Please use a PC Browser to access Register-Tadawul

Pfizer (PFE): Evaluating Valuation After New Oncology Partnership With Olema Pharmaceuticals

Pfizer Inc. PFE | 26.03 | +1.28% |

If you are watching Pfizer (NYSE:PFE) right now, this new collaboration with Olema Pharmaceuticals is the kind of news that could prompt a second look. The two companies have announced a clinical trial partnership to test Pfizer’s investigational CDK4 inhibitor in combination with Olema’s palazestrant for metastatic breast cancer. This expands Pfizer’s reach in targeted oncology. For investors, this new agreement builds on Pfizer’s pipeline strategy and keeps the spotlight on potential new therapies that could drive future growth.

This move comes as Pfizer’s stock has struggled to regain momentum. The share price has fallen around 11% over the past year, even with brief gains in the past month and past 3 months. While clinical programs and fresh partnerships like this may signal long-term opportunity, some investors are still balancing short-term performance with Pfizer’s historically defensive profile and potential new catalysts. Recent conference appearances and product-focused news demonstrate that the company is pressing ahead even as revenue growth remains muted.

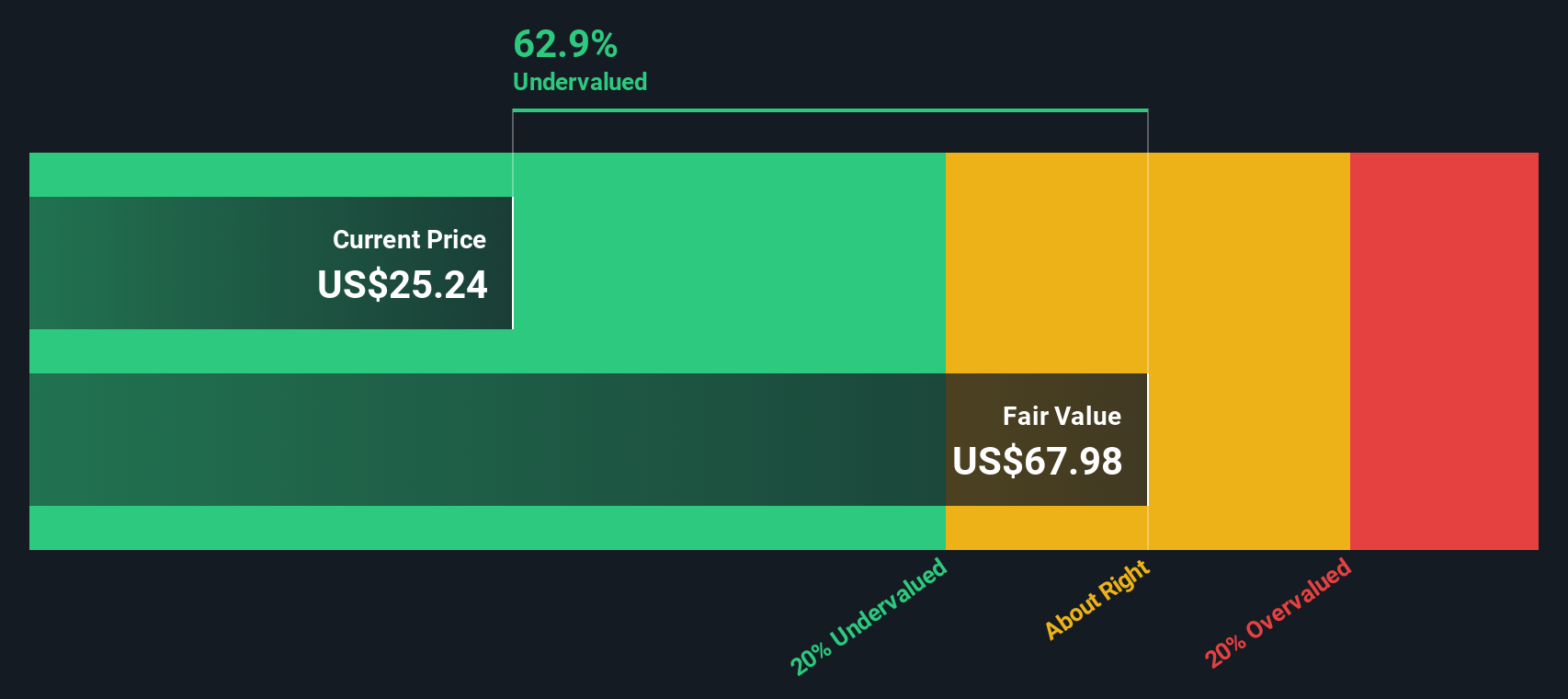

Given the market’s tepid reaction so far, is Pfizer undervalued at these levels or are investors already factoring in optimism about pipeline developments like this one?

Most Popular Narrative: 19.3% Undervalued

According to Francisco, the prevailing narrative argues that Pfizer’s current price undervalues its long-term growth potential. The thesis is anchored on upcoming oncology products, improved operational efficiency, and disciplined financial management.

I think that Pfizer has a strong pipeline. The acquisition of Seagen added many new oncology products that will continue to grow by 14%, partially offsetting the decline in sales of the COVID-19 vaccines. This should keep revenue flat or possibly growing in low to mid single digits in an optimistic scenario.

Could Pfizer’s pipeline trigger a comeback that few expect? There is one bold forecast suggesting double-digit annual stock returns could be attainable. Take note of the key financial lever that will determine the accuracy of this fair value estimate.

Result: Fair Value of $30.62 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, risks remain, including Pfizer’s high debt levels and the possibility of a dividend cut. These factors could quickly shift investor sentiment downward.

Find out about the key risks to this Pfizer narrative.Another View: What Does the SWS DCF Model Say?

A second look using our SWS DCF model leads to a similar undervalued result, which supports the initial fair value estimate. However, can a cash flow model account for all the uncertainties facing Pfizer’s future?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Pfizer Narrative

If you see things differently or want to dig into the numbers on your own terms, it only takes a few minutes to shape your own view. Do it your way

A great starting point for your Pfizer research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next big opportunity pass you by. Use the Simply Wall Street Screener to get ahead of the curve and spot new potential winners right now.

- Uncover hidden gems poised for explosive growth by checking out penny stocks with strong financials before the crowd catches on.

- Fuel your portfolio with the latest advancements in medicine and technology by browsing companies leading the charge in healthcare AI stocks.

- Boost your returns with reliable income streams by seeking out dividend stocks with yields > 3% offering impressive yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.