Please use a PC Browser to access Register-Tadawul

Henry Schein (HSIC) Expands SolutionsHub Platform With Colaborate Partnership Could Be a Game Changer

Henry Schein, Inc. HSIC | 73.62 | +0.38% |

- On September 9, 2025, Henry Schein Medical announced the expansion of its SolutionsHub™ platform by integrating Colaborate, giving clinical laboratories access to a full-service management consulting partner for compliance, efficiency, and financial sustainability services.

- This collaboration enhances Henry Schein’s suite of laboratory solutions and could help strengthen partner laboratory capabilities across the U.S. healthcare landscape.

- We’ll explore how the Colaborate alliance positions Henry Schein to broaden its value-added laboratory services and potentially shape its investment outlook.

Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

Henry Schein Investment Narrative Recap

To be a Henry Schein shareholder, you have to believe in its ability to drive growth through high-margin specialty and technology services, even as competitive pressures squeeze distribution margins. The recent integration of Colaborate into the SolutionsHub™ platform supports expansion in value-added laboratory services and strengthens the company’s digital health capabilities, but does not materially impact the immediate catalyst, margin improvement from cost-saving initiatives, or address the ongoing risk of price pressure in key distribution categories.

Among the latest announcements, the $750 million increase in buyback authorization stands out. While capital return activity may appeal to some, the most important catalyst for near-term results remains execution on operational efficiency targets, which underpin potential margin expansion and long-term earnings growth.

In contrast, investors should pay close attention to competitive pricing pressures, as these headwinds could persist in...

Henry Schein's outlook anticipates $14.4 billion in revenue and $614.4 million in earnings by 2028. This is based on a projected annual revenue growth rate of 4.0% and an earnings increase of $225.4 million from the current $389.0 million.

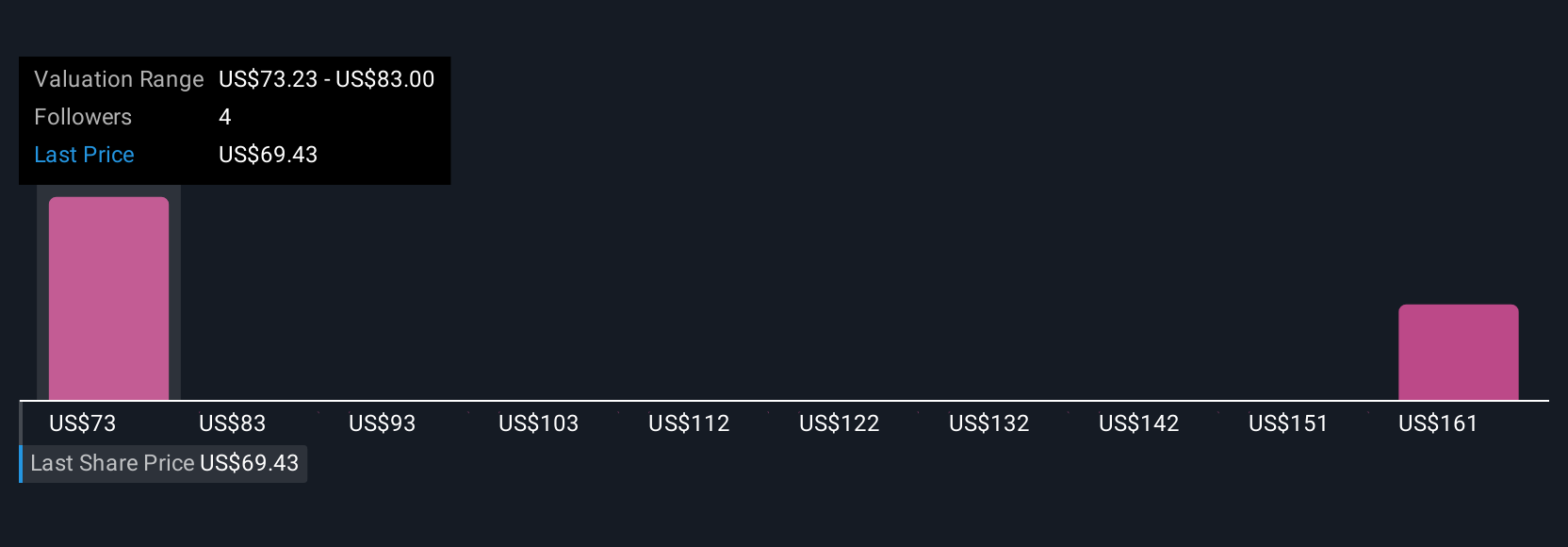

Uncover how Henry Schein's forecasts yield a $73.23 fair value, a 8% upside to its current price.

Exploring Other Perspectives

Two Simply Wall St Community members estimate Henry Schein's fair value between US$73 and US$171 per share. While many see opportunities in the company's expanding high-margin service lines, your view on competitive pricing pressure could shift expectations for future returns, so consider a wide range of perspectives.

Explore 2 other fair value estimates on Henry Schein - why the stock might be worth over 2x more than the current price!

Build Your Own Henry Schein Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Henry Schein research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Henry Schein research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Henry Schein's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.