Please use a PC Browser to access Register-Tadawul

How Do Domino’s Shares Stack Up After Recent Expansion Into South Korea?

Domino's Pizza, Inc. DPZ | 416.55 | -2.46% |

If you’re sizing up Domino's Pizza stock, you’re far from alone. With shares last closing at $417.46, investors are asking that age-old question: is now the right time to grab a slice? The numbers offer a story full of twists. Short-term movements haven’t exactly been piping hot, with the stock down 7.2% over the past month and dipping 4.0% year-to-date. Over the past year, the return is still negative, but just barely, down 1.1%. Looking over a longer period, Domino’s has delivered a 34.6% return over three years and a 13.8% haul over five years, showing there’s real potential for patient holders.

So, why the recent cool-down in price while the longer-term returns still shine? Part of it reflects how the market is viewing growth potential versus perceived risks, especially in a climate where consumer spending patterns shift and competition in quick-service food runs high. Global trends toward digital ordering and delivery have also helped shape market sentiment, sometimes quickly swinging opinions on which pizza brand will win big.

Of course, share price movement isn’t the whole story. When it comes to valuation, a simple score can be illuminating: Domino’s currently posts a value score of 0, meaning it isn’t flagged as undervalued in any of the typical six checks analysts watch. But how useful are these valuation methods? Let’s break down each approach and, later, explore if there’s a smarter way to truly understand what Domino’s is worth.

Domino's Pizza scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Domino's Pizza Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and discounting them back to today’s dollars. For Domino’s Pizza, this approach uses both analyst forecasts and longer-term extrapolations to get a sense of what the business is truly worth over time.

Currently, Domino’s is generating Free Cash Flow of $622 million. Analysts project that by 2028, annual Free Cash Flow will climb to around $796 million, with further increases modeled out using long-term growth estimates. These projections combine realistic analyst input for the next five years and extend beyond that with more automated calculations to reach a 10-year outlook.

After crunching the numbers, the DCF model estimates Domino’s intrinsic value at $343.09 per share. With the stock price sitting at $417.46, the shares are trading about 21.7% above what this model sees as fair value. That means, at least from a DCF standpoint, Domino’s stock is looking noticeably overvalued right now, despite strong cash generation and steady growth projections.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Domino's Pizza may be overvalued by 21.7%. Find undervalued stocks or create your own screener to find better value opportunities.

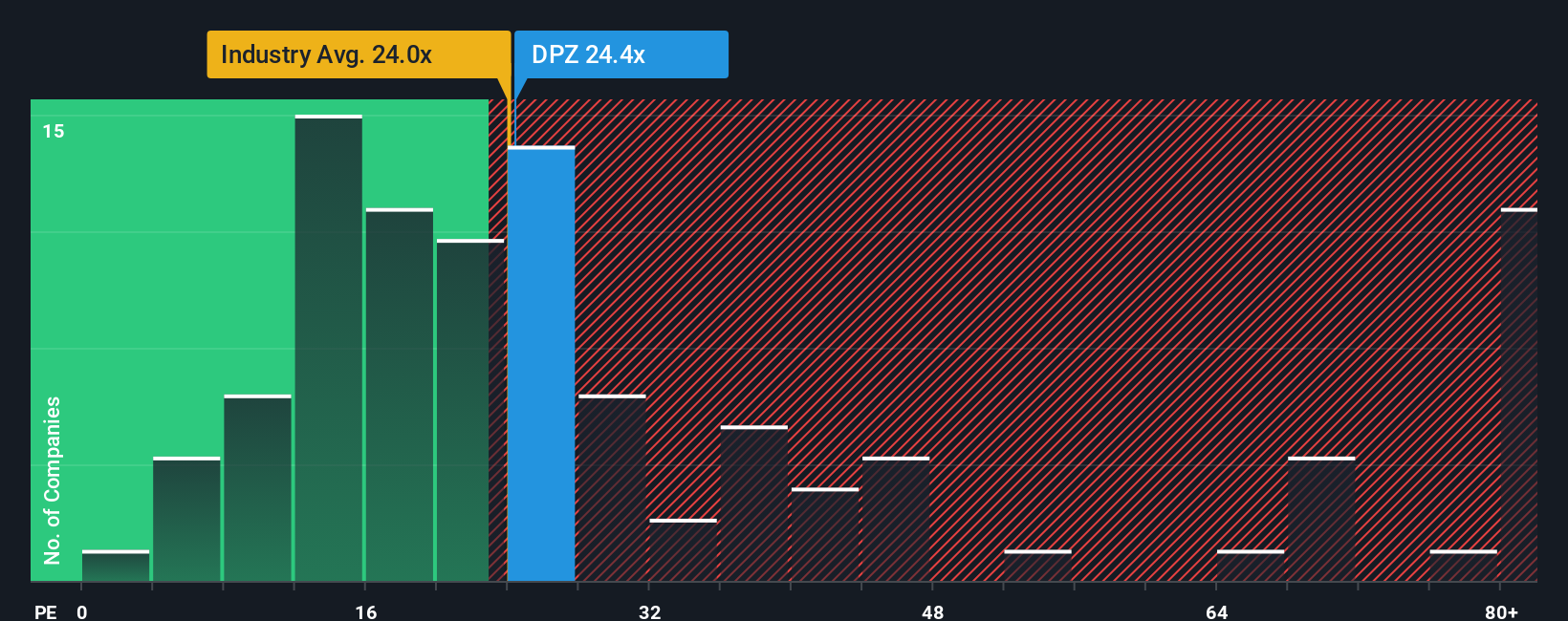

Approach 2: Domino's Pizza Price vs Earnings (PE)

For established, profitable companies like Domino’s Pizza, the Price-to-Earnings (PE) ratio is often a go-to valuation tool. It highlights how much investors are willing to pay for each dollar of current earnings, making it especially useful for brands with a consistent profit track record.

