Please use a PC Browser to access Register-Tadawul

Nuvation Bio (NUVB) Is Up 13.6% After Strong Taletrectinib Brain Metastases Data at IASLC 2025

NUVATION BIO INC NUVB | 8.55 | +2.89% |

- Nuvation Bio recently announced new and updated results from the pivotal Phase 2 TRUST-I and TRUST-II studies of IBTROZI™ (taletrectinib) in adult patients with locally advanced or metastatic ROS1-positive non-small cell lung cancer, featuring impressive objective response rates and progression-free survival data shared at the IASLC 2025 World Conference on Lung Cancer in Barcelona.

- An especially significant insight is the strong intracranial response rate observed among patients with brain metastases, addressing a challenging aspect of this cancer subtype.

- We'll explore how these encouraging clinical outcomes for taletrectinib could influence Nuvation Bio's investment narrative in the oncology space.

This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

What Is Nuvation Bio's Investment Narrative?

For anyone considering Nuvation Bio as an investment, the story rests on faith in innovation driving clinical and commercial breakthroughs in difficult cancer indications. The newly reported Phase 2 TRUST-I and TRUST-II data for IBTROZI (taletrectinib) have immediately shifted the conversation, providing some of the most meaningful catalysts the stock has seen since its recent FDA approval and preferred guideline listing. Strong efficacy and especially the intracranial response address core unmet needs, fueling not only recent share price momentum but also potentially accelerating adoption in the near term. That said, while this adds momentum to the bull case, challenges remain: revenue growth is high but absolute numbers are still modest, profitability is years away, and the board is relatively inexperienced. With a volatile share price and analyst uncertainty on fair value, risk tolerance remains a vital consideration.

On the other hand, the company’s unproven path to sustained profitability is something investors will want to track closely.

Exploring Other Perspectives

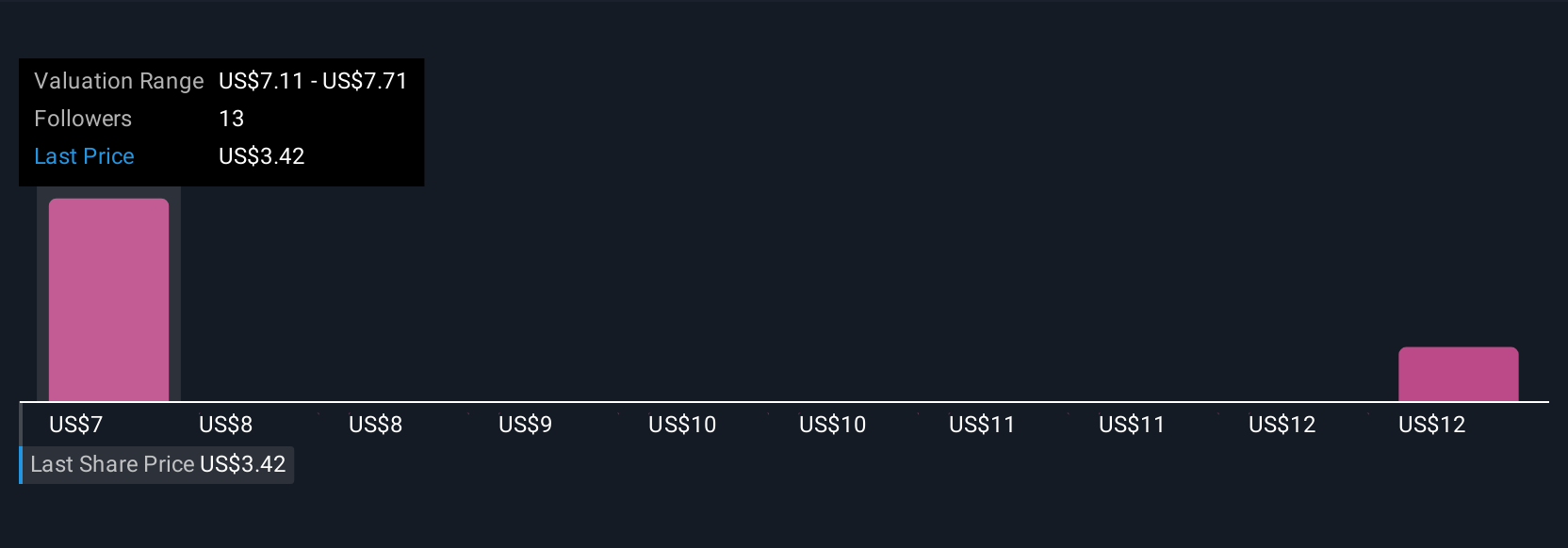

Explore 4 other fair value estimates on Nuvation Bio - why the stock might be worth just $7.11!

Build Your Own Nuvation Bio Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nuvation Bio research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nuvation Bio research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nuvation Bio's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.