Please use a PC Browser to access Register-Tadawul

Is CrowdStrike Set for Growth After Recent $7B Microsoft Security Contract Win?

CrowdStrike CRWD | 512.03 | -0.21% |

If you’ve been watching CrowdStrike Holdings lately, you know the stock has not exactly flown under the radar. Maybe you’re wondering whether it’s time to buy, take profits, or just keep holding those shares. Let’s zoom out for a moment and look at what’s really going on here.

CrowdStrike’s journey has been nothing short of impressive. Over the last five years, this cybersecurity firm has soared an incredible 261.9%, and even in the past year alone, it racked up a 59.7% gain. The past week saw a dip of 4.1%, following a 9.9% jump over the past month and a strong 40.8% rally year-to-date. These kinds of moves often trace back to broader financial market trends, such as the ongoing spotlight on digital security and investors seeking reliable growth as tech rebounds and threat landscapes shift.

If you’re curious about value, here’s an important number: CrowdStrike currently checks zero out of six boxes for being undervalued according to standard valuation metrics. That’s a zero on its value score, which is not a ringing endorsement from traditional models. But does this mean the stock’s too expensive, or just that the usual measures aren’t telling the full story?

Next, let’s dig into the most common approaches for valuing this company. After that, I’ll show you an even sharper way to cut through the noise when thinking about what CrowdStrike is truly worth.

CrowdStrike Holdings scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: CrowdStrike Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates the worth of a company by forecasting its future cash flows and discounting them back to today’s value. Essentially, it asks, “What is the present value of all the money CrowdStrike might generate over the coming years, adjusted for risk and time?”

As of now, CrowdStrike generates $1.04 billion in Free Cash Flow (FCF). Over the next decade, analysts expect its FCF to rise steadily, reaching approximately $4.58 billion by 2030. It is important to note that professional analysts only provide robust estimates for around five years, and the further years are projected using trends and models from Simply Wall St.

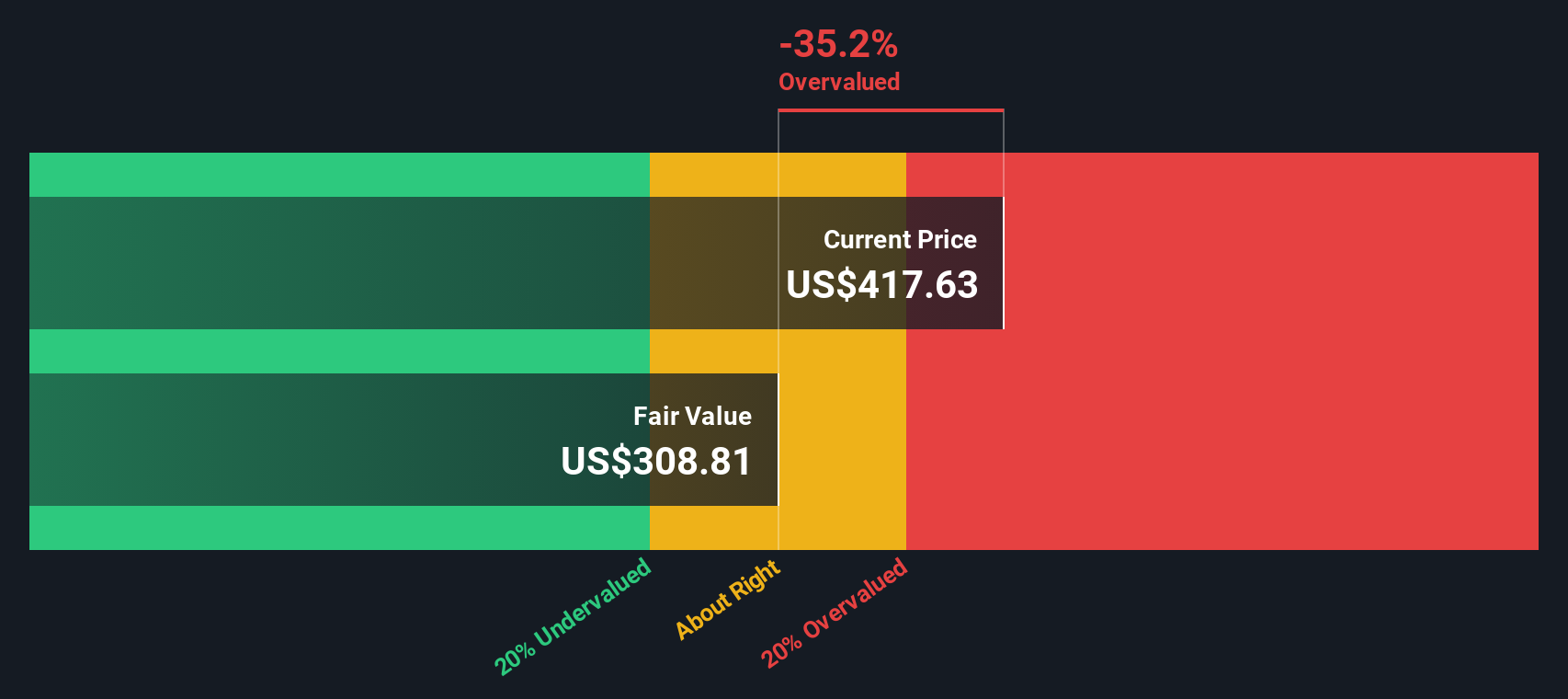

Using a two-stage Free Cash Flow to Equity approach, the DCF model calculates an intrinsic fair value for CrowdStrike’s stock at $413.43 per share. However, this figure stands about 18.3% below CrowdStrike’s current trading price. This means the stock appears overvalued when judged by this method.

