Please use a PC Browser to access Register-Tadawul

Is Napco’s Rally Justified After Its 24% Gain in 2025?

NAPCO Security Technologies, Inc. NSSC | 41.31 | +0.93% |

If you are standing at the crossroads with Napco Security Technologies' stock, you are certainly not alone. The buzz around this long-standing security solutions company has only grown louder as its shares continue to march higher. In the last week alone, Napco gained 2.4%. If you zoom out, the momentum is even more striking: up 10.1% in the past month, 24.4% year-to-date, and a robust 14.8% over the past year. Looking further back, you will see just how impressive the trajectory has been, with a three-year return of 67.8% and a staggering 255.7% over five years.

Most of these moves have come as investors respond to shifting market sentiment around security stocks, with underlying trends in smart building technologies and physical security fueling optimism. Although there have not been any earth-shaking headlines recently, the sector’s perceived resilience and long-term growth opportunities are clearly drawing renewed attention from both institutional and retail investors. Still, before you decide whether Napco fits in your portfolio, it is worth noting the company’s current value score stands at just 1 out of 6, meaning it is considered undervalued by only one of the main valuation checks we use.

This raises a key question for would-be buyers and holders: does the market’s excitement outpace Napco's true underlying worth? In the next sections, we will break down exactly how the company stacks up against several valuation approaches. Stay tuned for what may be the most insightful way to judge value before making your move.

Napco Security Technologies scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

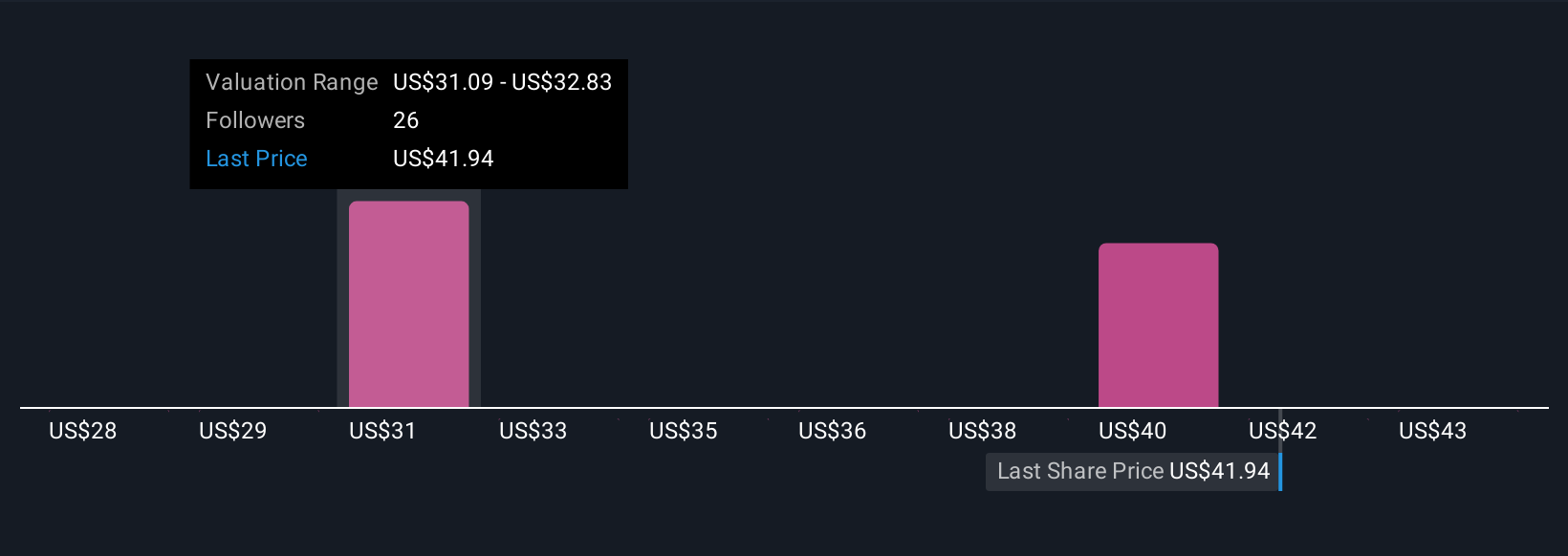

Approach 1: Napco Security Technologies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and then discounting them back to today’s dollars, reflecting their present worth. This approach aims to determine how much those future streams of money are worth in the present moment, helping to clarify whether a stock’s current price is reasonable.

For Napco Security Technologies, the most recent Free Cash Flow stands at $51.28 million. Analysts expect this to rise in the next few years, with projections indicating free cash flow could reach about $77.51 million by 2035 according to long-term estimates. Only the next five years are supported by direct analyst forecasts, and beyond those years, the numbers are extrapolated for continuity. These projections serve as the foundation of the DCF analysis.

Based on the 2 Stage Free Cash Flow to Equity model, the DCF-calculated intrinsic value for Napco is $31.62 per share. With the current share price sitting at a 37.6% premium to this estimated fair value, the market appears to be pricing in more optimism than the cash flow outlook supports.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Napco Security Technologies may be overvalued by 37.6%. Find undervalued stocks or create your own screener to find better value opportunities.

