Please use a PC Browser to access Register-Tadawul

IBM (IBM): A Fresh Look at Valuation as Strategic Bets on AI and Cloud Gain Attention

International Business Machines Corporation IBM | 307.94 | -0.02% |

If you have been watching International Business Machines (IBM) lately, you have probably noticed a lot of chatter around its efforts to navigate fierce competition, particularly with Amazon Web Services and Microsoft Azure dominating the cloud space. IBM is cutting costs through sizable job reductions and simultaneously betting big on hybrid cloud and AI initiatives like its watsonx platform. Industry voices are increasingly optimistic; recent commentary even highlights IBM’s CEO and the company’s role as a quantum computing contender.

These strategic moves have helped shift sentiment after a rocky earnings period that raised questions about growth in some software segments. While IBM’s shares experienced some turbulence earlier this year, forward-looking signals from analysts and recent events suggest momentum is back in focus. Over the past year, IBM’s stock has delivered an attractive 30% return, outpacing historical averages and hinting at renewed investor interest as leadership doubles down on high-growth areas.

So, after this year’s resurgence and new optimism, is IBM a bargain in disguise, or has the recent momentum already been priced in by the market?

Most Popular Narrative: 7.9% Undervalued

Based on the most widely followed narrative, IBM is currently viewed as undervalued, with analysts projecting a meaningful gap between the current share price and estimated fair value.

IBM's focused strategy on hybrid cloud and AI is driving solid revenue growth, providing cost savings, productivity gains, and scalability for clients. This is expected to continue supporting their revenue trajectory. The launch of the z17 mainframe with enhanced AI acceleration and energy efficiency is anticipated to drive significant customer adoption, positively impacting infrastructure revenue and possibly net margins due to differentiation and pricing power.

Want to uncover why analysts believe IBM’s story is just getting started? The foundation of this bullish valuation is built on bold assumptions about future profits and margins. Curious about which financial levers set this fair value apart? There is a set of game-changing projections you will not want to miss. Dig into the narrative to see what could drive IBM higher.

Result: Fair Value of $281.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if macroeconomic uncertainty causes clients to delay projects or government spending tightens, IBM’s upward trajectory could face notable headwinds.

Find out about the key risks to this International Business Machines narrative.Another View: Looking at Market Comparisons

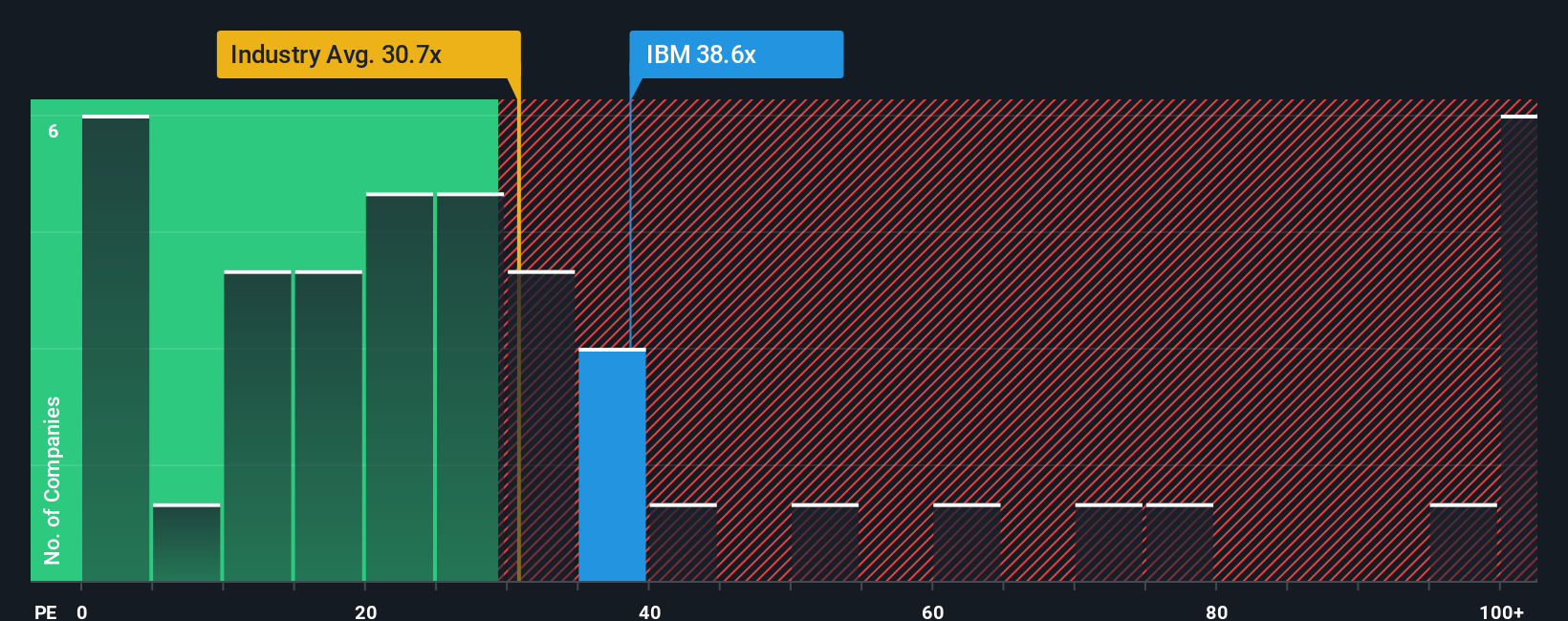

While analysts see IBM as undervalued based on future profits, a look at its price-to-earnings ratio paints a different story. The market currently prices IBM higher than the industry average. Which perspective will prove truer as conditions change?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own International Business Machines Narrative

If you want to challenge these perspectives or dig deeper into IBM’s numbers, you can build your own view in just a few minutes. Do it your way.

A great starting point for your International Business Machines research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Unlock even more potential for your portfolio by checking out handpicked investment opportunities tailored to your interests. Miss out now, and you might regret overlooking tomorrow’s top performers!

- Spot overlooked gems with explosive upside by tapping into penny stocks with strong financials, which are fueling growth in emerging markets and disruptive sectors.

- Upgrade your strategy and seize income opportunities by exploring dividend stocks with yields > 3%, which features companies boasting impressive yields and reliable payouts above 3%.

- Catalyze your returns as artificial intelligence reshapes industries with AI penny stocks, featuring trailblazers redefining what is possible through next-level technology.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.