If you are hoping for a bargain based strictly on projected cash flows, CrowdStrike does not hit that mark right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests CrowdStrike Holdings may be overvalued by 18.3%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: CrowdStrike Holdings Price vs Sales

For companies like CrowdStrike, which are reporting strong revenue growth but may not yet have consistent profitability, the Price-to-Sales (PS) ratio is often a more suitable valuation metric than earnings-based multiples. The PS ratio helps investors understand how much they are paying for each dollar of sales, placing growth and market share in focus.

Growth expectations and company-specific risks play a role in deciding what a “normal” or “fair” PS ratio should look like. Fast-growing firms with leading positions and strong recurring revenues can justify higher multiples, whereas riskier or slower-growing businesses tend to warrant lower ones.

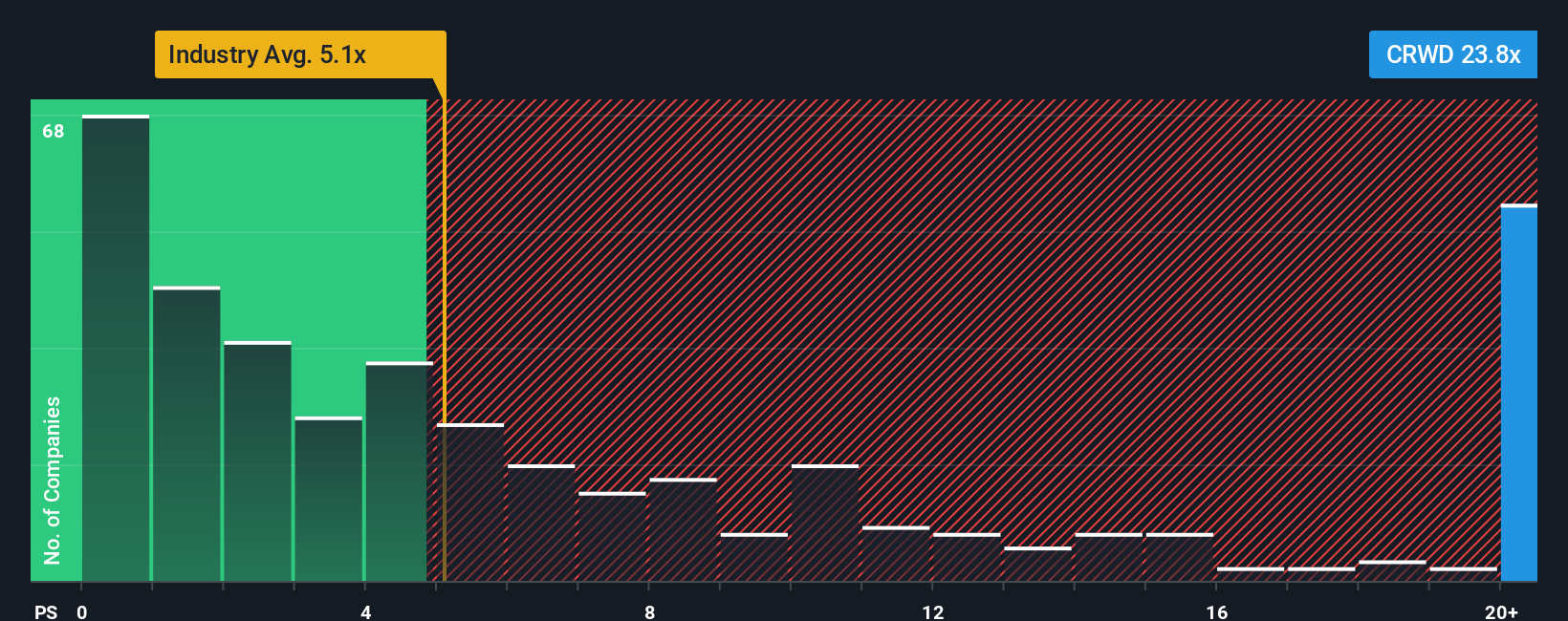

CrowdStrike currently trades at a PS ratio of 28.3x. By comparison, the software industry average is 5.1x and its peer group averages 14.7x. At first glance, this looks quite expensive.

However, Simply Wall St’s “Fair Ratio” goes a step further by analyzing factors like CrowdStrike’s market cap, rapid revenue expansion, profit margins, industry, and risk outlook. Unlike a simple peer or industry comparison, the Fair Ratio delivers a nuanced benchmark for what is reasonable, given the company’s specific profile. For CrowdStrike, this proprietary Fair Ratio stands at 17.4x.

