Please use a PC Browser to access Register-Tadawul

Is Herc Holdings a Bargain After Shares Drop 32% Ahead of 2025 Earnings?

Herc Holdings, Inc. HRI | 141.29 | -0.30% |

If you are weighing your next move with Herc Holdings stock, you are not alone. Investors have been puzzling over its recent ups and downs, and the story only gets more interesting the closer you look. Despite a challenging year, with the stock down nearly 32% year-to-date and 26% over the past twelve months, there are clear hints that the market is still figuring out how to price Herc's long-term growth potential. Just in the last week, shares bounced back by 2%, showing renewed interest after a general sector-wide lull. And if we zoom out to the last five years, Herc has notched a remarkable 199% gain, a sign that the company’s fundamentals have delivered for patient shareholders over the long haul.

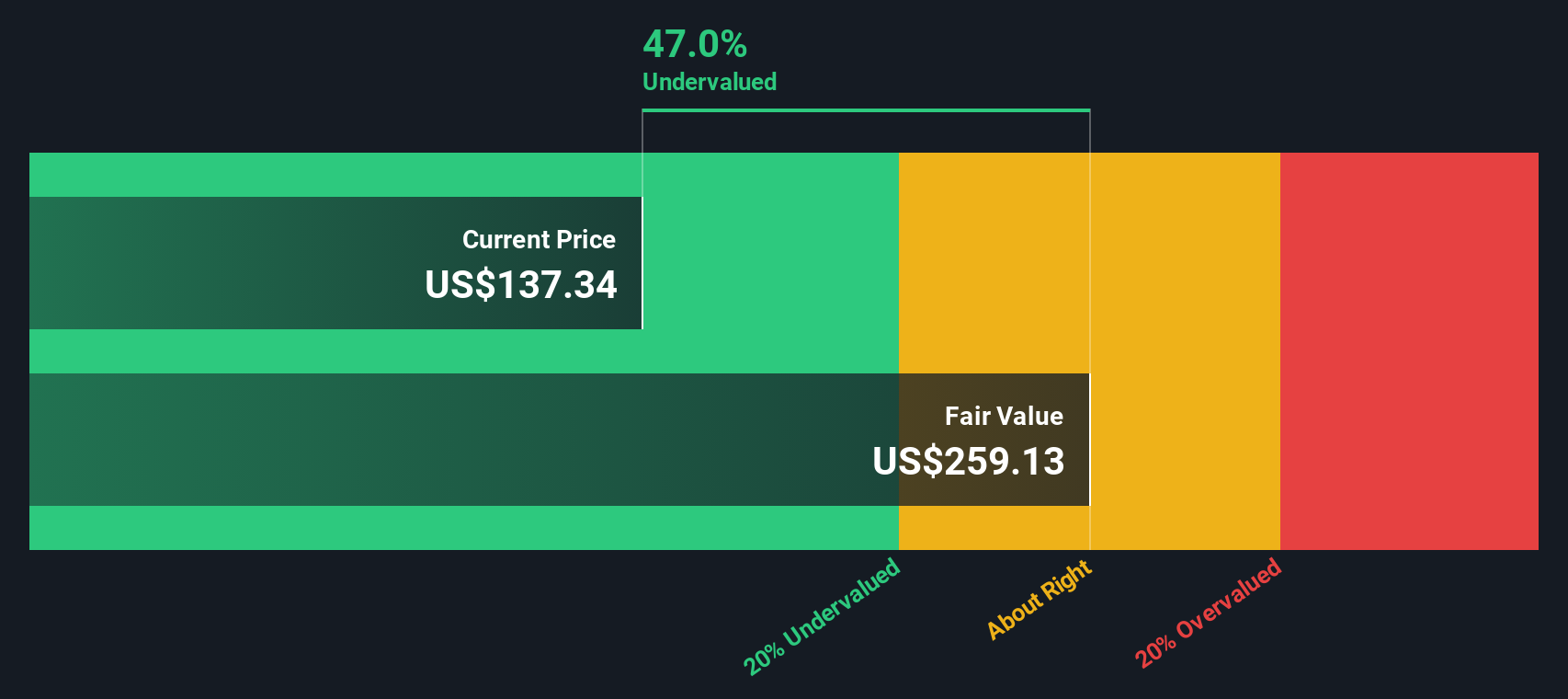

One thing that should catch your eye is the company's valuation score: Herc is undervalued on 5 out of 6 checks, putting its value score at a strong 5. That is not something you see every day, and it suggests the market may not be giving Herc enough credit for its underlying strengths or prospects. In the sections ahead, we will break down what’s behind that score using traditional valuation approaches. But stick with me until the end, as I will also share a more insightful way to judge whether Herc Holdings is genuinely a smart buy right now.

Approach 1: Herc Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them to today’s dollars. This approach aims to assess what Herc Holdings is fundamentally worth based on its ability to generate cash in the years ahead. It is a popular method for estimating true value, especially in capital-intensive sectors.

