Please use a PC Browser to access Register-Tadawul

Does the Recent 7% Climb Signal a Shift for IPG Photonics in 2025?

IPG Photonics Corporation IPGP | 81.92 | -1.13% |

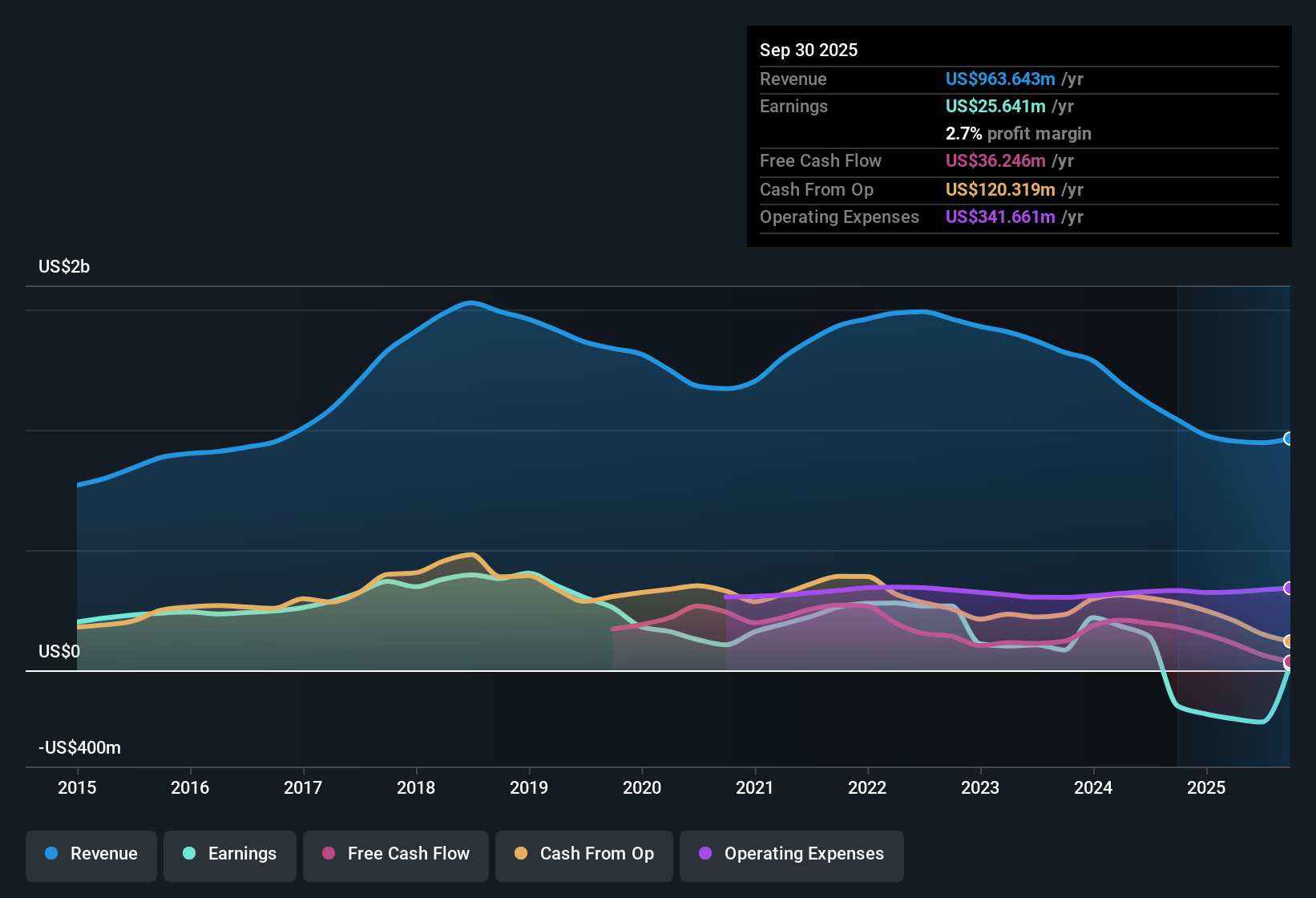

Thinking about what to do with your IPG Photonics shares? You’re not alone. After years of volatile price moves, IPG has given investors both reasons to celebrate and reasons to be cautious. Just last week, the stock slipped by 1.8%, but if you zoom out you’ll see a different picture. Over the past month, shares have climbed 7.3%, and if you held on since the start of the year, you’re sitting on an 18.6% gain. Even the one-year return paints a favorable 15.5% rise. However, if you stretch the timeline further, the five-year window tells a different story, with the stock still down 55%.

Much of this long-term underperformance can be traced to industry shifts and changing investor appetites for growth and technology stocks. Some recent market optimism can be attributed to broader enthusiasm for industrial automation and infrastructure investment, which benefit laser solutions providers like IPG. Still, as the market’s confidence in tech hardware groups waxes and wanes, so does risk perception for stocks in this space.

Now, here is where things get especially interesting. According to a commonly used valuation scoring system, IPG Photonics gets a score of 0 out of 6. That means by six different valuation checks, the stock is not showing up as obviously undervalued right now.

