Please use a PC Browser to access Register-Tadawul

Is Confluent’s Recent 17% Climb Justified After Major Cloud Partnerships?

Confluent, Inc. CFLT | 23.14 | -0.90% |

- Thinking about whether Confluent stock is a bargain or overhyped? You are not alone. As with most growth tech names, getting a clear read on value means cutting through a lot of noise.

- The stock has climbed 4.7% in the last week and a robust 17.6% over the past month, hinting at renewed optimism among investors despite being down 16.3% year-to-date.

- Recent headlines have highlighted Confluent’s strategic partnerships with major cloud providers and new product releases. Both factors are fueling speculation about longer-term growth. At the same time, growing competition in the streaming data space has prompted cautious optimism rather than runaway enthusiasm for the stock.

- On our 6-point valuation scorecard, Confluent earns a 4 out of 6. This reflects strengths in several key checks but also some areas for improvement. Next, we will break down the different ways analysts approach valuing Confluent stock and reveal an even better way to judge whether it’s truly worth your money at the end of the article.

Approach 1: Confluent Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a common method for valuing rapidly growing technology companies such as Confluent. In essence, a DCF model projects the company's future cash flows and discounts them back to today's value to estimate what the business is truly worth right now.

Currently, Confluent reports Free Cash Flow of approximately $30 million. Analysts expect this to rise sharply, with projections showing free cash flows could reach $454 million by 2029. While analyst estimates typically extend up to five years, further numbers are extrapolated to anticipate longer-term potential.

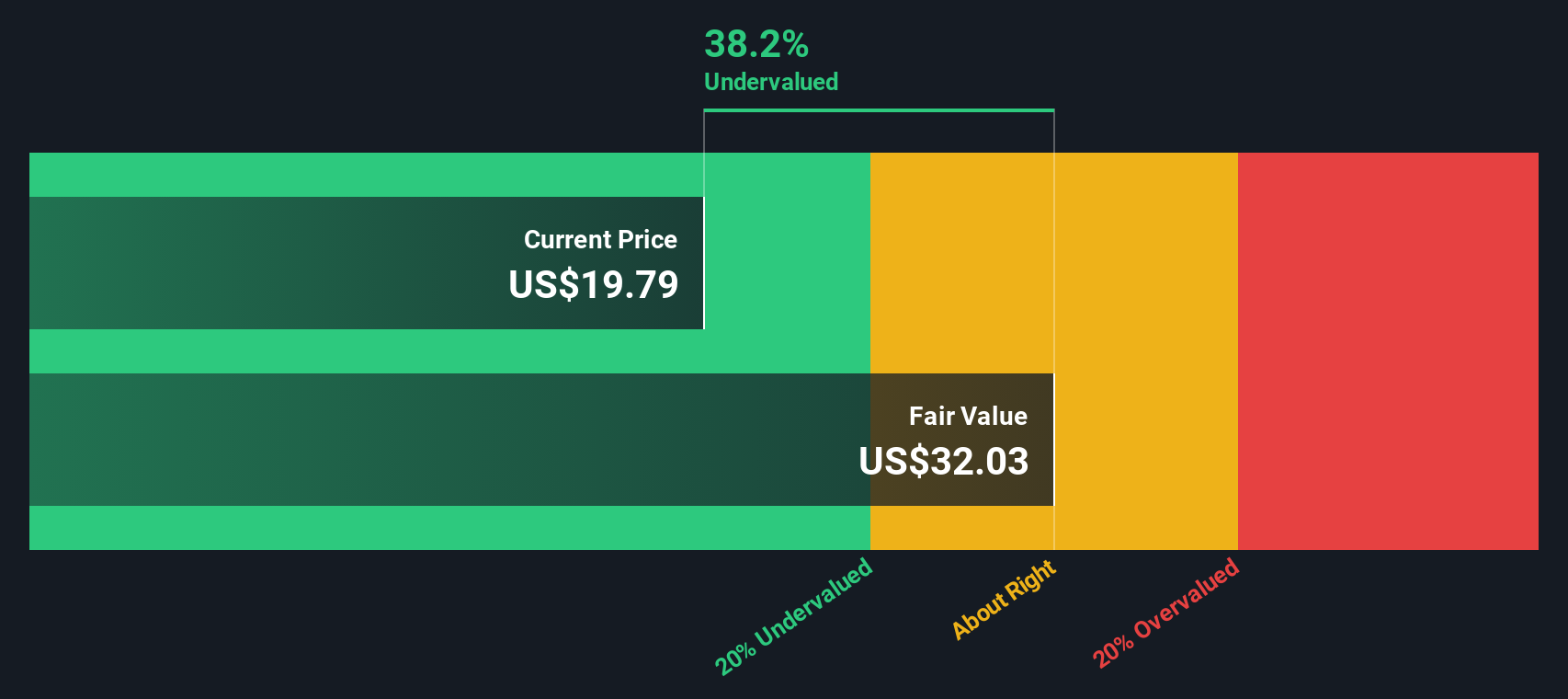

Based on these projections and using a 2 Stage Free Cash Flow to Equity model, the estimated intrinsic fair value for Confluent stock is $33.00 per share. That value is roughly 28.3% above the current market price, which suggests the stock is undervalued by a notable margin right now.

