Please use a PC Browser to access Register-Tadawul

Is Teradyne’s Valuation Justified After 23% Surge and AI Test System Momentum?

Teradyne, Inc. TER | 200.77 | +1.08% |

If you are standing at the crossroads with Teradyne stock, you are not alone. In the past month, Teradyne has surged 23.0%, building on an already impressive 96.9% gain over three years. Even this year, the stock has notched a 16.8% jump. Clearly, something is stirring as investors are responding to wider market optimism and sector tailwinds, reflecting both growth potential and changes in how risk is being perceived. From automation to the semiconductor testing boom, Teradyne’s momentum has caught the attention of those tracking technological shifts in manufacturing and electronics.

But while the price action feels exciting, what about the company’s value? Here is where things get interesting. Out of six key valuation checks, Teradyne meets none for being undervalued, giving it a valuation score of 0. This leaves many investors scratching their heads as they consider whether they are paying too much for the recent run-up or if there is more under the hood than the surface suggests.

To answer that, we are going to look at valuation through multiple proven lenses, from price-to-earnings to discounted cash flow. And if you are looking for a slightly different and perhaps even more insightful way to gauge Teradyne’s worth, stick around for what we will reveal at the end.

Teradyne scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Teradyne Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s true value by projecting its future cash flows and discounting them to today’s dollars. For Teradyne, this approach uses the latest Free Cash Flow (FCF) figure of $608.75 million as a starting benchmark. Analysts have provided detailed FCF projections for the coming five years, after which forecasts are extrapolated based on historic and expected trends.

Over the next decade, forecasts for Teradyne’s annual FCF rise to $1.09 billion by 2029, doubling current levels. These cash flows are all expressed in US dollars and highlight solid expectations for growth. The DCF model utilized here is the "2 Stage Free Cash Flow to Equity," meaning it considers both an initial high-growth period and a subsequent phase where growth moderates.