But before you dismiss IPG on valuation alone, let’s walk through the most popular approaches for judging a stock’s worth and see what they tell us in this case. At the end of the analysis, I’ll share a perspective on valuation that many investors overlook, but could make all the difference.

IPG Photonics scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: IPG Photonics Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular valuation tool that estimates a company's worth by projecting its future cash flows and discounting them back to today’s value. This approach gives investors a sense of what a company’s underlying business should be worth based on its ability to generate cash in the years ahead.

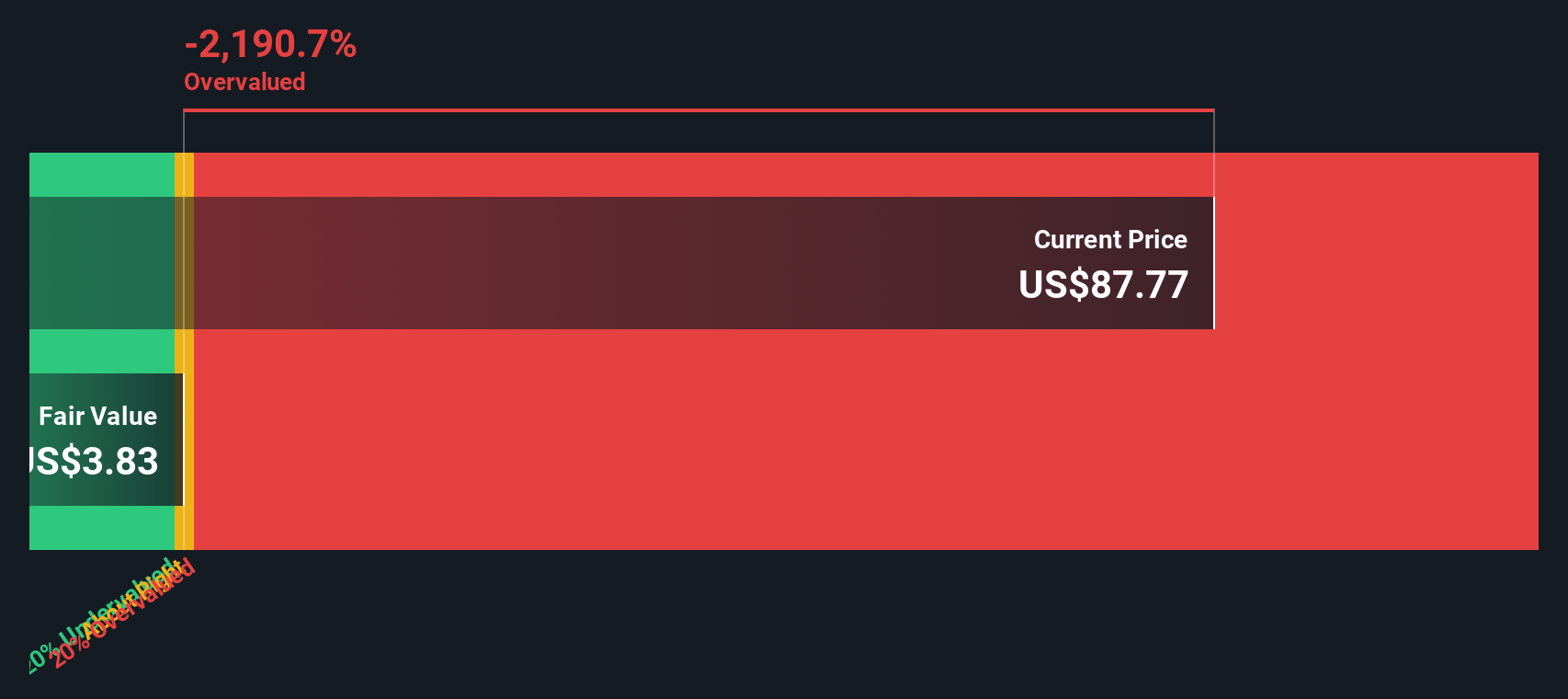

For IPG Photonics, the DCF model uses the company’s latest twelve months Free Cash Flow of $68.4 million as a starting point. Analysts expect Free Cash Flow to drop in the coming years, with estimates suggesting it will fall to $25.95 million by 2026. Looking further ahead, cash flows are projected to gradually decline, reaching about $8.4 million by 2035, according to extrapolated figures. All cash flows are reported in US dollars.