This means that, according to the DCF analysis, Confluent currently trades well below its estimated long-term worth. This is largely driven by expectations of accelerating cash flow growth in the coming years.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Confluent is undervalued by 28.3%. Track this in your watchlist or portfolio, or discover 848 more undervalued stocks based on cash flows.

Approach 2: Confluent Price vs Sales

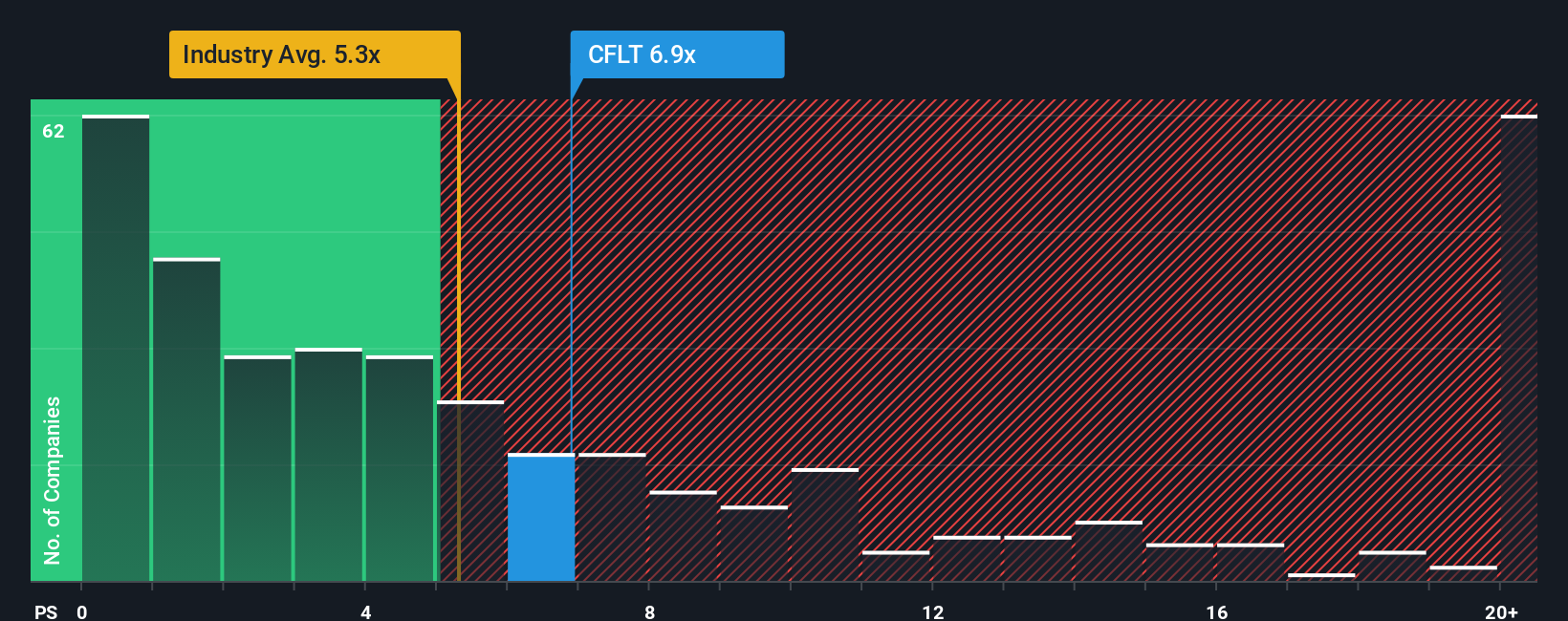

The Price-to-Sales (P/S) ratio is a popular method for valuing growth-focused companies like Confluent, especially when profits are not yet consistent at the bottom line. The P/S ratio provides a snapshot of how much investors are willing to pay for a dollar of sales, making it a favored multiple among analysts evaluating high-revenue, high-growth software businesses.

