Please use a PC Browser to access Register-Tadawul

Ermenegildo Zegna (NYSE:ZGN): Fresh Analyst Optimism Spurs Share Price—But What’s the Stock Really Worth Now?

Ermenegildo Zegna N.V. ZGN | 10.64 | +0.28% |

Ermenegildo Zegna (NYSE:ZGN) is catching investor attention following fresh analyst coverage. Major banks, including Jefferies, JPMorgan Chase & Co., and Bank of America, recently began expressing more optimistic views on the luxury menswear company.

After a year marked by a steady build in optimism, Zegna’s share price has climbed 21% year-to-date, supported by heightened analyst attention and positive momentum from names like Jefferies and JPMorgan Chase. The latest one-year total shareholder return sits at nearly 18%, reflecting growing market confidence and suggesting revived interest in the luxury sector.

If analyst upgrades have you thinking bigger, it could be the perfect moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

While analyst enthusiasm and price targets point to further upside, Zegna’s recent rally begs the question: is there untapped value left for new investors, or has the market already accounted for future growth potential?

Most Popular Narrative: 3.9% Undervalued

The most widely followed narrative values Ermenegildo Zegna slightly above its last close of $9.70, with an estimated fair value of $10.10. With the latest price target indicating mild undervaluation, curiosity is mounting about what is fueling this premium in a tough luxury market.

The strategic focus on direct-to-consumer (DTC) channels, aimed at increasing brand control, improving gross margins, and enhancing customer experience, is expected to drive long-term revenue growth and improve net margins across the Zegna, Thom Browne, and TOM FORD brands.

Is this premium all about high-margin expansion, or are analysts betting on something even more ambitious? Uncover the story behind ambitious growth projections, new segment launches, and a profit profile reshaping Zegna’s high-fashion future. The underlying math just might surprise you.

Result: Fair Value of $10.10 (UNDERVALUED)

However, slowing growth in Greater China or ongoing declines in Thom Browne's wholesale channel could quickly challenge this optimistic outlook.

Another View: Multiples Tell a Different Story

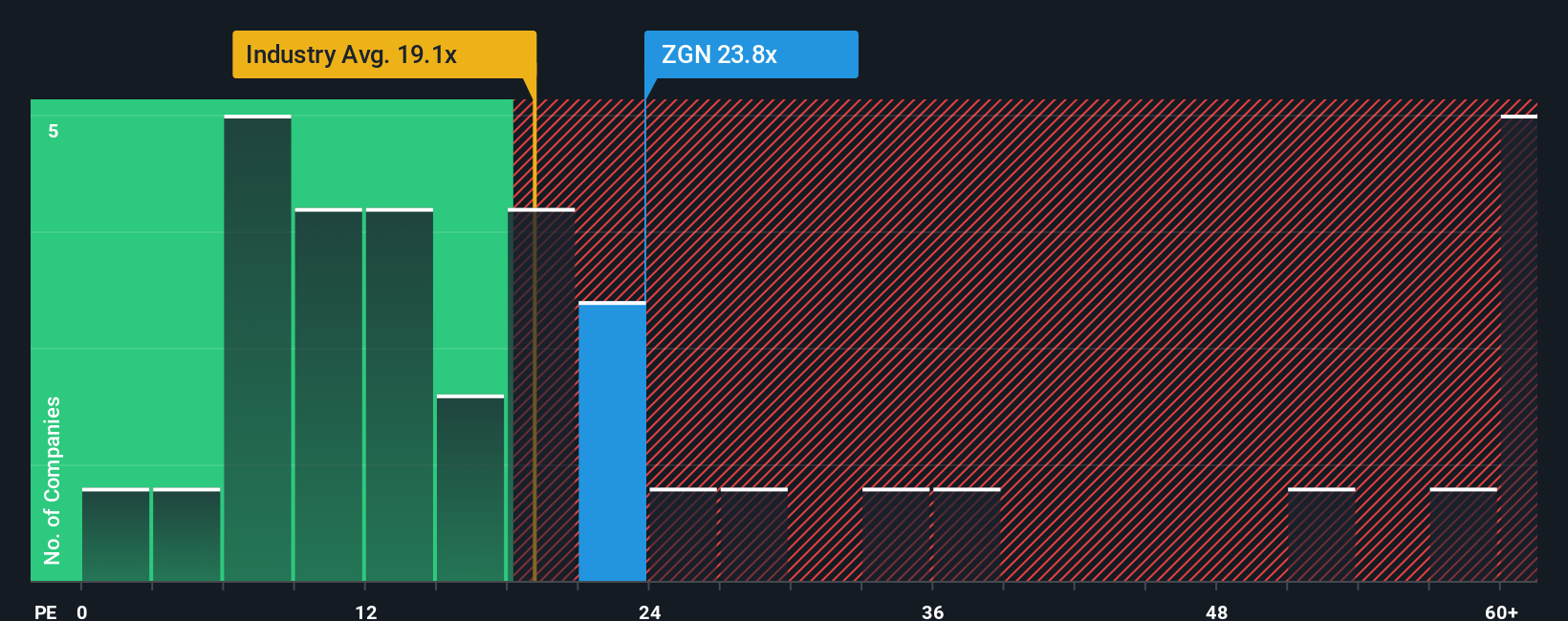

Compared to its peers, Zegna’s current price-to-earnings ratio of 22.3x looks like a relative bargain next to the peer average of 53.9x. However, it is still higher than the U.S. luxury industry average of 19.5x. The fair ratio for Zegna is estimated at 17.3x, suggesting there could be valuation risk if the market shifts toward this level. Might sentiment reverse if growth falters?

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Ermenegildo Zegna for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Ermenegildo Zegna Narrative

If you see the story differently or favor hands-on analysis, in just a few minutes you can shape your own perspective. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Ermenegildo Zegna.

Looking for more investment ideas?

Smart investors never settle for the obvious picks. Take your strategy up a notch by scanning dynamic opportunities that others are missing, often before they hit the headlines.

- Spot untapped potential and ride the next wave of innovation with these 24 AI penny stocks, shaping tomorrow’s breakthroughs in artificial intelligence.

- Capture hidden value by targeting these 875 undervalued stocks based on cash flows, which offer strong fundamentals and may be flying under the market’s radar.

- Secure reliable income by targeting these 18 dividend stocks with yields > 3%, boasting yields above 3% for a consistent return in any market climate.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.