Please use a PC Browser to access Register-Tadawul

Exploring Boot Barn (BOOT) Valuation After Recent Modest Share Movement and Pullback

Boot Barn Holdings, Inc. BOOT | 202.18 | +2.01% |

While Boot Barn Holdings' share price has rebounded slightly after the recent dip, momentum has struggled to build. The company has posted a modest 1-year total shareholder return of just over 5 percent, with signs of mixed sentiment as the year unfolds.

If you're tracking shifts in the retail space, it might be the perfect opportunity to broaden your search and discover fast growing stocks with high insider ownership

With Boot Barn Holdings trading nearly 26 percent below average analyst price targets, the question remains: does this gap hint at an undervalued opportunity, or is the market accurately reflecting the company’s long-term growth prospects?

Most Popular Narrative: 20% Undervalued

Boot Barn Holdings’s consensus fair value stands considerably above the last close, suggesting that the market has not fully embraced the narrative’s upbeat outlook. The stage is set for a closer examination of the rationale driving this optimism.

Robust store expansion into underpenetrated markets, particularly in population-growing regions, is driving higher-than-expected new store performance, strong customer acquisition, and increased sales productivity. This expansion provides an ongoing tailwind for revenue and positions Boot Barn to benefit from broader demographic shifts, supporting long-term top-line growth.

Curious what numbers justify such a big gulf between price and value? It is more than just expansion. The real secret is in a bold growth forecast and surprisingly rich profit multiples. The formula behind this consensus target might change what you thought possible for specialty retail. Want the full story? Dive in and see what could be fueling such high expectations.

Result: Fair Value of $213.29 (UNDERVALUED)

However, ongoing store expansion or changing consumer habits could challenge Boot Barn's growth story and quickly change analysts' optimistic outlook.

Another View: Multiples Tell a Different Story

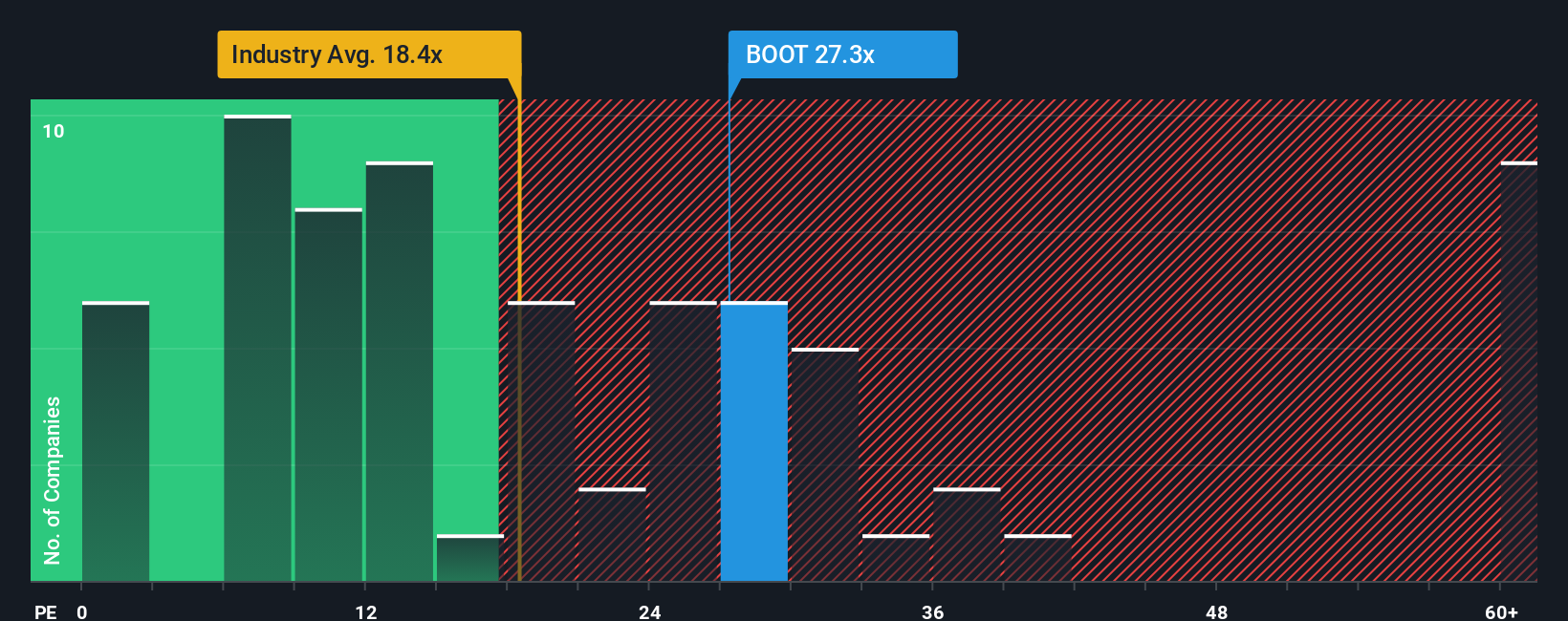

Looking through another lens, Boot Barn Holdings trades at a price-to-earnings ratio of 26.6x. This figure is noticeably higher than both the specialty retail industry average of 17.3x and a fair ratio of 18.5x. This premium raises questions about whether the market is pricing in more growth than is likely, or if there is a valuation risk investors should consider. Is this optimism justified, or does it signal a need for caution?

Build Your Own Boot Barn Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a fresh narrative in just minutes. Do it your way

A great starting point for your Boot Barn Holdings research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock your next winning pick by using the Simply Wall Street Screener. Be the first to spot fast-rising opportunities most investors overlook, and never settle for average performance.

- Tap into growth by reviewing these 3574 penny stocks with strong financials with strong financials and the potential to deliver outsized gains before the crowd catches on.

- Supercharge your returns by evaluating these 32 healthcare AI stocks powering innovation at the intersection of medicine and artificial intelligence.

- Secure steady income streams by analyzing these 19 dividend stocks with yields > 3% that offer attractive yields above 3 percent and help boost your long-term wealth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.