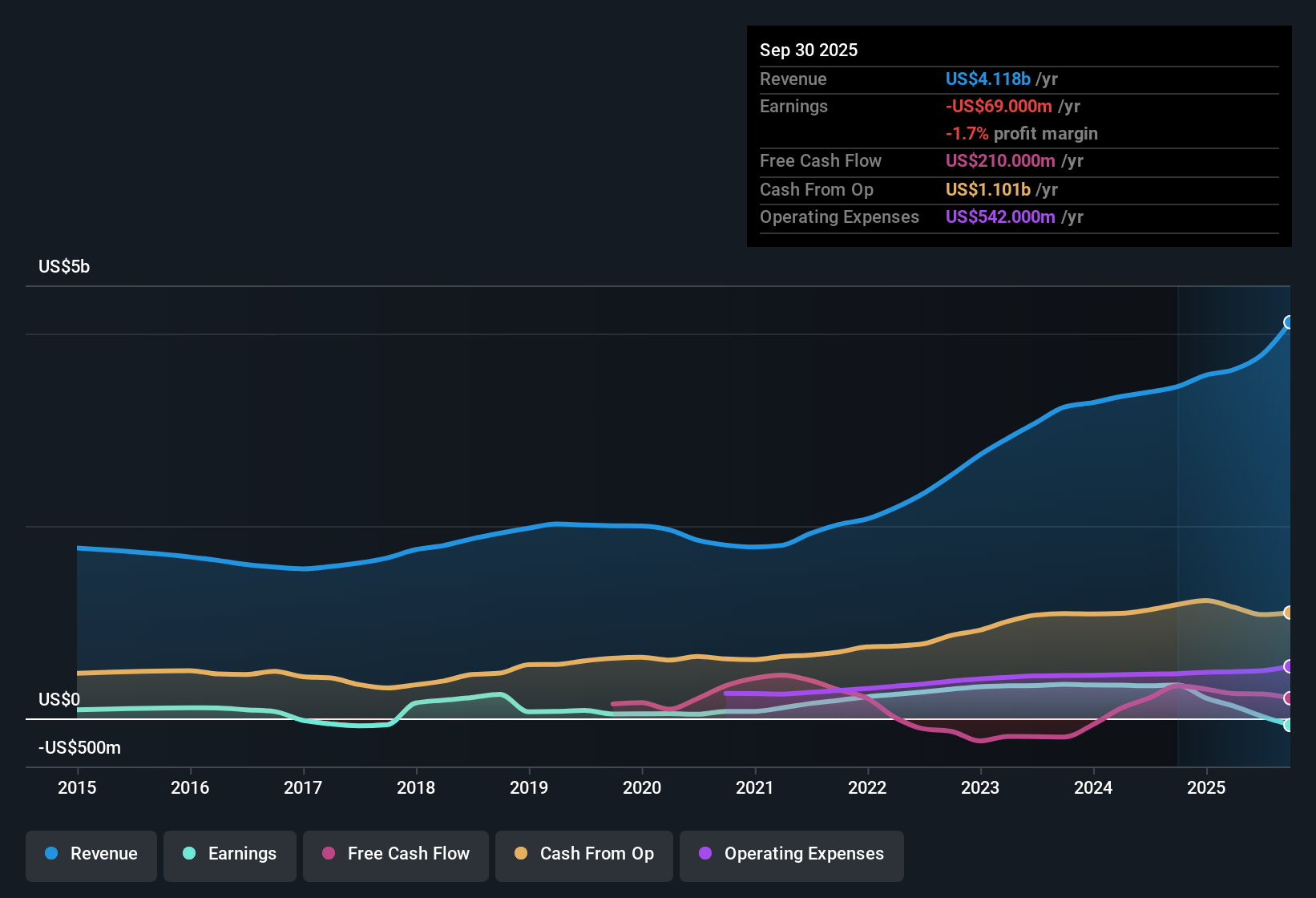

Herc Holdings’ most recent Free Cash Flow (FCF) was negative $29 million, but analyst forecasts show significant improvement ahead. Projections indicate that FCF could rise steadily each year, reaching $848 million by 2029. Beyond the analyst consensus for the next five years, projections are extended by Simply Wall St’s modeling, ultimately forecasting nearly $1.2 billion in FCF by 2034. All cash flows are stated in US dollars.

According to these estimates, the intrinsic value of Herc Holdings is calculated to be $275.39 per share. This suggests a 54.0% discount to the current share price, which indicates the stock may be dramatically undervalued based on the fundamentals of its business and the strength of its expected future cash flows.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Herc Holdings is undervalued by 54.0%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Herc Holdings Price vs Sales

For companies like Herc Holdings, where profitability can fluctuate due to business cycles or temporary headwinds, the Price-to-Sales (P/S) ratio is a valuable metric for assessing valuation. This multiple is particularly helpful for trade distributors because it helps smooth out the impact of short-term earnings swings and focuses attention on the underlying ability to generate revenue.

In general, the "normal" or "fair" P/S ratio can vary depending on factors such as expected sales growth, profit margins, and the risks associated with the industry. Higher growth or lower risk justifies paying a higher multiple, while slow-growing or riskier businesses should trade at lower ratios.

Currently, Herc Holdings trades at a P/S ratio of 1.11x, which is almost identical to the Trade Distributors industry average of 1.11x and below the peer group average of 1.52x. Simply Wall St’s proprietary "Fair Ratio" for the company is 2.65x. This Fair Ratio is calculated using a model that weighs not just revenue growth, but also profit margins, business risks, size, and how the overall industry is priced. This makes it a more robust benchmark than simply comparing with industry averages or competitors because it is tailored to Herc’s own financial outlook and risk profile.

Comparing Herc’s current P/S of 1.11x to the Fair Ratio of 2.65x suggests the stock is trading at a notable discount to what its fundamentals and potential deserve.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Herc Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your personal investment story; the perspective you have on a company, built by connecting real-world business events with your own forecasts for future revenue, profit margins, and ultimately, fair value. Unlike static numbers, Narratives tie the “why” behind business performance directly to the numbers you care about, showing not just what the company is worth but how it might get there.

On Simply Wall St's Community page, millions of investors are already using Narratives as a dynamic, easy-to-access tool. Narratives make your decision process smarter by letting you compare your vision (and fair value) against today’s market price. If your Narrative pegs Herc’s fair value much higher than the current price, it could signal a buying opportunity, and the opposite may be true for selling or holding. As new news, analyst updates, and earnings are released, your Narrative and fair value estimate are automatically refreshed, so you always have the latest view.

For instance, one investor might focus on Herc’s sustained infrastructure tailwinds and estimate its fair value as high as $285 per share. Another may worry about debt loads and assign just $100 per share. Narratives allow you to clearly articulate, update, and act on your unique outlook as things change, making your investment decisions both personal and precise.

Do you think there's more to the story for Herc Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.