares | 43.06% | 2.84% | 3.44% | ★★★★★★ |

| First Northern Community Bancorp | NA | 8.05% | 12.27% | ★★★★★★ |

| FineMark Holdings | 115.37% | 2.22% | -28.34% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 13.18% | 16.77% | ★★★★★☆ |

| FRMO | 0.10% | 35.28% | 40.61% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

Here's a peek at a few of the choices from the screener.

G. Willi-Food International (WILC)

Simply Wall St Value Rating: ★★★★★★

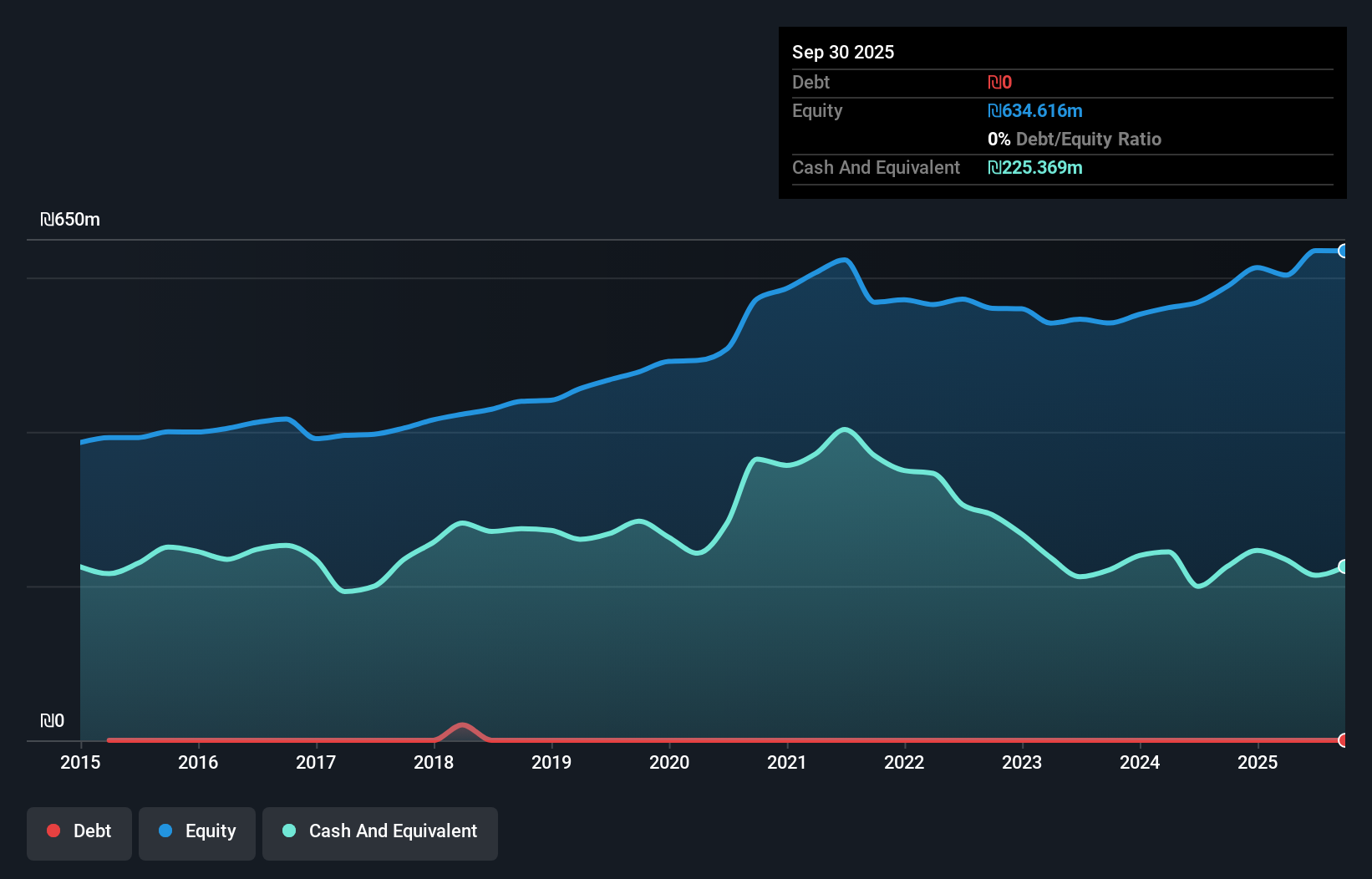

Overview: G. Willi-Food International Ltd. is engaged in the design, import, marketing, and distribution of food products globally under the Willi-Food and Euro European Dairies brand names, with a market capitalization of $294.31 million.

Operations: WILC generates revenue primarily from the import, marketing, and distribution of food products, totaling ₪598.42 million. The company's financial performance is reflected in its gross profit margin trends over recent periods.

G. Willi-Food International, a nimble player in the food industry, showcases impressive financial health with earnings growth of 132.9% over the past year, outpacing the Consumer Retailing sector's 9.4%. The company is debt-free, enhancing its financial flexibility and reducing risk exposure. Trading at a significant discount of 80.6% below estimated fair value suggests potential undervaluation opportunities for investors. Recent results highlight robust performance with second-quarter sales reaching ILS 160 million (US$42 million), up from ILS 146 million (US$38 million) last year, while net income surged to ILS 31 million (US$8 million) from ILS 6 million (US$2 million).