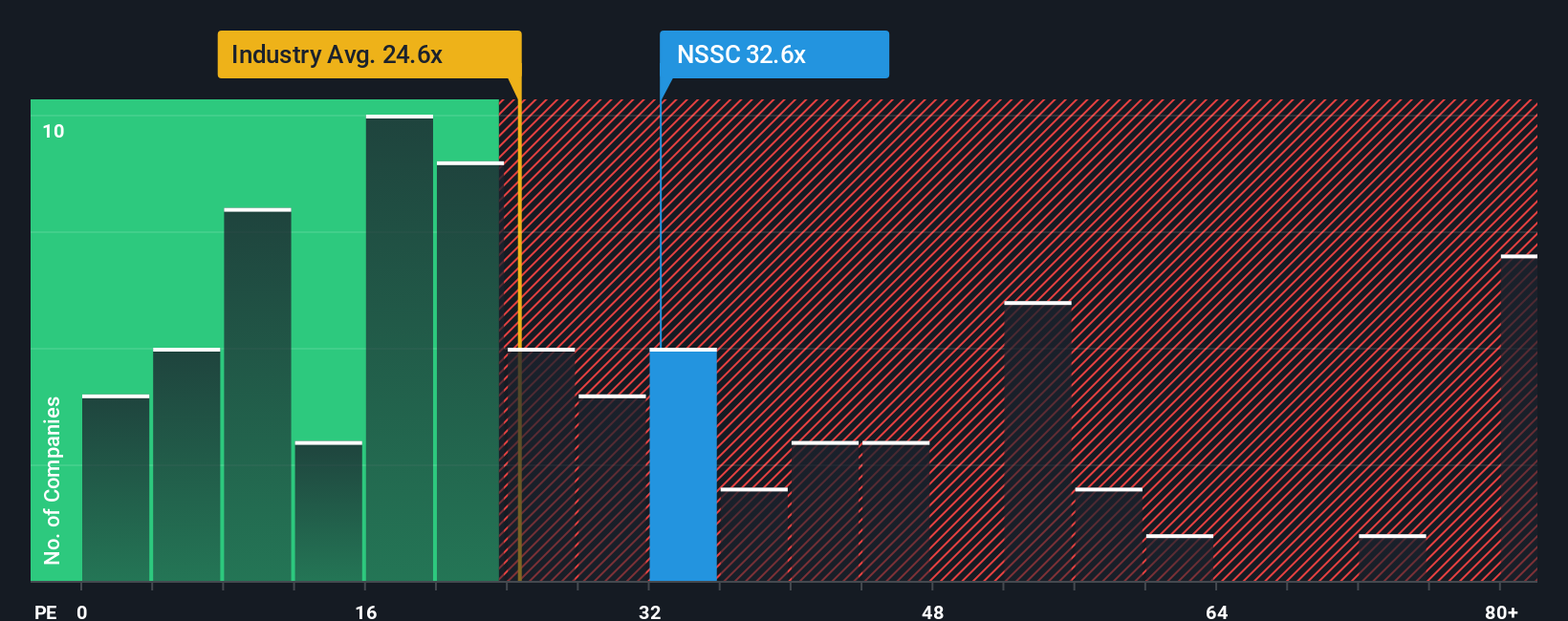

Approach 2: Napco Security Technologies Price vs Earnings

The Price-to-Earnings (PE) ratio is one of the most widely used valuation metrics for profitable companies like Napco Security Technologies. It reflects how much investors are willing to pay for each dollar of current earnings, making it especially relevant for firms with reliable profitability. Growth expectations and risk also play a big role in determining what a “normal” or “fair” PE should be. Companies with higher expected growth and lower risk often trade at premium PE ratios, while more mature or riskier businesses tend to fetch lower multiples.

Currently, Napco trades at a PE ratio of 35.8x. This figure is higher than the industry average PE of 25.2x and stands below the group peer average of 49.7x. At first glance, this suggests the market is pricing Napco at a premium to the overall sector, but not as richly as some comparable companies.

To add more precision, we can look to Simply Wall St's Fair Ratio, a proprietary measure designed to estimate the optimal PE for a business based on factors like growth, profit margins, risks, industry, and company size. Unlike simple peer or industry comparisons, the Fair Ratio provides a tailored benchmark by factoring in what actually drives value for Napco investors. For Napco, the Fair Ratio stands at 24.3x. Since this is well below the present PE, the numbers suggest that the stock’s current pricing reflects substantial optimism and is above what would be considered fair by these objective standards.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Napco Security Technologies Narrative

Earlier, we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is a simple way to express your own story about a company by combining your view of its future prospects, growth drivers, and potential risks. You then link those beliefs directly to a forecast of revenue, profit margins, and ultimately a fair value per share.

Rather than relying solely on static metrics, Narratives connect the dots between what you believe about Napco Security Technologies and what that would mean for its true worth. Every story is turned into a financial forecast and a fair value, so you can instantly compare your Narrative’s value with the current market price, helping you decide confidently whether to buy, hold, or sell. On Simply Wall St's Community page, used by millions of investors, you can easily create and update your own Narrative. Because Narratives are dynamic, they automatically adapt with each new earnings report, news story, or industry event.

For Napco, some investors might have an optimistic Narrative, pointing to expanding recurring revenues, rapid digital innovation, and new cloud platform launches that support a bullish price target of $45. Others may focus on risks such as hardware demand weakness or product dependence and arrive at a more cautious target of $36. Narratives let you transparently track, share, and refine your thinking as new data emerges, making investment decisions more personalized and informed than ever before.

Do you think there's more to the story for Napco Security Technologies? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.