Please use a PC Browser to access Register-Tadawul

LNG Supply Setbacks Could Be a Game Changer for Chevron (CVX)

Chevron Corporation CVX | 150.00 | -1.48% |

- Chevron has formally raised concerns with U.S. regulators about Venture Global’s request to delay the Plaquemines LNG terminal, highlighting potential risks to its long-term LNG supply contracts due to construction setbacks and prior delivery issues.

- This development reflects how project delays at a key LNG export facility could directly affect Chevron's ability to fulfill supply obligations and influence its operational outlook.

- To assess the effect of this challenge, we will consider how LNG supply uncertainty may shift Chevron’s medium-term investment narrative.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Chevron Investment Narrative Recap

To be a Chevron shareholder, you need to believe in the company’s ability to generate resilient cash flows from large-scale oil and gas projects, maintain cost advantages, and capture value from global energy demand despite shifting regulatory and environmental pressures. The latest concerns about potential delays at Venture Global’s Plaquemines LNG terminal present a near-term operational risk, but they do not materially alter the primary short-term catalyst: effective integration of the Hess acquisition and production ramp in key regions. The biggest risk remains long-term exposure to commodity cycles and energy transition pressures.

Against this backdrop, Chevron’s appointment of Kevin McLachlan as Vice President of Exploration stands out, arriving just after the Hess deal closed. This leadership change, paired with new exploration assets, could be influential for Chevron’s reserve replacement and production targets, which are integral to both the LNG supply narrative and the next phase of growth.

However, before you focus solely on upside potential, remember that persistent project execution risks could impact the pace and predictability of Chevron’s returns...

Chevron's outlook anticipates $196.0 billion in revenue and $21.8 billion in earnings by 2028. This is based on a projected annual revenue growth of 1.2% and a $8.1 billion increase in earnings from the current $13.7 billion.

Uncover how Chevron's forecasts yield a $168.78 fair value, a 11% upside to its current price.

Exploring Other Perspectives

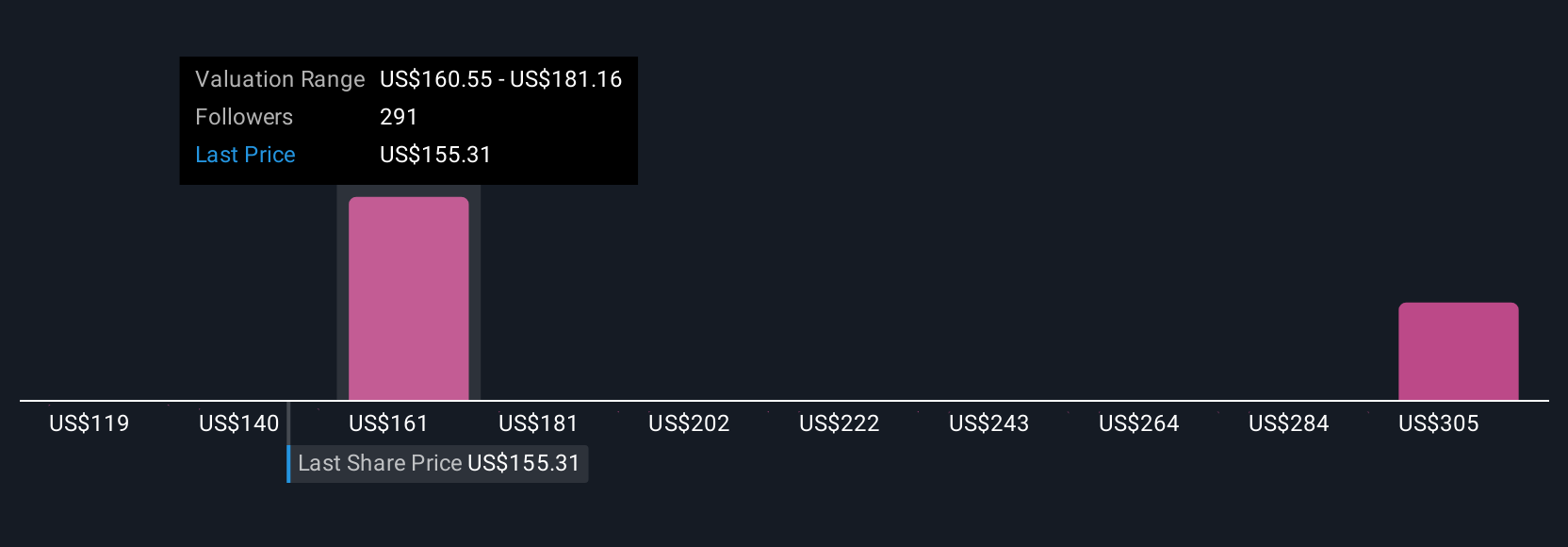

Simply Wall St Community members have shared 32 fair value estimates for Chevron ranging from US$119.44 to US$346.79 per share. While these views vary widely, ongoing project execution risk remains a key factor shaping future expectations for the company’s performance, so consider multiple viewpoints when assessing your own outlook.

Explore 32 other fair value estimates on Chevron - why the stock might be worth over 2x more than the current price!

Build Your Own Chevron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chevron research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chevron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chevron's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.