Based on these projections, the model calculates IPG Photonics’ intrinsic value per share at $3.83. This is much lower than the company’s current share price, implying an overvaluation of 2150.8 percent. In summary, the DCF model suggests that the stock does not appear cheap at today’s price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests IPG Photonics may be overvalued by 2150.8%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: IPG Photonics Price vs Sales

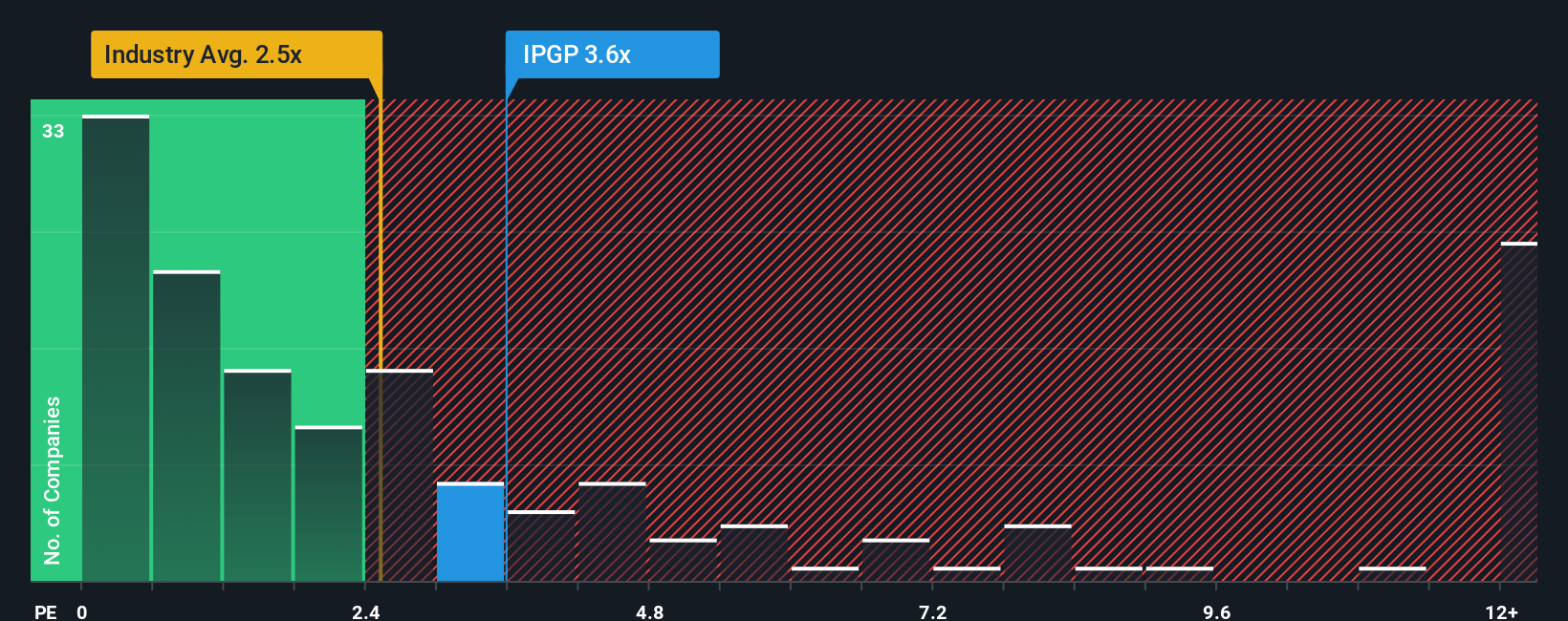

The Price-to-Sales (P/S) ratio is often a reliable valuation metric, especially for companies where earnings can fluctuate or where profits are temporarily impacted by investments and growth expenses. For profitable companies like IPG Photonics, the P/S ratio provides a clear-eyed view of how much investors are willing to pay for each dollar of sales, sidestepping short-term noise in the bottom line.

Growth prospects and risk are important in interpreting what constitutes a "normal" P/S ratio. If a company is expected to grow faster or has lower risks, investors will typically pay a higher multiple. Conversely, slow growth or greater uncertainty can pull that multiple lower.

Currently, IPG Photonics trades at a P/S multiple of 3.85x. This is noticeably higher than the average of its industry peers, which sit at 1.18x, and the broader electronics industry average of 2.83x. However, relying solely on peer or industry comparisons can miss key factors unique to each business.

This is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio reflects the P/S multiple you might expect, given IPG’s specific combination of earnings growth, profit margins, market cap, industry characteristics, and risk profile. For IPG Photonics, the Fair Ratio lands at 1.81x. This proprietary measure is a more tailored benchmark than a simple industry or peer average, taking into account the nuances that generic comparisons ignore.

With the actual P/S ratio of 3.85x notably higher than the Fair Ratio of 1.81x, the stock appears to be overvalued by this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your IPG Photonics Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives—a smarter, more personal tool for making investment decisions. A Narrative connects your view of a company's story to its financial forecasts and, ultimately, to an estimate of fair value. Instead of just looking at numbers, you can craft your own scenario for IPG Photonics: how you think revenue and profits will change, which market shifts will matter most, and how emerging trends might influence future growth.

On Simply Wall St's Community page, Narratives are accessible, easy to use, and updated dynamically with the latest news or earnings. This makes them a powerful way to sense-check, refine, and revisit your buy or sell convictions as the facts evolve. Narratives can help you stay ahead of market moves. By comparing your Fair Value to today's price, Narratives put data and context at your fingertips, whether you're bullish on automation opportunities or cautious due to competitive risks.

For example, some investors are optimistic that IPG's innovations will spark faster profit growth, assigning a higher Fair Value (like $97 per share), while others see headwinds and set lower targets (as low as $65). Narratives let you explore, challenge, and build your own investment conviction.

Do you think there's more to the story for IPG Photonics? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.