Growth expectations and risk typically determine what a “normal” P/S ratio should be. High-growth companies or those with more predictable revenue streams often command a premium. Companies facing higher risks or slower expected growth might trade at lower multiples.

As it stands, Confluent trades at a P/S ratio of 7.43x. This is higher than the average for the Software industry, which sits at 5.24x, but lower than its peer group average of 10.51x. To provide deeper context, Simply Wall St’s proprietary “Fair Ratio” for Confluent is calculated at 7.88x. The Fair Ratio is a more holistic benchmark because it accounts for factors like the company’s revenue growth, profitability, risk profile, industry context, and even market cap. Simple comparisons to the industry or peers can overlook important nuances.

Given that Confluent’s actual P/S multiple of 7.43x is very close to its Fair Ratio of 7.88x, the stock appears to be trading at about the right value according to sales-based valuation metrics.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1382 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Confluent Narrative

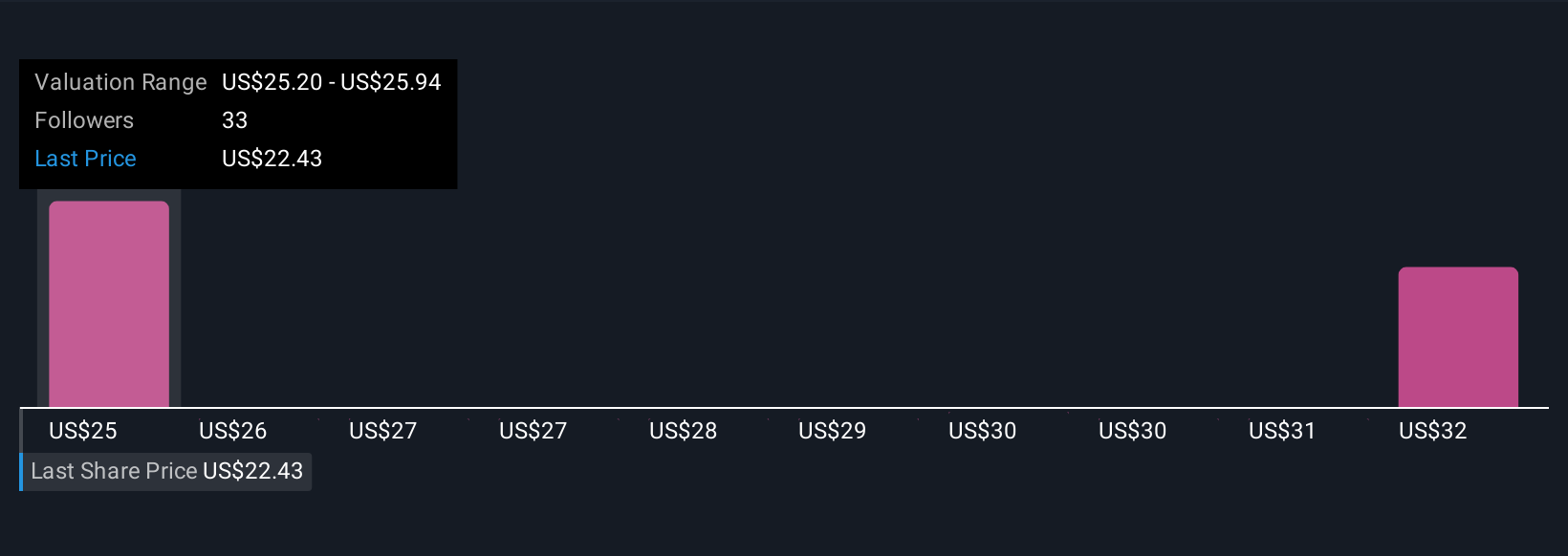

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal view on a company’s future, allowing you to tell the story behind the numbers by setting your expectations for fair value, revenue growth, margins, and more.

Rather than focusing only on ratios or analyst estimates, Narratives connect the company’s business story to a concrete financial forecast and, ultimately, an actionable fair value. This helps you see exactly how your perspective—optimistic or cautious—translates into what you believe the stock is worth.

Narratives are easy to use and available to everyone in the Community section of Simply Wall St’s platform, trusted by millions of investors. They let you quickly compare your fair value estimate to the current market price, so you can decide whether it is time to buy, sell, or watch for a better entry point.

As the market changes, Narratives update in real time with new information such as earnings results or major news so your view on Confluent evolves automatically.

To illustrate, one investor’s Narrative for Confluent might see surging AI adoption and strategic partnerships justifying a $36 price target, while another focuses on cloud competition and margin pressures, setting a fair value of $20. This helps you understand the full range of possibilities and make smarter decisions.

Do you think there's more to the story for Confluent? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.