Please use a PC Browser to access Register-Tadawul

Is Analyst Optimism on Reddit’s (RDDT) Ad Revenue Outlook Enough to Offset Engagement Questions?

RDDT | 234.11 | +5.10% |

- Earlier this week, analyst upgrades and renewed confidence in Reddit's advertising monetization prospects followed a period of debate over declining AI citation frequency and concerns about user engagement on the platform.

- The heightened optimism among analysts, including strong consensus in raising earnings estimates, emerged despite recent pressure related to Reddit’s data relevance for AI models and user activity trends.

- We'll explore how this shift in analyst sentiment, especially regarding Reddit's advertising revenue outlook, may influence the company's investment narrative going forward.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Reddit Investment Narrative Recap

To own Reddit shares, you need confidence in its ability to scale advertising revenue and maintain platform relevance through strong user engagement, despite swings from AI content citation. This week’s analyst upgrades reflect renewed faith in Reddit’s core ad business and raise near-term expectations, but the most significant risk, dependence on external platforms like Google and OpenAI for traffic and data licensing, remains unchanged by recent news.

Among announcements, Reddit’s robust Q2 2025 results stand out: $499.63 million in sales and $89.3 million in net income. Continued top-line growth and profitability support the investment thesis, reinforcing ad revenue’s role as the key short-term catalyst.

However, beneath recent optimism, investors should also consider the impact of any further decline in Reddit’s AI relevance, especially if...

Reddit's outlook anticipates $3.8 billion in revenue and $1.0 billion in earnings by 2028. Achieving this would require 31.8% annual revenue growth and a $783.7 million earnings increase from current earnings of $216.3 million.

Uncover how Reddit's forecasts yield a $219.15 fair value, a 8% upside to its current price.

Exploring Other Perspectives

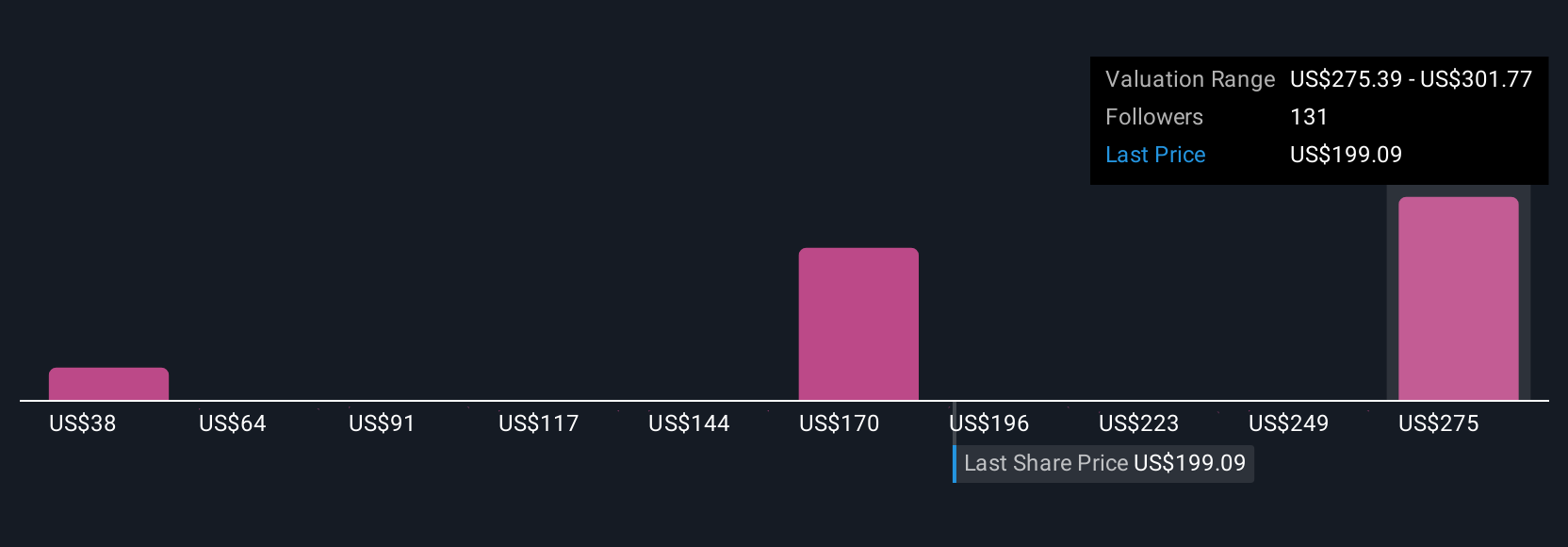

Simply Wall St Community fair value estimates for Reddit range widely from US$38 to nearly US$297 based on 29 member opinions. While there’s broad disagreement on valuation, many remain focused on whether Reddit can expand data licensing revenue or if dependence on external platforms could curb its future earnings.

Explore 29 other fair value estimates on Reddit - why the stock might be worth as much as 46% more than the current price!

Build Your Own Reddit Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Reddit research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Reddit research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Reddit's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.