Please use a PC Browser to access Register-Tadawul

Planet Labs PBC (PL) Sees 66% Price Rise Over Last Quarter

Planet Labs PBC PL | 12.77 | -1.31% |

Planet Labs PBC (PL) recently announced a notable 66% increase in its share price over the last quarter, largely anchored by significant corporate developments. The company reported improved financial performance with increased sales and a reduced net loss, signaling positive operational momentum. Additionally, the successful launch of new satellites in collaboration with SpaceX enhances PL's product offerings and capabilities, potentially driving investor confidence. These developments align with broader market trends, where the tech-heavy Nasdaq recently reached all-time highs. Despite a mixed market performance, PL's proactive advancements in satellite technology and AI integration likely added weight to its share price movement.

The recent developments announced by Planet Labs PBC could significantly impact its ongoing narrative. The 66% increase in share price this quarter aligns with the company's strategy to enhance its satellite technology and AI integration, potentially expanding its revenue streams. However, it's worth noting that, over the past year, Planet Labs has experienced a total shareholder return of 374.74%. This represents a very large increase compared to the previous year's performance, making it a significant point of interest for stakeholders.

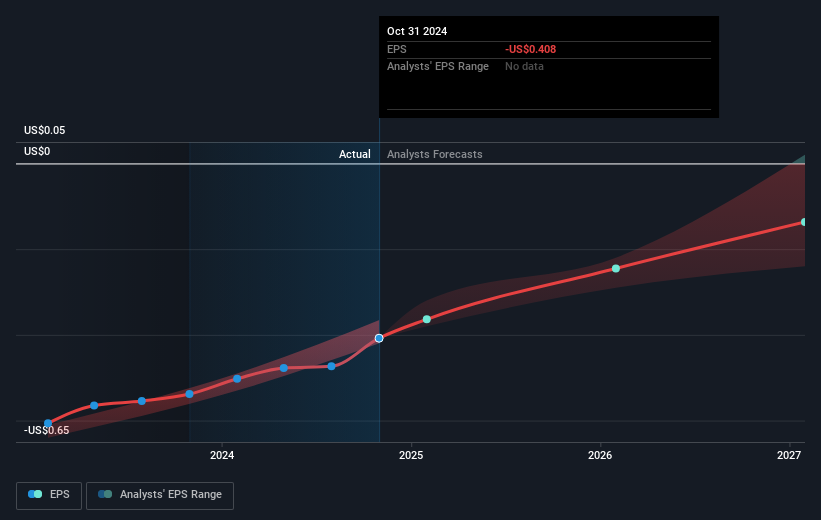

Compared to the broader market, Planet Labs has outperformed the US Professional Services industry, which returned 2.2% over the past year. These advances in satellite capabilities with partners like SpaceX might enhance future earnings forecasts, though analysts currently expect the company to remain unprofitable for the next three years. While projected revenue growth is promising, at 17.6% per year, the share price's recent movements reflect optimism that could see fluctuations as new financial data emerges.

On the valuation front, despite the share price rising to $9.02, it currently trades close to the most optimistic analyst target of $9.00. The price target of $8.84 suggests a possible decline relative to recent prices, highlighting uncertainties in aligning anticipated growth with current market valuations. Investors should remain cautious about the stock's high Price-To-Sales Ratio, indicating that the market currently has high expectations of Planet Labs’ future revenue growth and operational achievements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.