Please use a PC Browser to access Register-Tadawul

How Might Major Share Sales and New Partnerships Shape Confidence in CCC Intelligent Solutions (CCCS)?

CCC Intelligent Solutions Holdings Inc. Common Stock CCCS | 8.75 | 0.00% |

- In recent weeks, CCC Intelligent Solutions Holdings Inc. saw a significant secondary offering as Advent International affiliates announced plans to sell 30 million shares, while Executive Vice President John Page Goodson sold over 42,000 company shares.

- Simultaneously, an expanded integration between CCC and Elitek Vehicle Services was announced, offering enhanced diagnostic detail capture for repair shops through the CCC Diagnostics Network.

- We’ll explore how the major share sales from Advent and an executive may reshape confidence in CCC’s investment outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 29 companies in the world exploring or producing it. Find the list for free.

CCC Intelligent Solutions Holdings Investment Narrative Recap

To be a shareholder in CCC Intelligent Solutions Holdings, you need to believe in the accelerating digitization of insurance and auto repair, and the company's ability to drive recurring revenue from AI-enabled solutions across a large client base. The recent major share sales by Advent International and an executive likely do not have a material impact on the company's biggest short-term catalyst, enterprise-wide adoption by large insurers, or its greatest current risk of structurally declining industry claim volumes, though they may shape short-term perceptions of confidence. Of recent announcements, the expanded integration with Elitek Vehicle Services stands out. This move enhances CCC’s diagnostics network offering and aligns with its catalyst of deeper technology adoption among repair shops and insurers, which could help offset stagnant claim volumes by pushing new service layers and upsells across its ecosystem. In contrast, investors should be aware of how persistent declines in claim volumes could...

CCC Intelligent Solutions Holdings' outlook projects $1.3 billion in revenue and $187.4 million in earnings by 2028. This reflects a 9.3% annual revenue growth and an earnings increase of $185.5 million from the current $1.9 million.

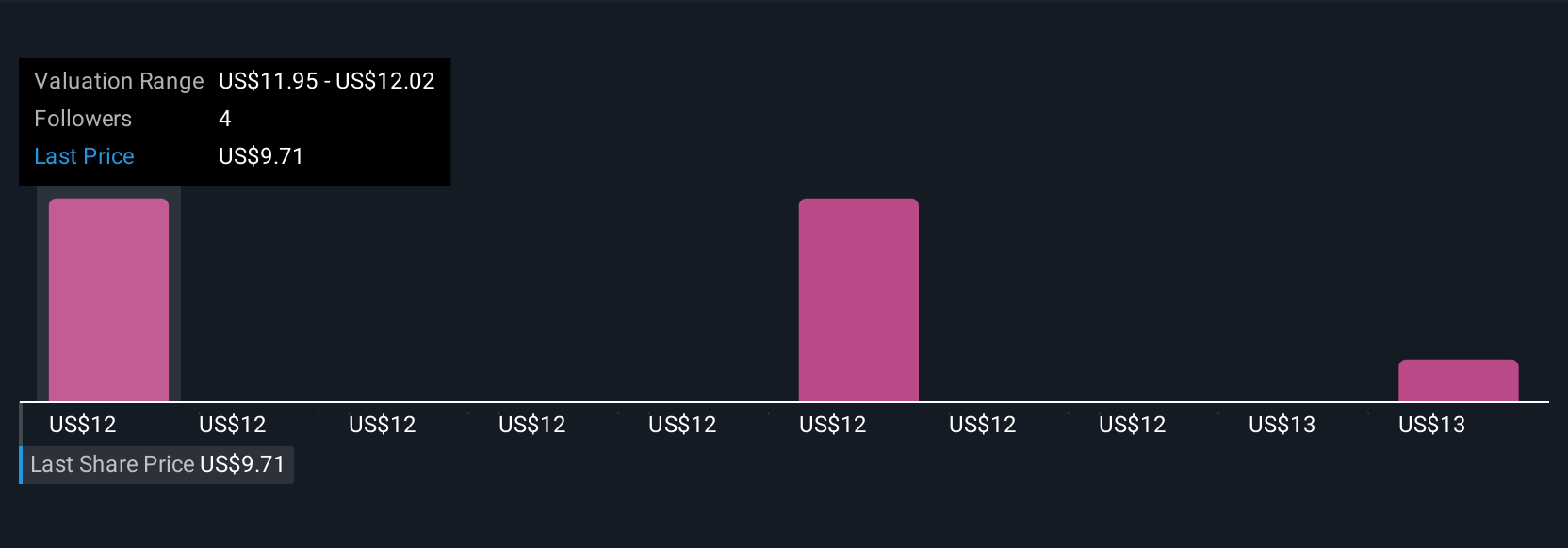

Uncover how CCC Intelligent Solutions Holdings' forecasts yield a $12.12 fair value, a 26% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community estimate CCC’s fair value between US$12.01 and US$12.65 per share. While many see advantage in CCC’s expanding diagnostics network, persistent weakness in industry claim volumes remains a key uncertainty you should consider when weighing these viewpoints.

Explore 4 other fair value estimates on CCC Intelligent Solutions Holdings - why the stock might be worth as much as 31% more than the current price!

Build Your Own CCC Intelligent Solutions Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your CCC Intelligent Solutions Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free CCC Intelligent Solutions Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate CCC Intelligent Solutions Holdings' overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.