When we compare the current 28.3x PS ratio to the Fair Ratio of 17.4x, it is clear that shares are trading well above what would be considered fair on a risk-adjusted, growth-aware basis.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your CrowdStrike Holdings Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company, your perspective on its future, linked to the numbers that matter, like your own estimates of revenue, earnings, and fair value.

Narratives bridge the gap between what makes a business unique and how the numbers play out over time. By weaving together the company’s strategies, risks, opportunities, and financial forecasts, they give you a practical and personal framework for arriving at a fair value.

This approach is easy to start using on Simply Wall St, where Narratives are shared and updated by millions of investors on each company’s Community page. With Narratives, you can see at a glance whether others think the current price is a bargain or overvalued compared to their stories and forecasts, and you can adjust your own view as new information or earnings reports come in.

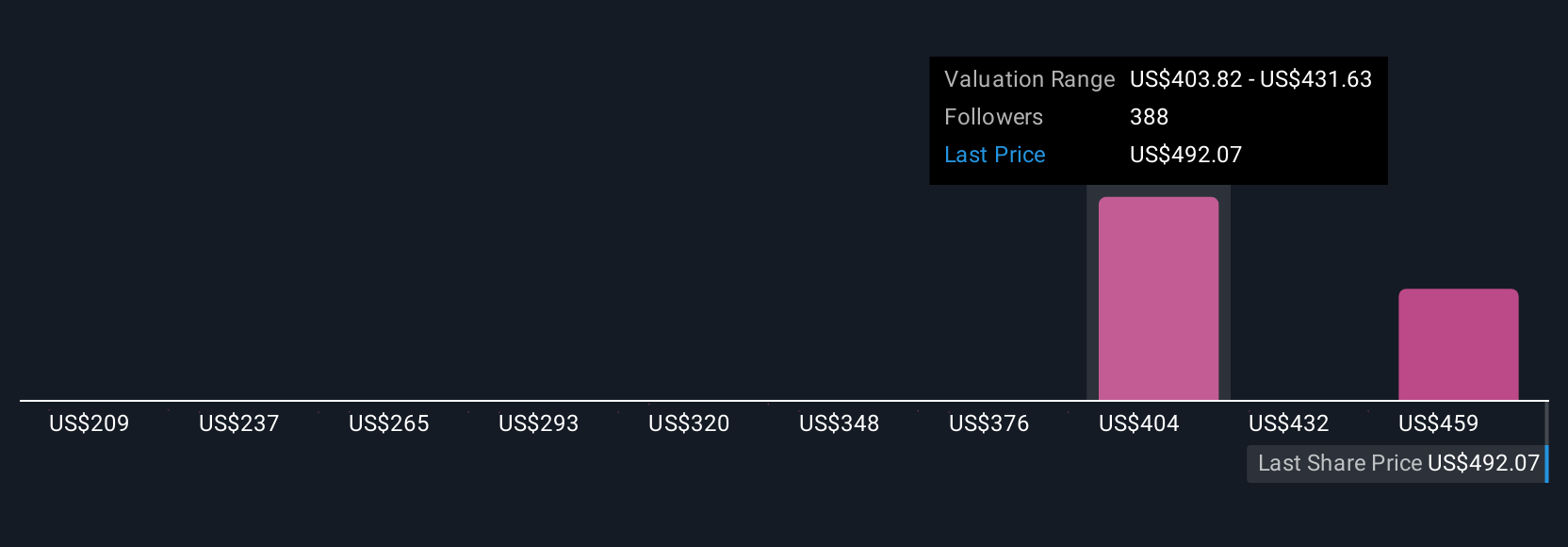

For CrowdStrike Holdings, some investors see opportunity for rapid growth, setting fair value as high as $495 per share, while others focus on execution risk or market competition, seeing fair value closer to $330. This allows you to quickly explore both optimistic and cautious perspectives, then decide which story fits your view and investment goals.

For CrowdStrike Holdings, we’ll make it really easy for you with previews of two leading CrowdStrike Holdings Narratives:

Fair Value: $495.45

Current price is approximately 1.3% below this narrative's fair value.

Projected annual revenue growth: 21.9%

- Strategic innovations such as Falcon Flex and AI capabilities are driving customer loyalty, efficiency, and potential revenue and margin improvements.

- Strong cloud partnerships and ongoing investment in emerging security products support significant market expansion and robust demand.

- Analyst consensus expects revenue to grow 22.1% annually and sees earnings turning positive, with some risk if execution or new products underperform.

Fair Value: $431.24

Current price is approximately 13.4% above this narrative's fair value.

Projected annual revenue growth: 18.0%

- CrowdStrike’s cloud-based Falcon suite delivers flexible, modular cybersecurity solutions that attract a growing base of recurring revenue.

- The company maintains strong fundamentals with more equity than debt and steadily improving profitability driven by ARR and ROE growth.

- Recent operational missteps, like the worldwide “blue screen” incident, are viewed as setbacks that should not derail long-term growth, but the current price looks high relative to calculated fair value.

Do you think there's more to the story for CrowdStrike Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.