Southern First Bancshares (SFST)

Simply Wall St Value Rating: ★★★★★★

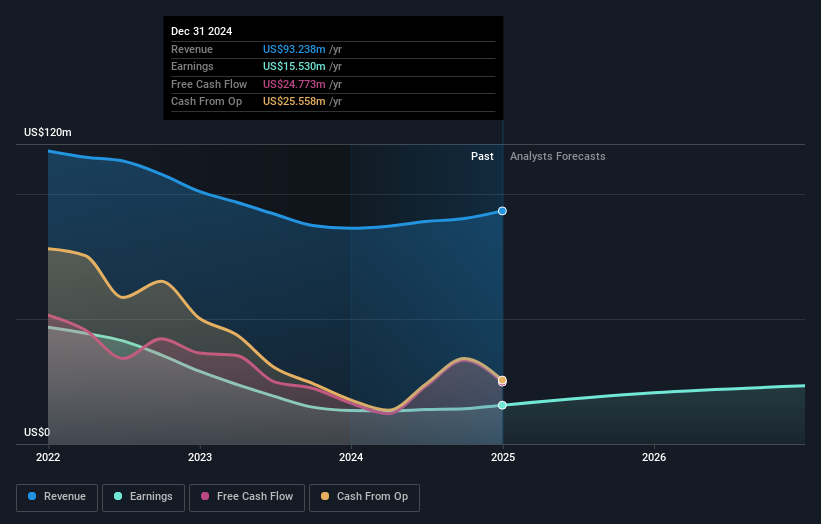

Overview: Southern First Bancshares, Inc. is a bank holding company for Southern First Bank, offering commercial, consumer, and mortgage loans in South Carolina, North Carolina, and Georgia with a market cap of $366.66 million.

Operations: Southern First Bancshares generates revenue primarily from its banking operations, totaling $109.39 million. The company's financial strategy focuses on providing a mix of commercial, consumer, and mortgage loans across South Carolina, North Carolina, and Georgia.

Southern First Bancshares, with assets totaling US$4.4 billion and equity of US$356.3 million, stands out due to its robust financial health and high-quality earnings. The bank's reliance on customer deposits as 92% of its liabilities underscores its low-risk funding approach. Impressively, earnings surged by 85.8% last year, outpacing the industry average of 16.8%. With total deposits and loans both at US$3.7 billion, it maintains a net interest margin of 2.1%. A sufficient allowance for bad loans at 0.3% further supports stability, while a price-to-earnings ratio of 13.7x suggests potential value compared to the broader market's 18.8x ratio.

SandRidge Energy (SD)

Simply Wall St Value Rating: ★★★★★★

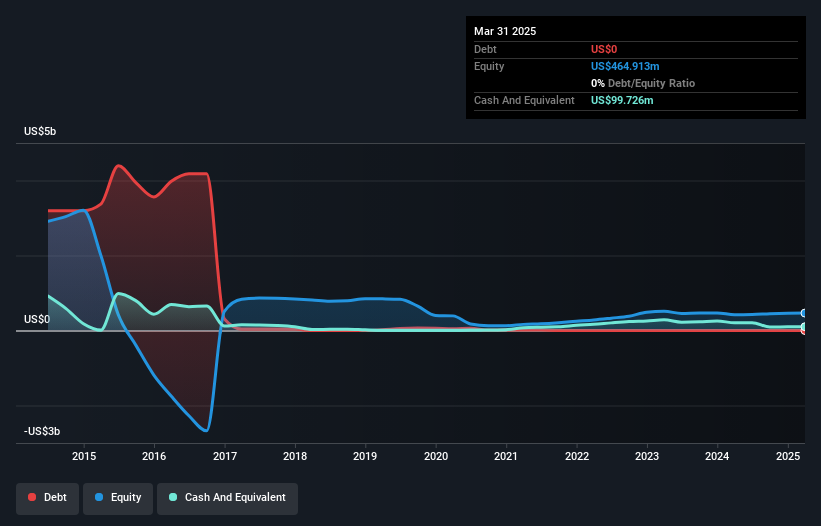

Overview: SandRidge Energy, Inc. operates in the acquisition, development, and production of oil, natural gas, and natural gas liquids primarily in the United States Mid-Continent region with a market capitalization of approximately $423.14 million.

Operations: SandRidge Energy generates revenue of $146.17 million from its oil, natural gas, and natural gas liquids operations in the U.S. Mid-Continent region.

SandRidge Energy, a nimble player in the oil and gas sector, has shown remarkable financial resilience. With no debt on its books compared to a 33.8% debt-to-equity ratio five years ago, it stands out for its clean balance sheet. The company's earnings surged by 87%, far outpacing the industry average of -17%. Its price-to-earnings ratio of 5.7x is notably lower than the US market's 18.8x, suggesting potential undervaluation. Despite not being free cash flow positive recently, SandRidge's focus on strategic acquisitions and disciplined capital management could enhance shareholder value further down the line.

Taking Advantage

- Gain an insight into the universe of 300 US Undiscovered Gems With Strong Fundamentals by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.