Please use a PC Browser to access Register-Tadawul

Johnson Controls (JCI): A Valuation Deep Dive Following Global Launch of Silent-Aire Data Center Cooling Platform

Johnson Controls, Inc. JCI | 114.23 | +0.03% |

Johnson Controls International just rolled out its new Silent-Aire Coolant Distribution Unit (CDU) platform, and the timing could be especially intriguing for investors. With AI and high-performance computing driving up data center demands, energy-hungry chips need advanced cooling. This makes the product launch highly relevant. The CDUs offer scalable, precision cooling for everything from small edge operations to large AI factories, with the company stating they can reduce non-IT energy use by more than 50% in some North American hubs. That combination of scale, efficiency focus, and global reach could have lasting implications for the stock.

The market appears to have taken notice. Johnson Controls International is up 35% year-to-date, with a 54% return over the past 12 months, suggesting momentum as the company broadens its presence in emerging tech infrastructure. Looking at recent performance alongside prior developments in thermal management, the company has consistently introduced new offerings, building credibility in the data center market. The share price movement indicates investors may be factoring in growth potential from these broader trends rather than just the current business environment.

As Johnson Controls International responds to rising demand, an important question remains: Is the stock’s current price still reasonable, or has the market already accounted for future growth?

Most Popular Narrative: 5.8% Undervalued

The most widely followed narrative suggests that Johnson Controls International is modestly undervalued. Analysts point to underlying business changes, enhanced operational practices, and robust growth expectations as key reasons behind the valuation.

The company has significant opportunities for cost reductions and process improvements through the implementation of Lean practices, likely positively impacting net margins and overall earnings. Johnson Controls’ strong record backlog and sustained demand in key areas, such as its York HVAC and Metasys building automation platforms, provide a solid foundation for future revenue growth.

What is behind this optimistic outlook? The fair value estimate is calculated using ambitious profit margin and growth projections not yet reflected in the current price. Want to know the new profit targets, bold revenue forecasts, and which future financial milestones analysts are betting on? You might be surprised how far-reaching these assumptions go. Read on to uncover the full equation behind this valuation.

Result: Fair Value of $112.85 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, challenges such as operational complexity or market disruptions from new competitors could weigh on revenue growth and net margin expansion going forward.

Find out about the key risks to this Johnson Controls International narrative.Another View: Market Comparisons Raise Questions

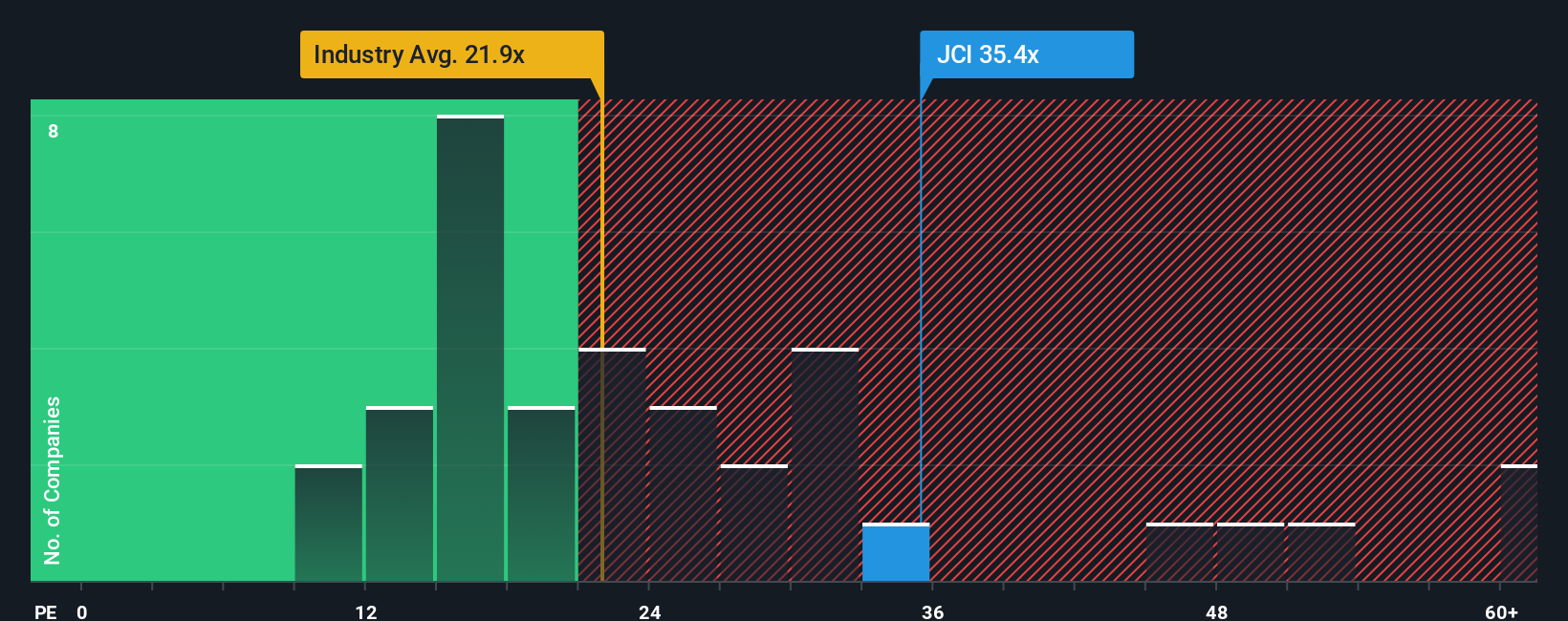

When we look at Johnson Controls International’s valuation through a different lens, things get interesting. Compared to industry averages, its market valuation appears rich. Does the excitement for growth trends justify paying this premium?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Johnson Controls International Narrative

If you see the story differently or want to dig into the numbers firsthand, you can build your own valuation in just a few minutes. Do it your way

A great starting point for your Johnson Controls International research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Curious about what else is out there? Don’t miss your chance to uncover stocks in sectors primed for big moves. Use these tools to find standout opportunities others may overlook and put yourself ahead of the crowd.

- Unlock income potential by scanning for top picks among dividend stocks with yields > 3% that deliver steady yields above 3%.

- Be first to spot game-changers in technology by zeroing in on AI penny stocks leading the charge in artificial intelligence innovation.

- Snap up value gems by targeting undervalued stocks based on cash flows powered by strong future cash flows and solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.