Please use a PC Browser to access Register-Tadawul

How Upgraded Analyst Ratings at Gates Industrial (GTES) Have Changed Its Investment Story

Gates Industrial Corporation plc GTES | 21.84 | -1.00% |

- In recent days, analyst sentiment toward Gates Industrial has turned more positive, with multiple analysts maintaining strong buy ratings and raising their expectations for the company's performance. This shift in outlook has been accompanied by upward revisions to full-year earnings estimates and an improved ranking from research firms.

- The heightened analyst confidence arrives as Gates Industrial continues to outperform peers in the Industrial Products sector and demonstrates resilience amid industry challenges.

- We'll explore how this improved analyst sentiment, coupled with stronger earnings projections, updates the overall investment case for Gates Industrial.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Gates Industrial Investment Narrative Recap

To be a shareholder in Gates Industrial right now, you need confidence in its ability to convert strong analyst sentiment and raised earnings projections into sustained profit growth, especially as the company faces uneven demand in core industrial and automotive markets. The recent wave of upward analyst revisions does not materially alter the core short-term catalyst, which remains Gates' push into data center and personal mobility applications, nor does it remove the biggest risk: prolonged weakness in industrial OEM and construction segments could impact revenue stability.

Among the latest announcements, Gates' July guidance update stands out, maintaining core revenue growth expectations at 0.5% to 2.5% for 2025. This measured outlook, paired with bullish analyst activity, highlights that near-term optimism is still balanced by acknowledgments of slow recovery in key end markets, a crucial context for anyone considering the current price momentum and forecast upgrades.

But investors should also be aware that, despite recent confidence, ongoing softness in North American and EMEA end markets could still...

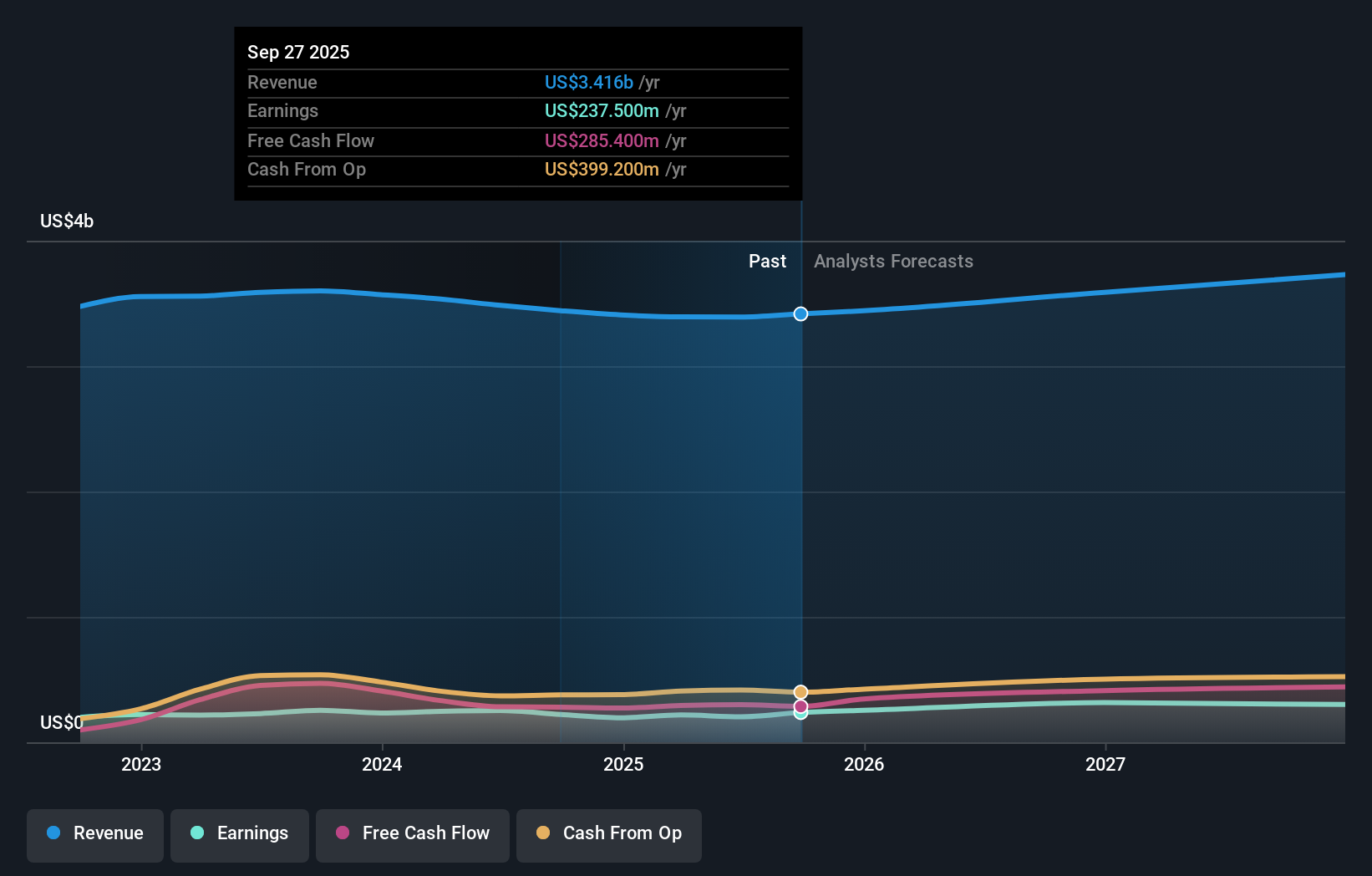

Gates Industrial's outlook forecasts $3.8 billion in revenue and $395.4 million in earnings by 2028. This is based on a 4.2% annual revenue growth rate and a $191.9 million increase in earnings from the current $203.5 million.

Uncover how Gates Industrial's forecasts yield a $30.27 fair value, a 19% upside to its current price.

Exploring Other Perspectives

All one fair value estimate from the Simply Wall St Community landed at US$30.27 per share. Still, analysts point to slow growth in Gates' core markets, signaling that community and professional perspectives might weigh quite different expectations for the company's next move.

Explore another fair value estimate on Gates Industrial - why the stock might be worth just $30.27!

Build Your Own Gates Industrial Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Gates Industrial research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Gates Industrial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Gates Industrial's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.