Please use a PC Browser to access Register-Tadawul

How Slower EPS Growth Guidance at MongoDB (MDB) Has Changed Its Investment Story

MONGODB MDB | 409.62 | +3.25% |

- MongoDB recently reported strong Q2 results driven by robust gains in its AI initiatives and Atlas cloud platform, but issued full-year guidance for fiscal 2026 that highlights a projected slowdown in key metrics, especially earnings per share growth.

- While profitability and cash flow improved, the company's forward P/E ratio remains very high, raising persistent concerns among investors about potential overvaluation despite ongoing revenue momentum.

- We'll now explore how this guidance of slower EPS growth, despite AI gains, impacts MongoDB’s broader investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

MongoDB Investment Narrative Recap

To own MongoDB stock, an investor needs to believe that its AI and cloud initiatives will translate into sustained, high-quality growth, particularly through continued adoption of Atlas and product innovation. The latest Q2 results reinforce this narrative in the short term, but the company's updated guidance for slower EPS growth casts some doubt on the immediate benefit of AI gains. Right now, the most important catalyst remains enterprise adoption of Atlas, while the biggest risk centers on intensifying competition from cloud-native database providers; neither appears materially changed by the recent guidance, though margin pressure remains a concern. Among several recent company developments, the announcement of MongoDB AMP, an AI-powered Application Modernization Platform, stands out as especially relevant. This move directly highlights MongoDB’s commitment to helping enterprises leverage AI for legacy transformation, linking clearly with both current customer demand and AI-driven revenue momentum. These product rollouts align closely with the growth catalysts investors are watching. Yet, despite AI momentum and breakthroughs, investors should also be aware that competitive risks are ...

MongoDB's outlook suggests $3.5 billion in revenue and $5.0 million in earnings by 2028. This is based on a projected 16.8% annual revenue growth rate and reflects an increase in earnings of $83.6 million from the current level of -$78.6 million.

Uncover how MongoDB's forecasts yield a $350.80 fair value, a 12% upside to its current price.

Exploring Other Perspectives

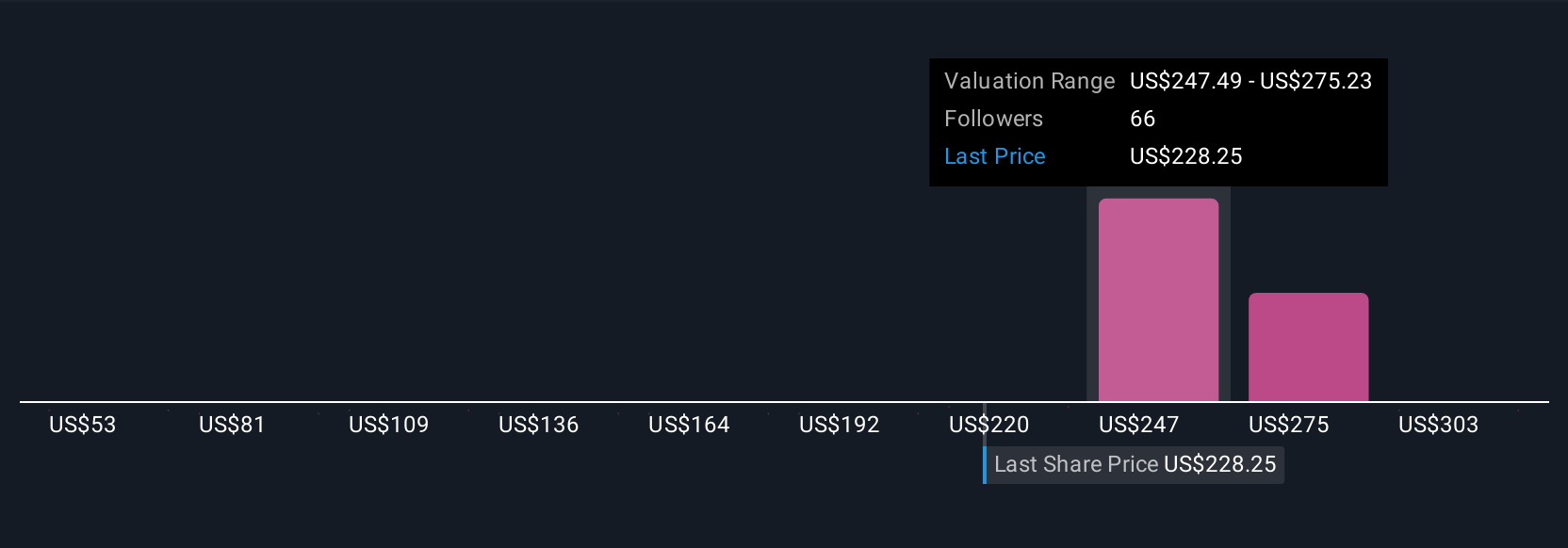

Eleven members of the Simply Wall St Community estimate fair value for MongoDB between US$130.20 and US$394.78 per share. While these views span both bullish and cautious expectations, many are watching carefully as competition from cloud-native database providers could impact MongoDB’s margins and scale.

Explore 11 other fair value estimates on MongoDB - why the stock might be worth as much as 26% more than the current price!

Build Your Own MongoDB Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your MongoDB research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free MongoDB research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate MongoDB's overall financial health at a glance.

Seeking Other Investments?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.