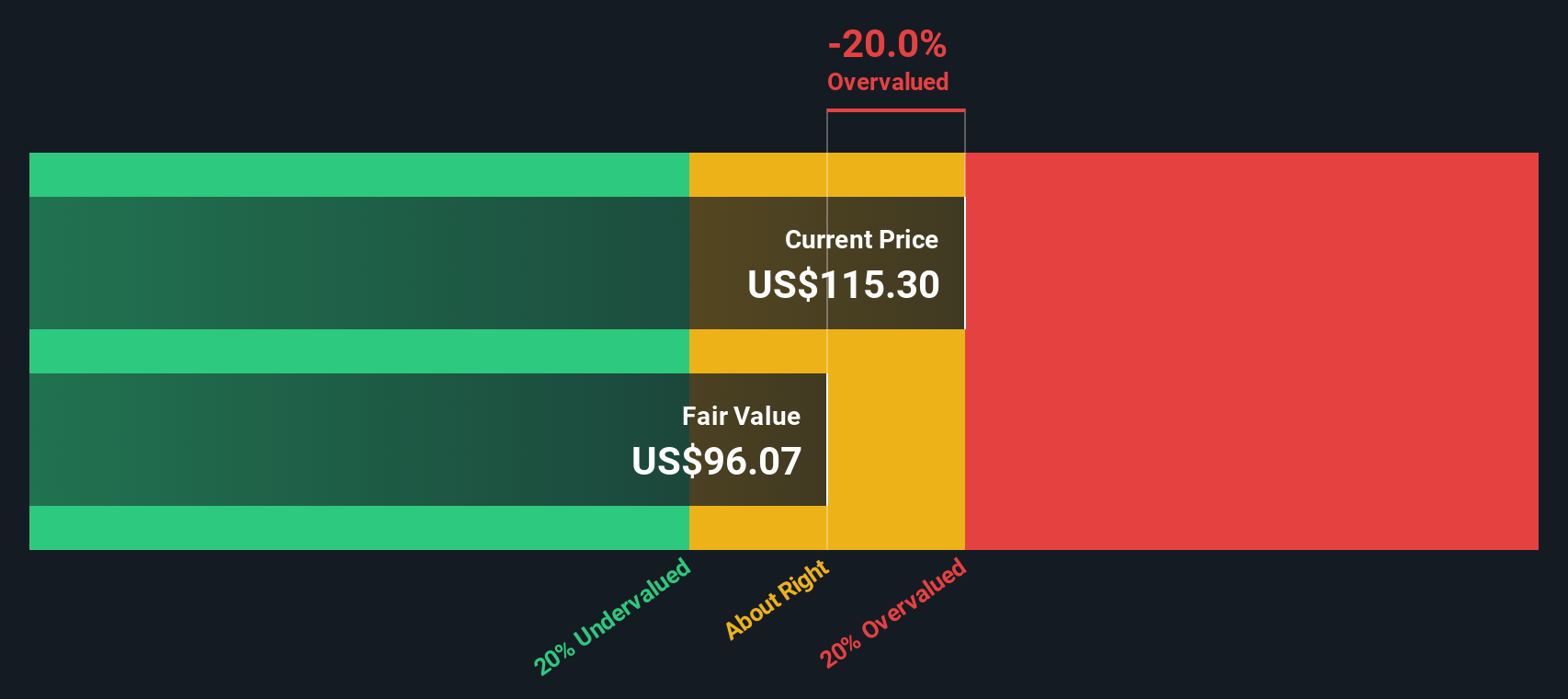

After crunching all these numbers, the DCF calculates Teradyne’s intrinsic value at $96.28 per share. However, given the recent stock surge, this value sits at a notable 53.6% discount compared to the current share price. This suggests that the stock is currently trading at a much higher level than what the cash flow projections justify.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Teradyne may be overvalued by 53.6%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Teradyne Price vs Earnings (PE Multiple)

The Price-to-Earnings (PE) ratio is a reliable valuation metric for profitable companies like Teradyne because it directly connects what investors are willing to pay to the company’s earnings power. Especially for companies with consistent profits, PE allows for an apples-to-apples comparison across the sector and peer group.

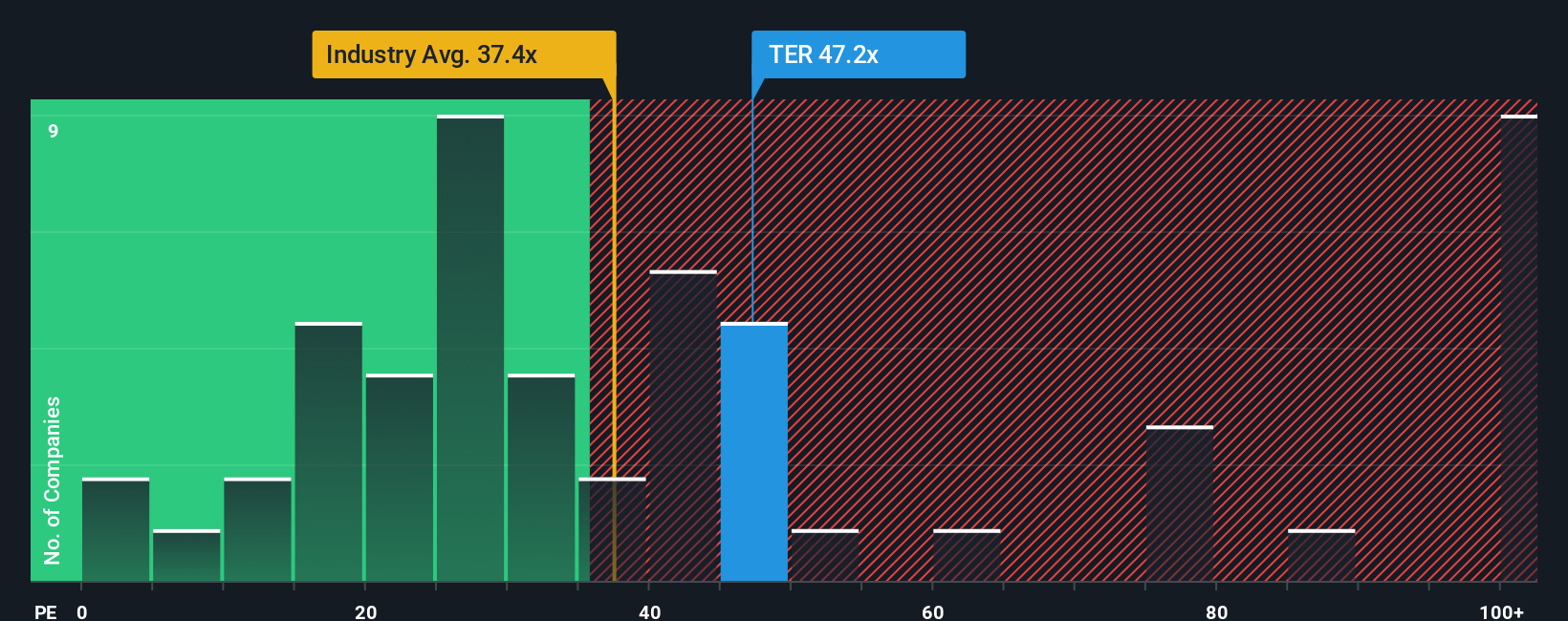

Growth expectations and perceived risk play a big role in what’s considered a “normal” PE ratio. Fast-growing companies or those with industry leadership usually justify higher PE multiples, while higher risk or slower growth tends to bring the fair PE lower. For Teradyne, the current PE multiple stands at 50.1x. That is a notable premium to its industry average of 37.8x and the peer average of 38.3x. This is indicative of heightened investor optimism or superior growth expectations baked into the share price.