Of course, the “right” PE ratio is seldom one-size-fits-all. Growth expectations and perceived risk can significantly influence what is considered fair. Faster-growing, more stable businesses usually justify higher PEs, while slower or riskier companies trade at lower multiples.

Domino’s Pizza trades at a PE ratio of 23.9x, which is just above the average for both its hospitality industry peers (23.1x) and the sector overall (23.8x). However, simply looking at industry averages and peers can miss company-specific nuances. This is where Simply Wall St’s Fair Ratio comes in. This proprietary benchmark weighs Domino’s expected earnings growth, profit margins, industry conditions, risks, and even its market cap to come up with a more tailored figure: a fair PE of 22.7x.

Comparing Domino’s current PE to its Fair Ratio suggests that the stock is trading slightly above where those fundamentals would place its value. The difference is marginal, so the valuation appears to be largely in line with expectations.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

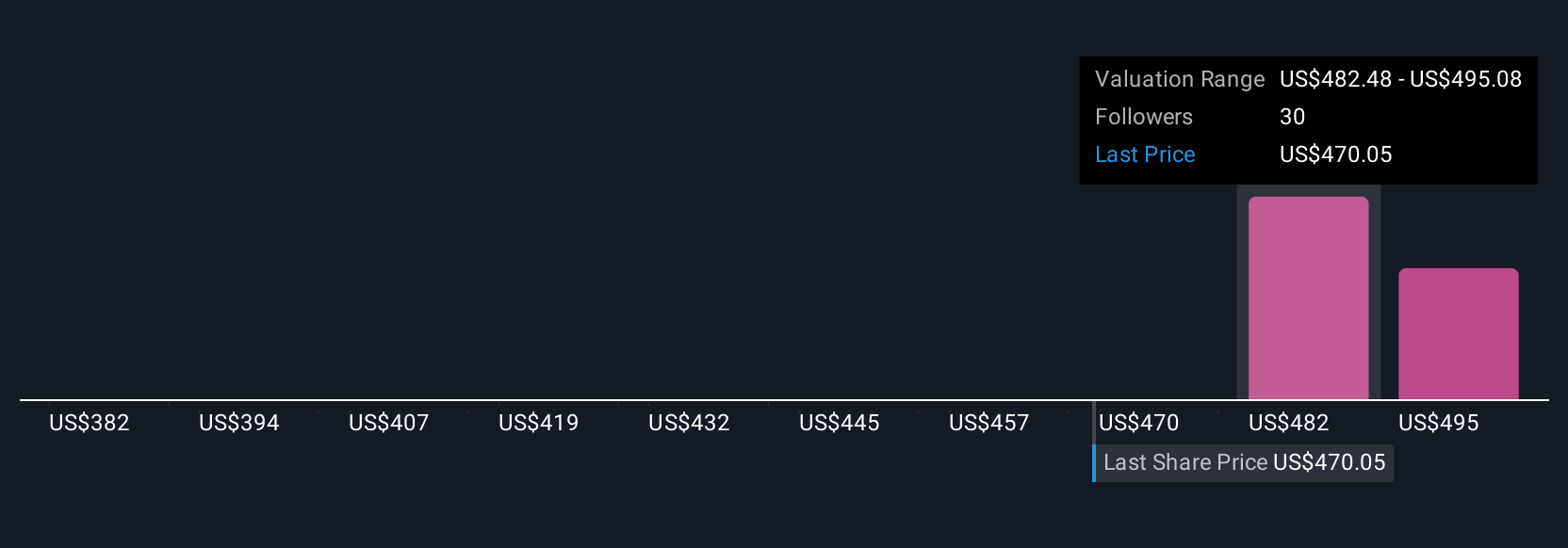

Upgrade Your Decision Making: Choose your Domino's Pizza Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a dynamic approach that connect the story you believe about a company, such as Domino’s digital growth or global expansion ambitions, to your financial forecasts like future revenue, earnings, and margins. This approach ultimately gives you your own fair value.

Rather than relying solely on traditional ratios, Narratives let you build and personalize your investment case, turning your perspective on Domino’s into clear numbers and price targets. This approach is intuitive and accessible to everyone and is available right now on Simply Wall St’s Community page, used by millions of investors.

Narratives are especially powerful because they adjust as new news or earnings updates come in, helping you track if your thesis is playing out and whether it's time to buy, sell, or hold based on how your fair value compares to the current price.

For example, some investors see Domino's growing quickly thanks to tech and third-party delivery partnerships and set a fair value above $590, while others focus on international risks and assign a value closer to $340. This wide range reflects unique views, all easily captured and compared through Narratives.

Do you think there's more to the story for Domino's Pizza? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.