Please use a PC Browser to access Register-Tadawul

Huntington Ingalls Industries (HII): Examining Valuation Following Recent Mixed Momentum in Defense Stocks

Huntington Ingalls Industries, Inc. HII | 304.58 | -3.58% |

Most Popular Narrative: 6.6% Undervalued

The most widely followed narrative currently values Huntington Ingalls Industries as moderately undervalued, reflecting strong projections for future earnings and robust defense sector tailwinds.

Sustained increases in U.S. defense budgets and policy tailwinds, as evidenced by multi-year funding allocations in the FY26 budget (including support for Columbia-class, Virginia-class, and amphibious ship programs) and the reconciliation bill's directed industrial base investments, ensure robust multi-year order flow and underpin long-term revenue growth and backlog visibility.

Curious what’s fueling this bullish fair value? It is not just traditional shipbuilding revenue. The narrative leans on remarkable operational targets, margin boosts, and a future earnings multiple you might not expect from the sector. Think you know the numbers? Dive into the full narrative for the valuation formula the pros are betting on.

Result: Fair Value of $285.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, supply chain disruptions or delays in large defense contracts could quickly erode today’s optimism and shift analyst sentiment in the other direction.

Find out about the key risks to this Huntington Ingalls Industries narrative.Another View: SWS DCF Model Suggests Undervaluation Persists

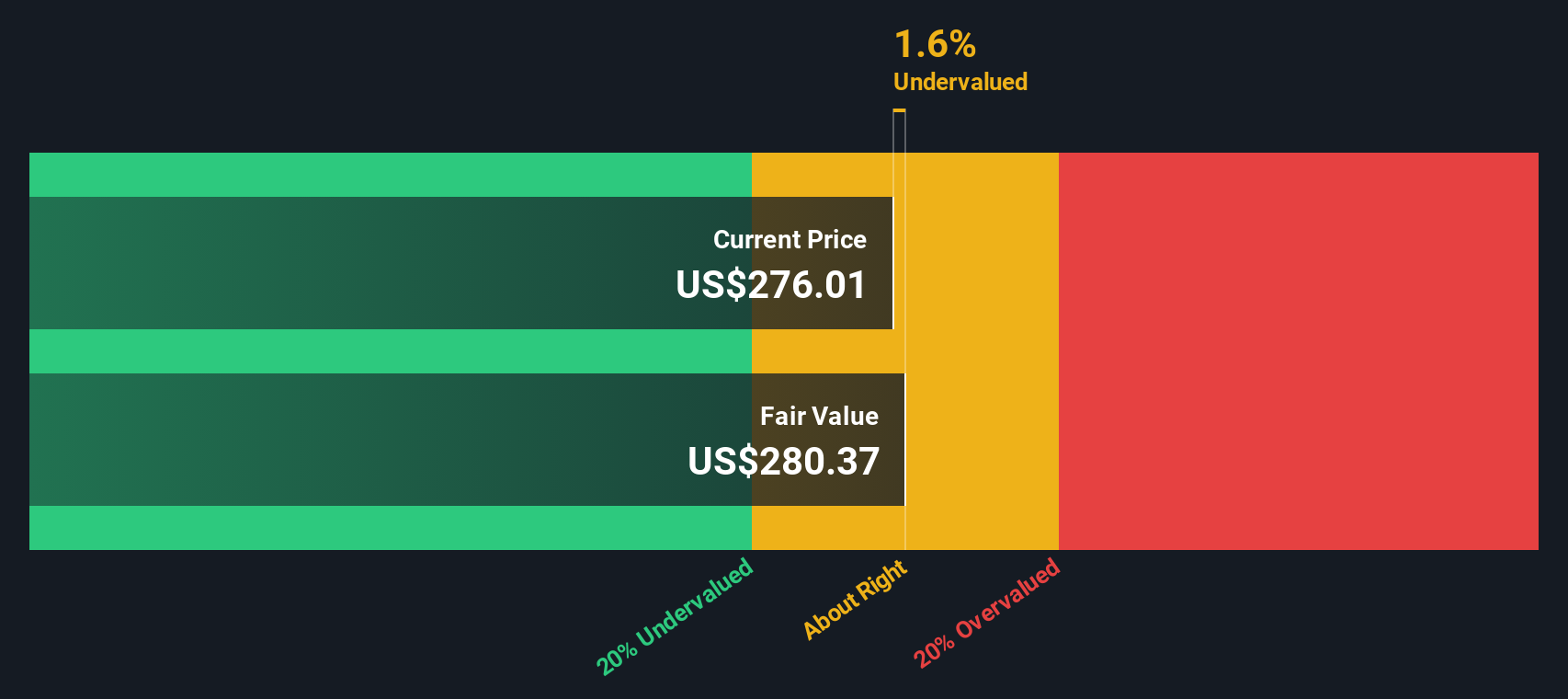

Taking a step away from analyst targets, our DCF model also points to Huntington Ingalls Industries being undervalued at current levels. Can both the market and the math really agree? Or is something missing?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Huntington Ingalls Industries Narrative

If you are looking to dig deeper or form your own perspective, you can quickly build your own narrative using the data at hand. Do it your way

A great starting point for your Huntington Ingalls Industries research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always keep an eye on the next big opportunity. If you are ready to move beyond the usual watchlist, seize these hand-picked ideas and stay on top of tomorrow’s winners.

- Tap into the unstoppable growth of the artificial intelligence revolution with AI penny stocks. Uncover companies transforming industries through cutting-edge machine learning and automation.

- Boost your portfolio’s income potential by targeting dividend stocks with yields > 3% to spot established businesses offering robust yields and reliable dividend payouts above 3%.

- Get ahead of the market with undervalued stocks based on cash flows; this tool is designed to spotlight stocks trading below their intrinsic value, highlighting companies with strong cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.