Simply Wall St also provides a “Fair Ratio,” which in this case is 34.3x. Unlike basic industry or peer comparisons, this proprietary metric factors in Teradyne’s earnings growth, profit margins, risk profile, industry conditions, and market capitalization. The Fair Ratio aims to provide a more holistic and forward-looking view than static averages, making it a better guide for fair value in dynamic markets.

When we put Teradyne’s current PE of 50.1x against the Fair Ratio of 34.3x, it’s clear the stock is trading well above what the fundamentals suggest is reasonable, even after accounting for growth and risk factors.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Teradyne Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is the story you tell about a company, where you bring together your perspective on its future, such as what you think Teradyne’s revenue, earnings, and profit margins will look like, and use that to set your own fair value estimate.

Unlike traditional metrics that only show you a snapshot, Narratives connect your view of the business and its opportunities with a real financial forecast, and then directly link it to a share price you think is reasonable. Narratives make professional-level analysis accessible to all. Simply Wall St’s Community page lets you write or explore millions of investor Narratives, side by side with peers and experts.

This tool does not just make investing easier, it also makes decisions clearer. By comparing your fair value estimate to the current price, you can judge whether now is the moment to buy, hold, or sell. Narratives update automatically whenever major news breaks or when companies announce new earnings, so your valuation always stays relevant.

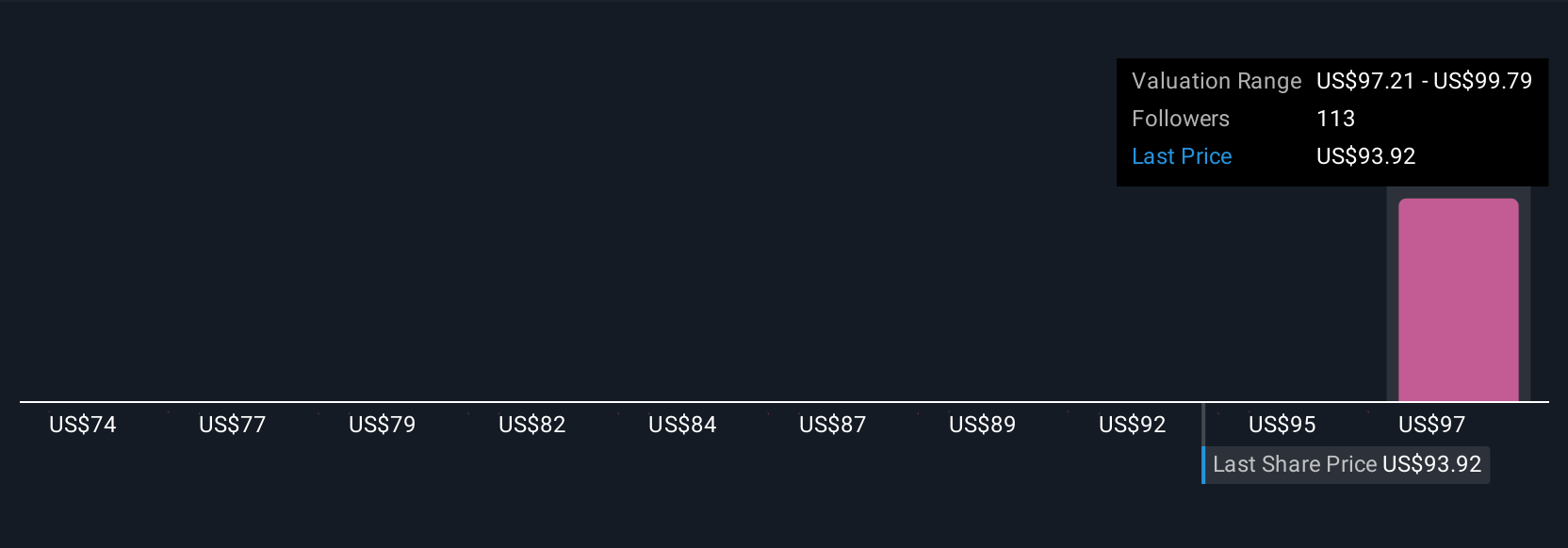

For Teradyne, for example, bullish investors believe its earnings could reach $1.1 billion and value the stock as high as $133, while more cautious investors set earnings closer to $685 million and see fair value at just $85. This demonstrates how different stories about the future can quickly turn into actionable numbers.

Do you think there's more to the story for Teradyne? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.